Amphenol (APH) Is Up 10.3% After $8 Billion Debt Raise and Major Dividend Boost - Has the Investment Case Evolved?

Reviewed by Sasha Jovanovic

- Amphenol Corporation recently completed a series of major debt and fixed income offerings, including the issuance of senior notes totaling over US$8 billion with maturities ranging from 2027 to 2055, following strong third-quarter results and a 52% rise in its quarterly dividend.

- The proceeds from this debt issuance are intended to help fund Amphenol's acquisition of CommScope Holding Company's Connectivity and Cable Solutions businesses, further expanding its position in the interconnect sector.

- We will now examine how Amphenol’s substantial dividend increase and robust financial results influence its investment narrative and outlook.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Amphenol Investment Narrative Recap

To believe in Amphenol as a shareholder today, you need confidence in continued strong demand for high-value interconnect solutions across AI, datacenter, and diversified industrial sectors, as well as in the company's ability to execute and integrate major acquisitions. The recent multi-billion dollar debt issuance, intended to finance the CommScope deal, increases financial leverage but does not fundamentally change the short-term catalyst, which remains the sustainability of datacenter and AI-driven revenue growth. The main risk is heightened earnings volatility if IT and communications sector demand slows.

One of the most relevant recent announcements is Amphenol’s 52 percent dividend increase. This action reflects management’s confidence in cash generation, which is important as the company takes on more debt and integration risk tied to acquisitions. Dividend strength is also a signal many investors watch for early signs of the health of ongoing catalysts in the business.

By contrast, investors should also be mindful that elevated capital expenditures and new debt levels could become a concern if...

Read the full narrative on Amphenol (it's free!)

Amphenol's narrative projects $26.9 billion in revenue and $5.1 billion in earnings by 2028. This requires 12.7% yearly revenue growth and a $1.9 billion increase in earnings from the current $3.2 billion.

Uncover how Amphenol's forecasts yield a $139.29 fair value, in line with its current price.

Exploring Other Perspectives

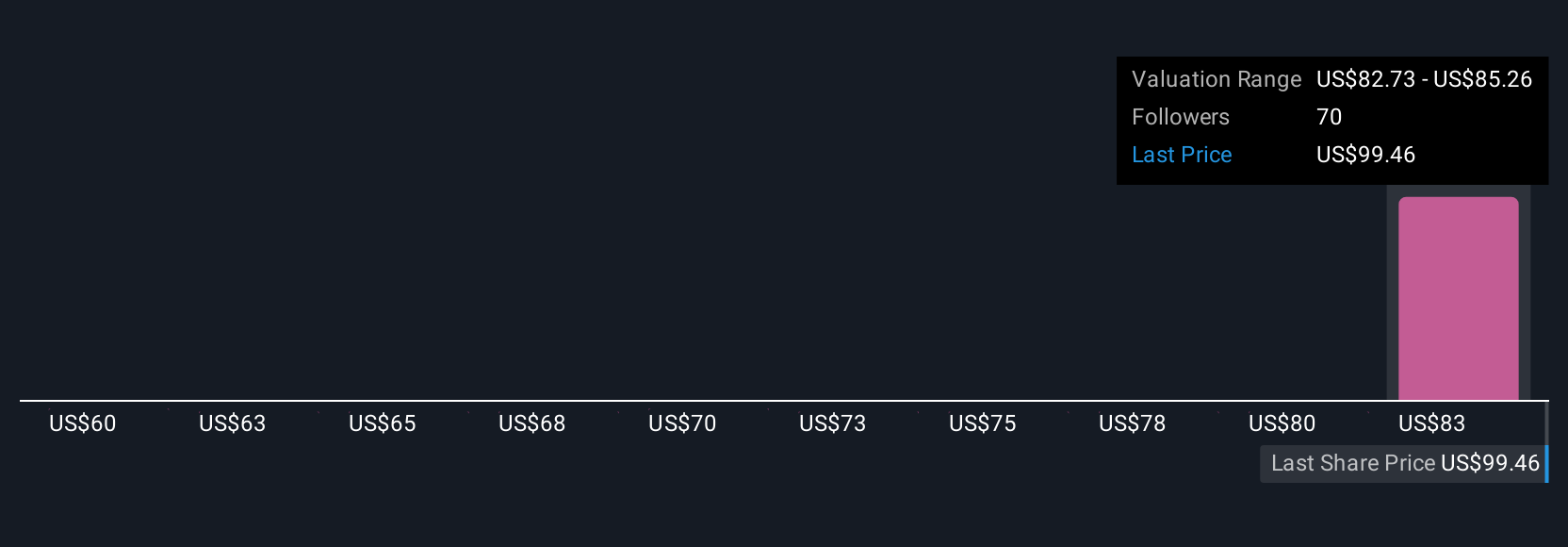

Six fair value estimates from the Simply Wall St Community range from US$60 to US$139.29, reflecting sharply differing opinions. With Amphenol’s sizeable reliance on acquisitions, many see integration risk as a key variable affecting long-term performance; you can compare these alternative outlooks directly.

Explore 6 other fair value estimates on Amphenol - why the stock might be worth as much as $139.29!

Build Your Own Amphenol Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amphenol research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Amphenol research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amphenol's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APH

Amphenol

Designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives