Arlo Technologies (ARLO): Evaluating Valuation After Tariff Threat and US-China Trade War Concerns

Reviewed by Kshitija Bhandaru

Arlo Technologies (ARLO) shares took a sharp hit after President Trump threatened a massive increase in tariffs on Chinese imports. This fueled renewed worries about a possible US-China trade war and its impact on technology supply chains.

See our latest analysis for Arlo Technologies.

Arlo Technologies’ impressive 52% share price return year-to-date stands out even after this week’s tariff-driven slide, which shaved nearly 4% off in a single day. Momentum has built on the back of new product launches, especially the AI-enabled security cameras announced recently, but the stock remains vulnerable to shifts in global trade sentiment.

If fast-moving tech stories like this have you wondering what’s next, it could be the perfect moment to discover See the full list for free.

After such a strong run and the latest tariff-driven volatility, the big question is whether Arlo’s current price reflects ongoing risks and future growth. Alternatively, today’s uncertainty could signal a real buying opportunity for investors.

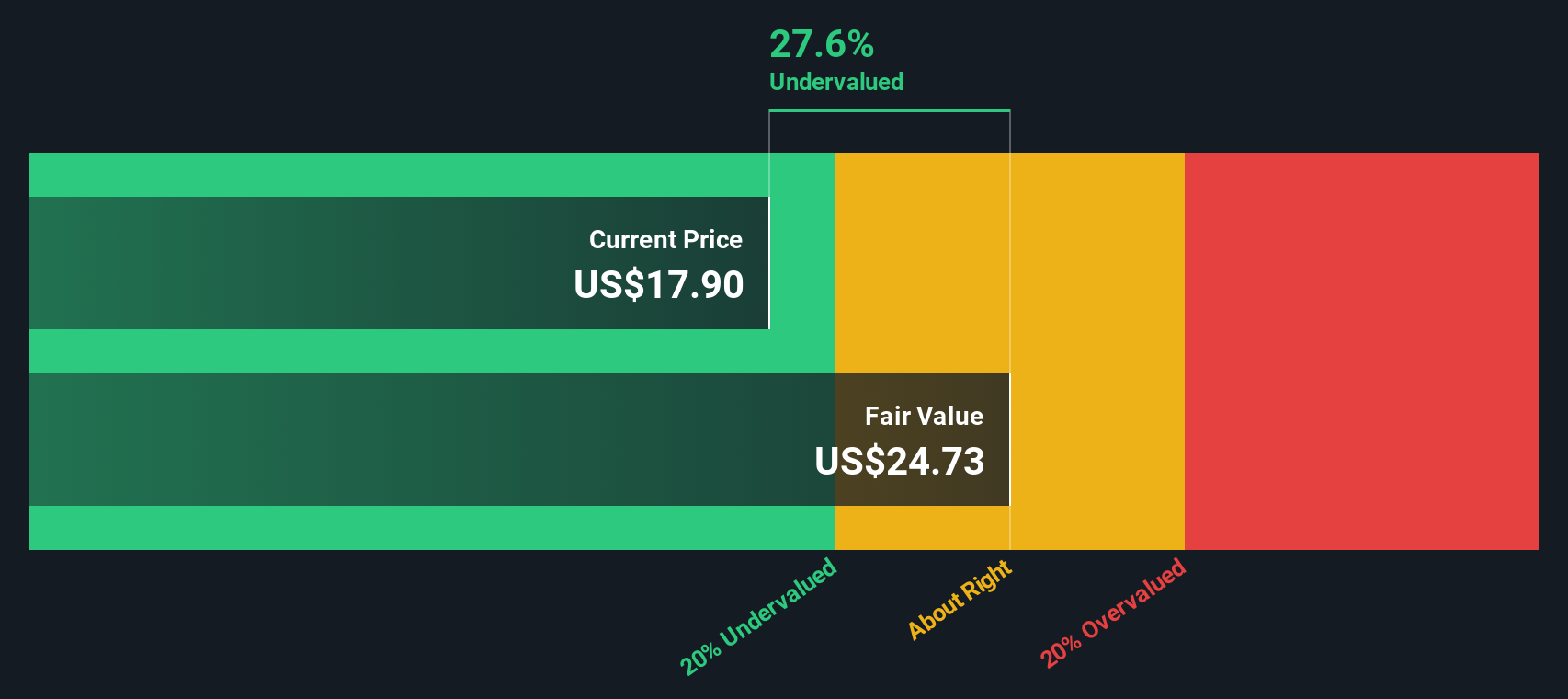

Most Popular Narrative: 28% Undervalued

With Arlo Technologies closing at $16.67 and the most popular narrative setting a fair value at $23.20, the gap suggests that analyst consensus remains bullish even amid recent volatility. The premium assigned to Arlo is based on more than just headline growth, highlighting the potential for future margin gains and recurring revenue.

Continual migration of subscribers to higher-priced AI-driven service tiers (Arlo Secure 6) and the corresponding increase in ARPU (now over $15, up 26% y/y) reinforces the long-term shift to recurring, high-margin (85% non-GAAP service margin) subscription revenue. This trend supports expanding net margins and improved earnings visibility.

Want to understand what’s fueling this optimism? This narrative focuses on future profit margins and premium service adoption, not just hardware sales. Curious about the expectations driving these forecasts? See the full story and break down the assumptions behind that ambitious fair value.

Result: Fair Value of $23.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent international weakness and intensifying competition from major smart home brands could challenge Arlo's growth and profitability outlook in the years ahead.

Find out about the key risks to this Arlo Technologies narrative.

Another View: What Does the SWS DCF Model Say?

Taking a different approach, the SWS DCF model estimates Arlo Technologies’ fair value at $24.77, which is higher than both the consensus analyst target and the current share price. This suggests a wider margin of undervaluation. Does this view make the opportunity look even more compelling, or does it highlight a risk of aggressive assumptions about future growth?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Arlo Technologies Narrative

If you see things differently or like to dig into the numbers yourself, you can craft your own Arlo Technologies story in just a few minutes. Do it your way

A great starting point for your Arlo Technologies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Great investors seize every edge. If you want to spot the next breakout, go beyond Arlo and hunt for powerful opportunities with these proven stock ideas.

- Unlock the potential for high-value payouts by spotting companies featured in these 19 dividend stocks with yields > 3%. Robust yields can reveal income streams the crowd could be missing.

- Catalyze your watchlist by targeting tomorrow’s AI leaders with these 24 AI penny stocks. Position yourself early as artificial intelligence transforms entire industries.

- Boost your upside by grabbing shares that seasoned analysts rate as great bargains. Start with these 891 undervalued stocks based on cash flows and see which stocks are trading below fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARLO

Arlo Technologies

Provides cloud-based platform services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific regions.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success