Assessing Amphenol (APH) Valuation as Robust AI-Driven Demand and Earnings Momentum Fuel Latest Stock Surge

Reviewed by Simply Wall St

If you have been following Amphenol (APH), you have probably noticed the stock’s solid momentum, highlighted by its climb to a new 52-week high after recent news. The excitement centers on surging demand for Amphenol’s high-speed interconnect products, especially those crucial to AI and next-generation data center infrastructure. Add to this a series of earnings beats and management’s positive tone on organic growth, and you get a narrative that is turning heads across the investment community.

All this has fuelled an impressive share price run so far this year, with Amphenol outpacing broader benchmarks and showing impressive consistency. Several acquisitions have helped expand Amphenol’s footprint, but investors seem primarily focused on the company’s strong ongoing demand for its AI and cloud offerings. Momentum appears strong, with the stock logging an 88% return over the past year and more than tripling over five years, a trend powered by both strong business performance and rising investor confidence around its key growth verticals.

With Amphenol posting gains like these, is there still a bargain to be found, or has the current price already factored in the full extent of its AI-driven growth potential?

Most Popular Narrative: Fairly Valued

According to the most widely followed narrative, Amphenol's current market price is considered to be in line with its fair value, based on robust growth expectations and sector positioning. Analysts see little immediate upside, as the consensus price target is almost identical to recent trading levels.

Enhanced focus on high-technology and a differentiated product mix, driven by customer demand for mission-critical, high-performance components, has strengthened pricing power and operating efficiency. This has resulted in structurally higher conversion and operating margins, with management now targeting 30% incremental margin conversion versus the historical 25%.

Ready to uncover the math powering Amphenol’s impressive valuation? The top narrative hinges on ambitious growth targets, profit momentum, and a future earnings multiple you do not see every day. Which assumptions are shaping the analysts’ consensus? All will be revealed in the full deep dive to see what is fueling the fair value call.

Result: Fair Value of $116.19 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifts in technology cycles or a slowdown in AI demand could quickly challenge Amphenol’s pace, which makes sustained growth less certain.

Find out about the key risks to this Amphenol narrative.Another View: Discounted Cash Flow Tells a Different Story

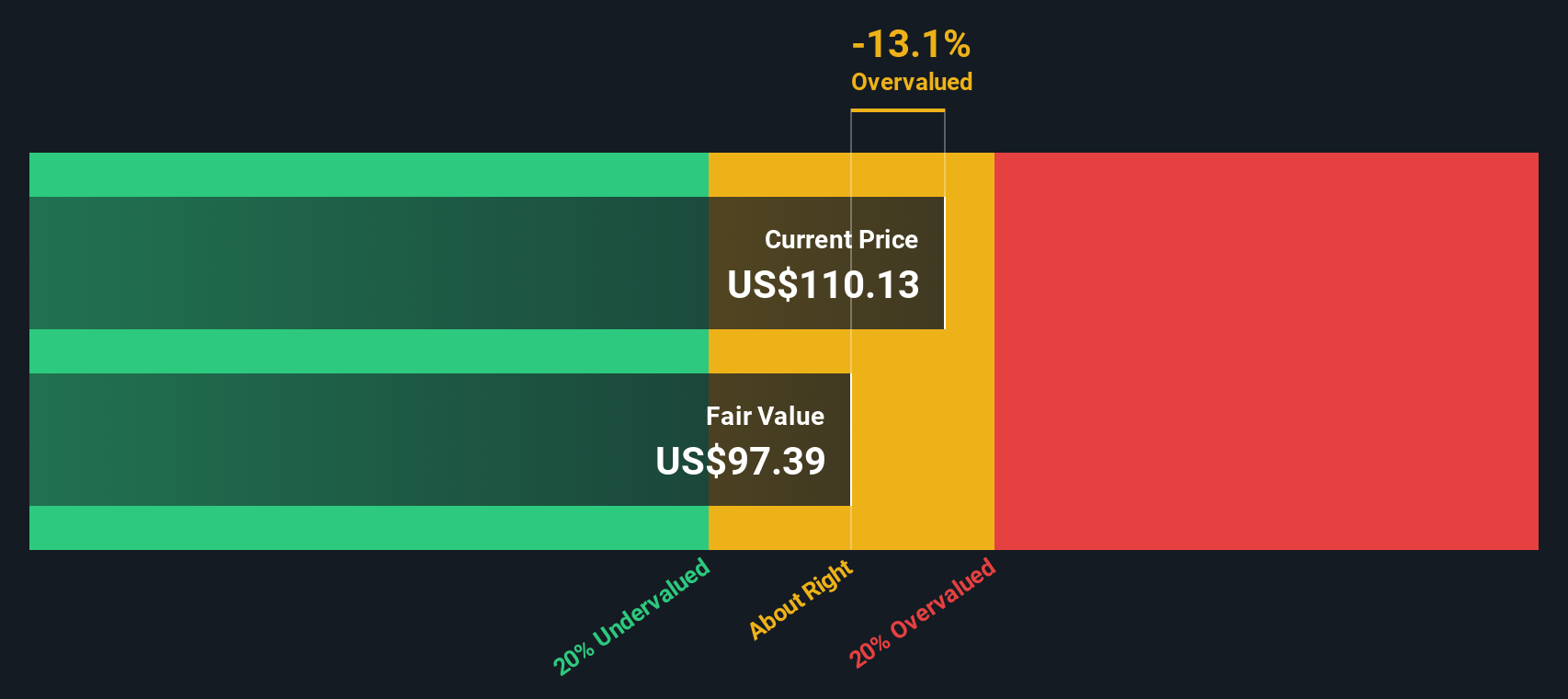

While analyst targets point to fair value based on growth assumptions, our SWS DCF model suggests a less optimistic outlook. This indicates that Amphenol could be overvalued if you focus on future cash flows. Could the market's excitement be running ahead of reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Amphenol Narrative

If you are not convinced by these perspectives or prefer to delve into the data yourself, you can easily build your own narrative in just a few minutes. Do it your way

A great starting point for your Amphenol research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Investment Ideas?

Why wait for the next big opportunity to pass you by? Take charge of your portfolio by jumping into stock themes shaking up markets right now.

- Unlock growth with AI leaders shaking up entire industries and spot the frontrunners with AI penny stocks.

- Zero in on companies trading below their real worth and get ahead with undervalued finds through undervalued stocks based on cash flows.

- Tap into steady income streams by finding stocks boasting reliable yields over 3% directly on dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APH

Amphenol

Designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives