Benchmark Electronics (BHE): Evaluating Valuation as CEO Transition and Succession Plan Announced

Reviewed by Simply Wall St

For investors tracking Benchmark Electronics (NYSE:BHE), fresh news about a planned CEO transition is sure to draw attention. The company has announced that Jeff Benck will retire as CEO at the end of March 2026, with David Moezidis, currently Executive Vice President and Chief Commercial Officer, set to take the reins. Benck will remain as an advisor for an additional year, giving shareholders and employees reassurance that continuity is front of mind as leadership changes hands. In a sector where execution and adaptability matter, this kind of roadmap from the board tends to reduce uncertainty around future strategic direction.

Leadership changes like this do not happen in a vacuum. Over the past twelve months, Benchmark Electronics’ shares are down around 6%, even as the long-term momentum remains strong, with a 64% gain over three years and a more than twofold return over five. Recent weeks have shown modest declines, which may be the market digesting this and other developments, such as the recent dividend affirmation. While current returns do not reflect rapid momentum, they do set a solid backdrop for assessing whether the company’s next chapter could unlock further value.

With the stock trading below last year’s highs and a carefully mapped succession plan in place, investors may be considering whether this is a buying opportunity or if the market is already pricing in Benchmark’s future growth path.

Most Popular Narrative: 12.3% Undervalued

According to the most widely followed narrative, Benchmark Electronics is considered undervalued, with analysts expecting the share price to rise above its current level.

Management is deepening vertical integration, particularly in the semi-cap sector, by expanding capabilities in complex assembly and cleanroom operations. This not only differentiates Benchmark from lower-margin competitors, but it should also support higher net margins and more stable long-term earnings as the semi-cap market moves toward a trillion-dollar opportunity by 2030.

Want to know why this company’s future earning power has analysts buzzing? There is a bold profit forecast at the heart of this valuation, including ambitious growth and margin leaps. Ready to uncover the exact projections behind this attractive price target? Discover which powerful assumptions are fueling this undervalued call.

Result: Fair Value of $44.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, prolonged weakness in the semi-cap sector or persistent industrial sluggishness could quickly challenge the current bullish outlook for Benchmark Electronics.

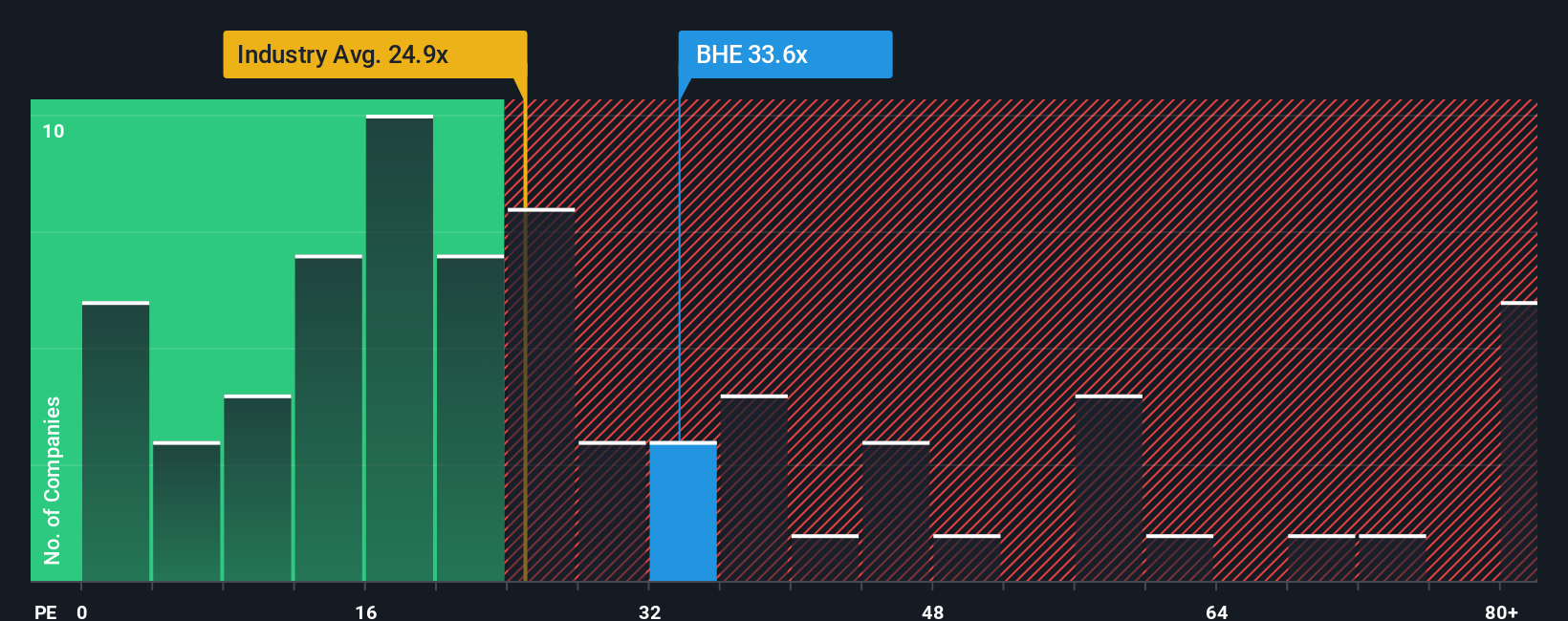

Find out about the key risks to this Benchmark Electronics narrative.Another View: High Price Tag by Industry Standards

Yet, when we look at Benchmark Electronics using industry comparisons, it appears on the expensive side relative to the average. This view challenges the undervalued story. Could the market be overestimating its future?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Benchmark Electronics to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Benchmark Electronics Narrative

If you have a different perspective or want to dig deeper on your own, you can easily put together your own narrative in just a few minutes. Do it your way

A great starting point for your Benchmark Electronics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Every smart investor knows fresh opportunities set the pace for tomorrow’s gains. Don't wait for the crowd; put yourself ahead by using tools built for advantage.

- Spot undervalued gems in the market and get a head start on potential outperformance with undervalued stocks based on cash flows.

- Tap into the AI revolution and track companies positioned to disrupt industries with AI penny stocks.

- Maximize your cash flow with companies offering promising yields by checking out dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Benchmark Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BHE

Benchmark Electronics

Offers product design, engineering services, technology solutions, and manufacturing services in the Americas, Asia, and Europe.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives