Benchmark Electronics (BHE) Valuation Check After Leadership Shake-Up and New Commercial Chief

Reviewed by Simply Wall St

Benchmark Electronics (BHE) just reshuffled its top ranks, promoting David Moezidis to President and bringing in industry veteran David L. Cummings as Chief Commercial Officer. This leadership shift is one investors will be watching closely.

See our latest analysis for Benchmark Electronics.

The leadership shake up comes after a choppy spell for the stock, with a 30 day share price return of 4.36 percent but a slightly negative year to date move. At the same time, a 3 year total shareholder return above 75 percent suggests longer term momentum remains solid and investors are still being rewarded for patience.

If this kind of leadership driven story has your attention, it could be a good moment to explore fast growing stocks with high insider ownership as another way to spot under the radar opportunities with aligned management incentives.

With earnings still growing faster than revenue, a small dividend uplift, and the stock trading just below analyst targets, the key question now is whether Benchmark is quietly undervalued or if the market is already discounting its next leg of growth.

Most Popular Narrative: 5.9% Undervalued

With Benchmark Electronics last closing at 44.52 dollars versus a narrative fair value of about 47.33 dollars, the story leans toward modest upside anchored in steady execution rather than a moonshot re-rating.

The company continues to deploy disciplined capital allocation, evidenced by debt refinancing, cash repatriation, and consistent share repurchases. Combined with strong free cash flow and a replenished repurchase authorization, this is expected to support EPS growth and shareholder returns.

Curious how stable, mid single digit revenue growth can still underpin punchy earnings expansion and a richer future earnings multiple? The narrative quietly connects margin lift, buybacks, and compounding EPS into one tight valuation puzzle. Want to see the exact growth runway and profit bridge behind that fair value mark?

Result: Fair Value of $47.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this balanced upside can weaken if the recovery in semiconductor capital equipment stalls or if AI data center wins ramp more slowly, which would mute both revenue momentum and margins.

Find out about the key risks to this Benchmark Electronics narrative.

Another Lens on Value

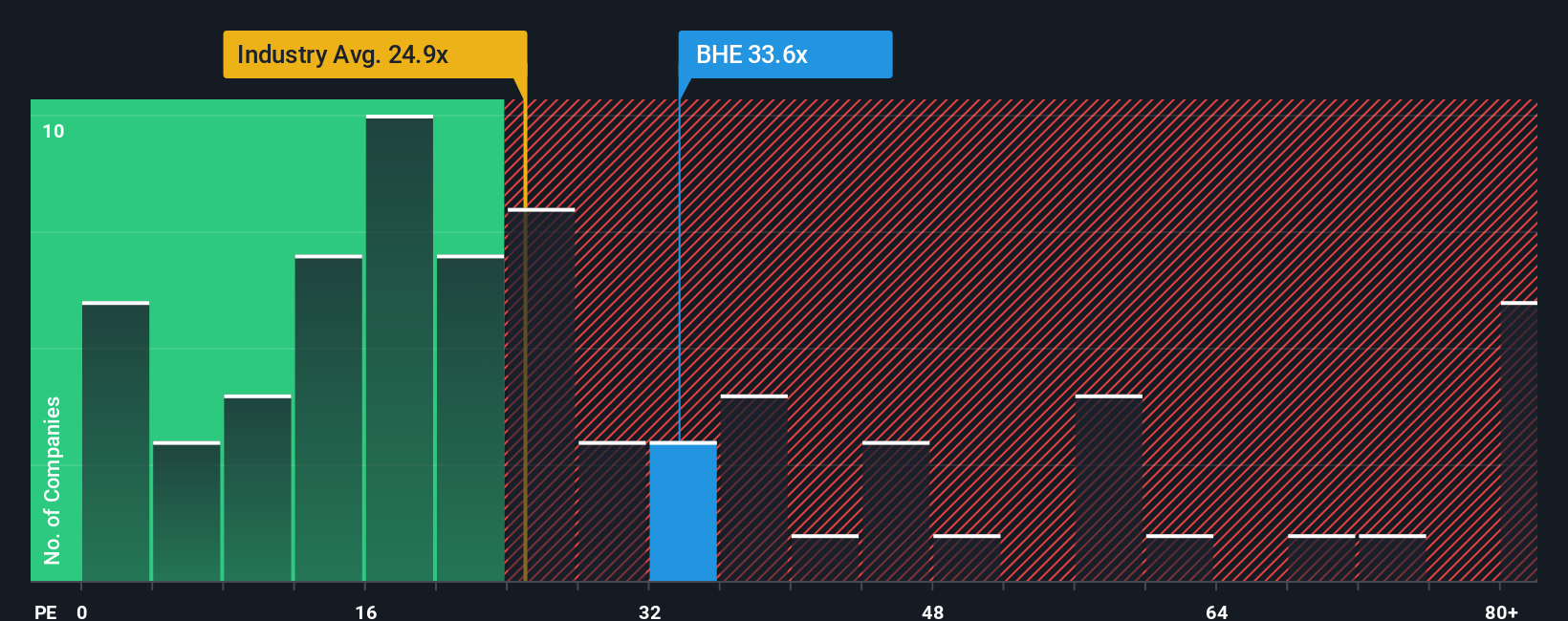

Look past the narrative fair value and the picture turns less generous. On a price to earnings basis, BHE trades at about 42.6 times earnings, well above the US Electronic industry at 24.9 times and its own fair ratio of 32.8 times, even if still cheaper than peers at 49.7 times. That premium suggests investors are already paying up for execution, leaving less room for error. How comfortable are you with that margin of safety?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Benchmark Electronics Narrative

If you are not fully aligned with this view or want to dig into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your Benchmark Electronics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about sharpening your edge, do not stop at one stock when you can quickly scan high potential opportunities tailored to your strategy.

- Capture fast-moving innovation by reviewing these 24 AI penny stocks that could reshape entire industries with new data driven business models.

- Lock in more compelling entry points by targeting these 910 undervalued stocks based on cash flows where prices still lag behind long term cash flow potential.

- Boost your income stream by focusing on these 12 dividend stocks with yields > 3% that may offer reliable yields alongside solid financial foundations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Benchmark Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BHE

Benchmark Electronics

Offers product design, engineering services, technology solutions, and manufacturing services in the Americas, Asia, and Europe.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion