A Look at Arlo Technologies’s Valuation After Beating Quarterly Revenue Estimates and Raising Guidance

Reviewed by Simply Wall St

Arlo Technologies (ARLO) just posted quarterly results that topped revenue estimates and lifted its outlook for the next quarter. This marks a strong performance that caught investors’ attention. The company’s earnings news reflects momentum in specialized tech stocks recently.

See our latest analysis for Arlo Technologies.

Arlo Technologies’ latest earnings beat has fueled renewed optimism, and the stock has steadily built momentum throughout the year. After jumping 2.7% on the day and notching a 6.2% gain over the past week, Arlo’s year-to-date share price return stands at an impressive 71%. Even more telling, the company has delivered a 72.5% total return for shareholders in the past year and a remarkable 301% five-year total return. This has cemented its status as a long-term outperformer in the tech space.

If tracking this kind of growth sparks your curiosity, it might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With Arlo’s share price surging after its earnings beat and analysts still seeing nearly 24% upside to their targets, the question now is whether the stock remains undervalued or if the market is already pricing in all future growth potential.

Most Popular Narrative: 19.1% Undervalued

Compared to Arlo Technologies’ last close of $18.77, the most popular narrative assigns a fair value nearly 20% higher, suggesting significant upside. This perspective weighs up factors including recurring revenue momentum and the scale of new partnerships when projecting the company's future potential.

Continual migration of subscribers to higher-priced AI-driven service tiers (Arlo Secure 6) and the corresponding increase in ARPU (now over $15, up 26% y/y) reinforces the long-term shift to recurring, high-margin (85% non-GAAP service margin) subscription revenue. This trend supports expanding net margins and earnings visibility.

Want to know what bold financial bets and upward margin moves lie beneath this sharp price target? The core narrative is built around big gains in recurring service revenues and a margin transformation that could change everything. Can these drivers really propel valuation to tech-sector heights? Find out which future assumptions power this thesis.

Result: Fair Value of $23.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sharper hardware price war or a slowdown in consumer demand could quickly derail Arlo’s profit projections and growth outlook.

Find out about the key risks to this Arlo Technologies narrative.

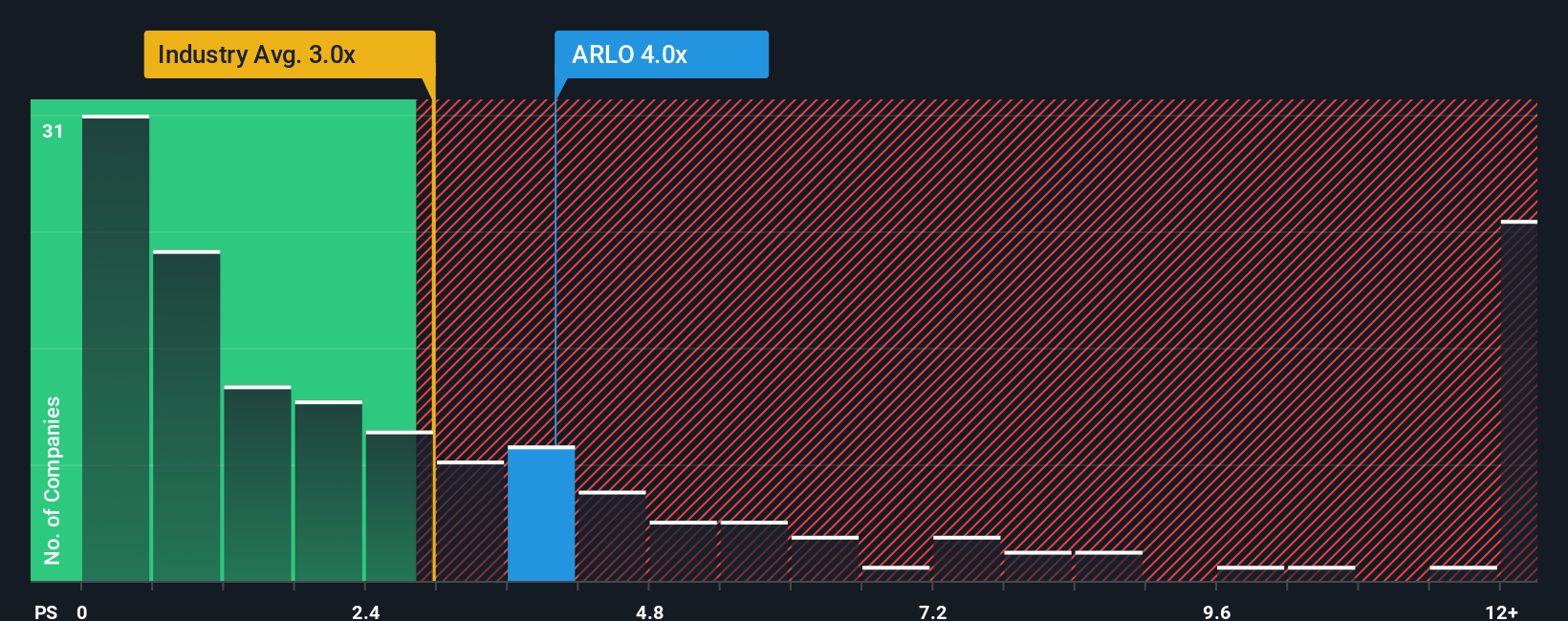

Another View: Market Ratios Tell a Different Story

While analyst narratives highlight Arlo as undervalued, the company actually trades at a price-to-sales ratio of 3.9x, which is higher than both the US Electronic industry average of 2.9x and its peer average of 4.9x. When compared to the fair ratio of 2x, Arlo looks expensive on this basis, pointing to less upside if the market moves towards that benchmark. Could this signal additional valuation risk, or does the growth story justify the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arlo Technologies Narrative

If you have a different take on Arlo’s valuation or enjoy digging through company data firsthand, you can build your own perspective on the story in just a few minutes, so why not Do it your way

A great starting point for your Arlo Technologies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why stop at one winning story? Broaden your investment opportunities and stay ahead of the market by researching stocks with strong growth, tech innovation, or reliable dividends using these handpicked tools:

- Uncover growth potential by targeting these 27 AI penny stocks, which are set to shape the world with artificial intelligence breakthroughs and rapid digital adoption.

- Snap up value by tracking these 879 undervalued stocks based on cash flows, as analysts believe these stocks are poised for rebounds and strong returns based on their future cash flows.

- Secure regular income by focusing on these 17 dividend stocks with yields > 3%, offering robust yields above 3 percent for those who appreciate steady, reliable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARLO

Arlo Technologies

Provides cloud-based platform services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific regions.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives