Arlo Technologies, Inc. (NYSE:ARLO) Stock Rockets 26% As Investors Are Less Pessimistic Than Expected

Arlo Technologies, Inc. (NYSE:ARLO) shares have continued their recent momentum with a 26% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 34% in the last year.

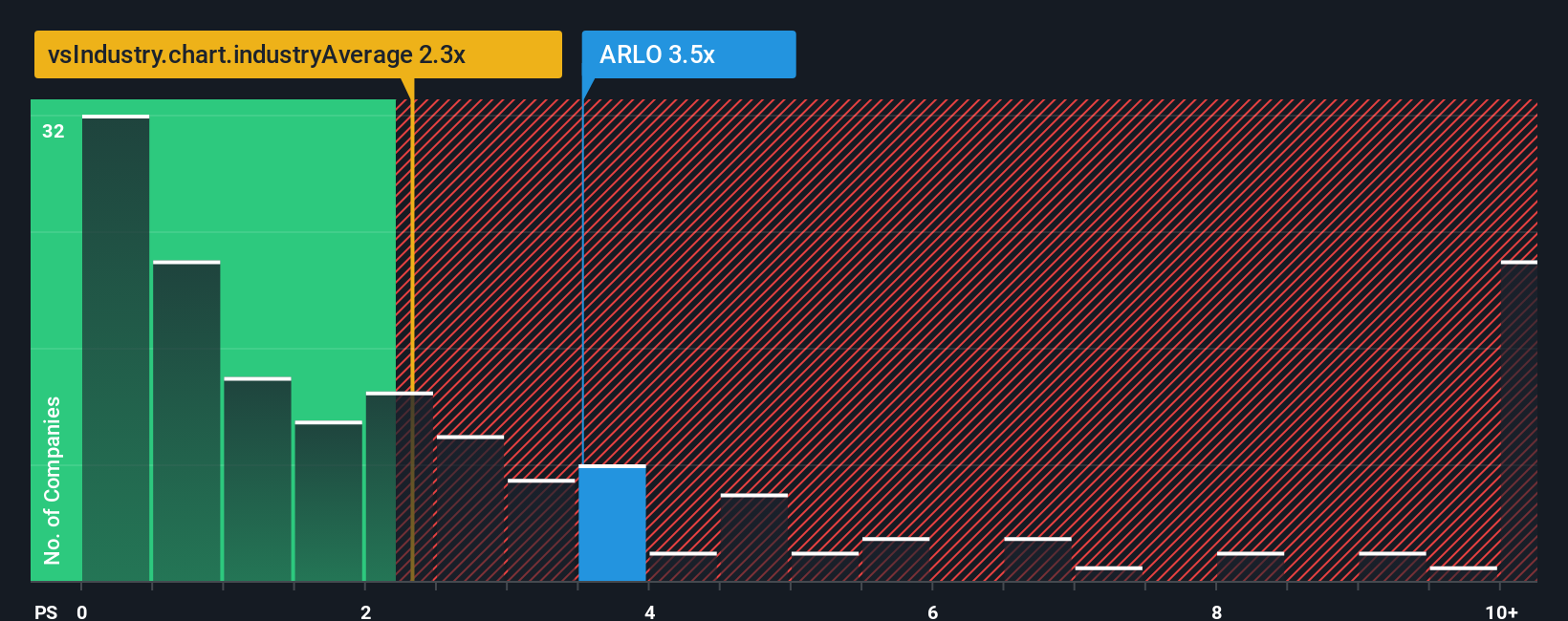

Following the firm bounce in price, when almost half of the companies in the United States' Electronic industry have price-to-sales ratios (or "P/S") below 2.3x, you may consider Arlo Technologies as a stock probably not worth researching with its 3.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Arlo Technologies

What Does Arlo Technologies' P/S Mean For Shareholders?

Recent times haven't been great for Arlo Technologies as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Arlo Technologies' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Arlo Technologies' is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Fortunately, a few good years before that means that it was still able to grow revenue by 6.0% in total over the last three years. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next year should generate growth of 5.0% as estimated by the five analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 18%, which is noticeably more attractive.

In light of this, it's alarming that Arlo Technologies' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

Arlo Technologies shares have taken a big step in a northerly direction, but its P/S is elevated as a result. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Arlo Technologies, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Having said that, be aware Arlo Technologies is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Arlo Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ARLO

Arlo Technologies

Provides cloud-based platform services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific regions.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success