Assessing Amphenol (APH) Valuation After 23% Share Price Surge Over Past Quarter

Reviewed by Kshitija Bhandaru

Amphenol (APH) has caught the attention of investors recently, with shares up 23% over the past 3 months. This uptick has led many to take a closer look at current performance and prospects.

See our latest analysis for Amphenol.

Amphenol's 23% share price return over the past quarter builds on a year that has seen significant momentum. The share price is now at $121.7, with a remarkable 1-year total shareholder return of 87.1%. While there have been few headline-grabbing announcements lately, the pace of recent gains signals ongoing optimism about Amphenol’s growth potential and market position.

If you're interested in finding stocks with similarly dynamic growth profiles, broaden your radar and discover fast growing stocks with high insider ownership

With momentum showing little sign of slowing and shares nearing analyst price targets, investors are left wondering whether Amphenol is currently undervalued or if the market is already pricing in all future growth potential.

Most Popular Narrative: Fairly Valued

Amphenol’s current share price of $121.70 is strikingly close to the narrative’s fair value estimate of $122.88, signaling a strong alignment between market price and analyst consensus. This tight margin suggests that most expectations for future growth and profitability are already factored in, making the case for a balanced valuation discussion.

“Accelerating global deployment of AI-driven data centers and adoption of next-generation IT architecture is driving strong, sustained demand for Amphenol's high-speed, high-value interconnect solutions. This is evidenced by exceptional growth in IT datacom revenue and continued multi-quarter customer engagement. This is expected to support further top-line growth and maintain higher incremental margins.”

Curious about which financial levers are propelling this impressive figure? The valuation leans on projections and catalysts that might surprise you. Delve deeper to uncover what analysts are betting on to justify this tightly matched fair value and spot what could shift the story next.

Result: Fair Value of $122.88 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intense competition and volatile tech sector demand could still derail these upbeat growth assumptions. This may expose Amphenol to sharper revenue or margin swings.

Find out about the key risks to this Amphenol narrative.

Another View: SWS DCF Model Poses a Tougher Question

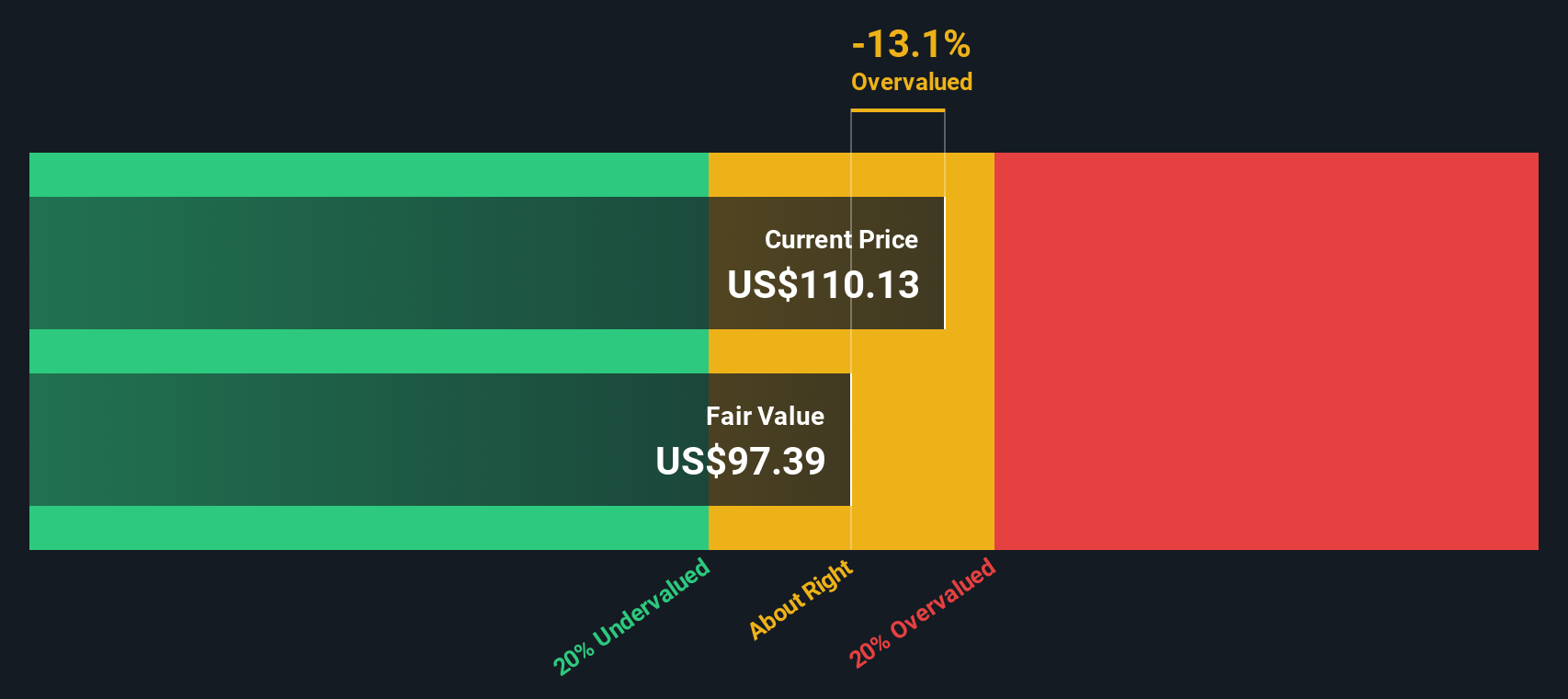

While most analysts see Amphenol’s price and fair value as closely matched, our DCF model suggests the shares could actually be overvalued. The DCF approach calculates a fair value of $92.99, which is well below today’s share price. This raises the possibility that future growth may already be built into the price. How do you weigh these conflicting signals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Amphenol for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Amphenol Narrative

If you want to test your own assumptions or challenge the consensus, you can dig into the data and shape a narrative in just a few minutes. Do it your way

A great starting point for your Amphenol research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready to Find Your Next Winning Stock?

Stay ahead and give yourself an edge by tapping into new market opportunities. If you’re serious about building wealth, don’t miss these fresh ideas:

- Unlock steady income streams by scanning for high-yield opportunities among these 19 dividend stocks with yields > 3%. These may offer attractive payouts and the potential for long-term returns.

- Jump ahead in rapidly growing sectors by spotting future leaders through these 24 AI penny stocks, which focus on next-generation artificial intelligence breakthroughs.

- Capitalize on market inefficiencies and pinpoint genuine bargains by targeting these 898 undervalued stocks based on cash flows, which is packed with stocks trading below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APH

Amphenol

Designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion