Should Belden’s (BDC) AI Collaboration and Share Buyback Spur Investor Reassessment of Its Growth Trajectory?

Reviewed by Sasha Jovanovic

- Belden Inc. recently reported its third-quarter 2025 earnings, showing year-over-year growth in sales to US$698.22 million and net income to US$56.69 million, while also updating the completion of a share repurchase totaling US$109.91 million since September 2024.

- Separately, Accenture announced a collaboration with Belden and NVIDIA to deploy AI-driven safety systems for factories and warehouses, targeting enhanced worker protection and operational modernization in industrial environments.

- We'll explore how Belden's focus on AI-powered safety innovation may influence its longer-term growth and investment outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

Belden Investment Narrative Recap

To believe in Belden as a shareholder, you need to trust that digital transformation in manufacturing and industrial automation will keep driving demand for differentiated, high-value connectivity solutions. The recent AI-powered safety collaboration with NVIDIA and Accenture supports Belden's growth ambitions but does not materially alter the near-term catalyst, which remains centered on sustained order momentum; input cost inflation and margin pressure still pose the largest risks in the short run.

Among the recent announcements, Belden’s share repurchase completing nearly US$110 million since September 2024 is most relevant, as it signals management's confidence in its current financial position and ability to generate returns, even as it prioritizes investment in Smart Infrastructure growth initiatives alongside this capital allocation.

However, investors should be aware that shifting revenue toward integrated solutions may create challenges for short-term margins if sales growth does not keep pace with...

Read the full narrative on Belden (it's free!)

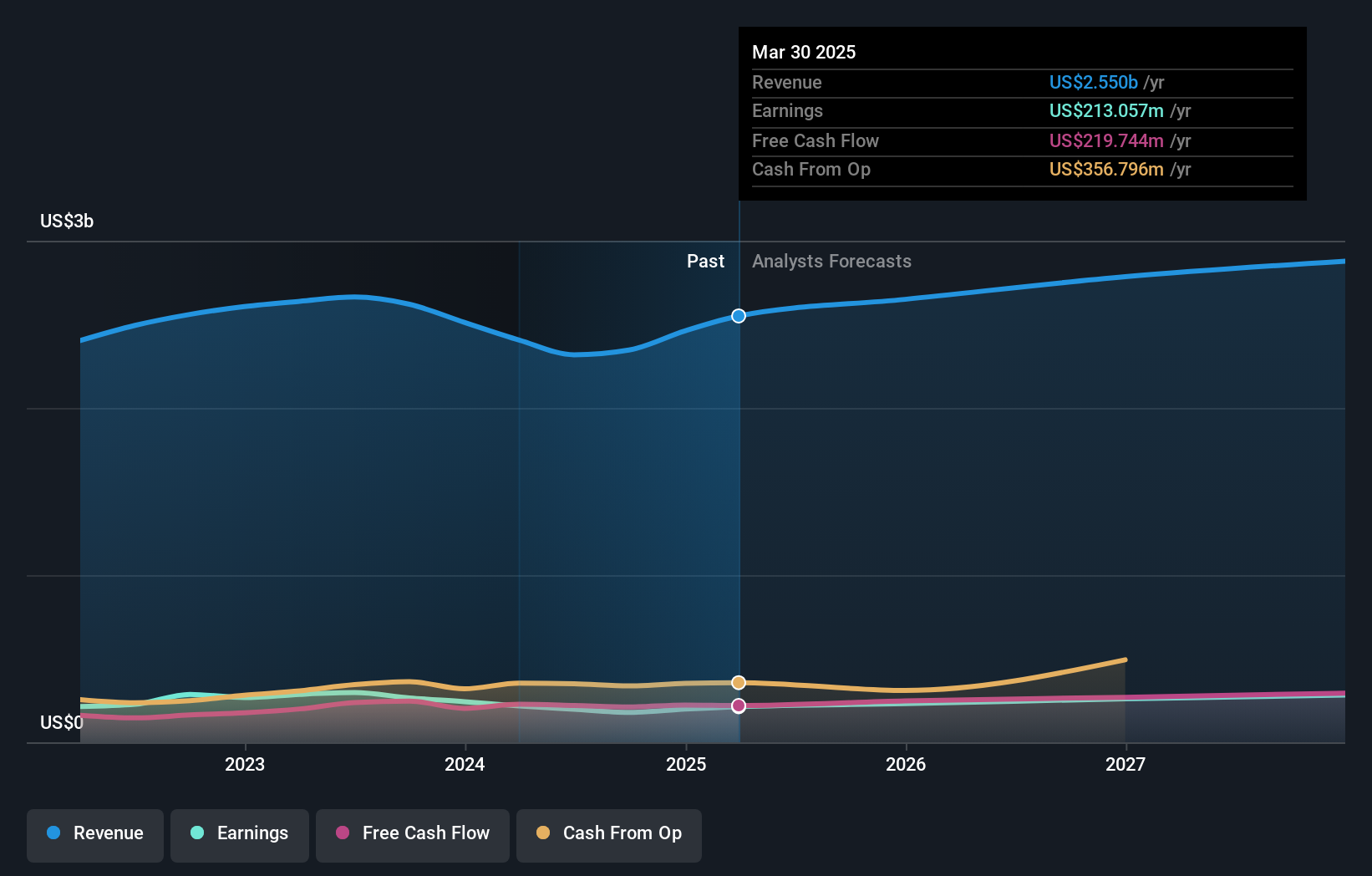

Belden's narrative projects $3.0 billion revenue and $277.7 million earnings by 2028. This requires 4.4% yearly revenue growth and a $52.7 million earnings increase from $225.0 million today.

Uncover how Belden's forecasts yield a $142.60 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Community fair value estimates for Belden range widely from US$80.69 to US$142.60 across three Simply Wall St Community perspectives. As many watch for margin pressure from rising input costs, make sure to compare different viewpoints before deciding where you stand.

Explore 3 other fair value estimates on Belden - why the stock might be worth as much as 19% more than the current price!

Build Your Own Belden Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Belden research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Belden research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Belden's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Belden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BDC

Belden

Provides connection solutions to bring data infrastructure into alignment to unlock new possibilities for its customers.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives