Amphenol (APH): Assessing Valuation After a 96% Year-to-Date Surge and Recent Dip

Reviewed by Simply Wall St

Amphenol (APH) stock has been on the radar for many investors, driven by its steady growth figures over the past year. The company’s strong financial trajectory continues to spark interest among those following the tech hardware sector.

See our latest analysis for Amphenol.

After a rapid climb throughout the year, Amphenol’s share price currently sits at $135.25 following a recent dip. This marks a notable 96% year-to-date share price return. The momentum has been especially pronounced over the past three months, and with a five-year total shareholder return of 346%, longer-term investors have seen exceptional gains.

If you're keen to find more standout tech hardware names with strong momentum, now is a great moment to check out the latest movers in our curated tech and AI stock list: See the full list for free.

With recent gains and solid fundamentals, the big question is whether Amphenol shares remain an overlooked value, or if the current price fully reflects expectations for its future growth. Could this be the right moment to buy in, or is the market already one step ahead?

Most Popular Narrative: 6.2% Undervalued

Amphenol’s most followed narrative sets a fair value of $144.12, which is above the last close of $135.25. The latest fair value upgrade signals that margin improvement and demand outlook are prompting investors and analysts to reconsider how high Amphenol can go from here.

Ongoing strategic acquisitions (such as ANDREW, CIT, and Narda-MITEQ) are broadening product offerings in attractive, high-growth segments (AI, RF/microwave, aerospace/defense), creating further operating leverage and margin expansion opportunities through integration, as reflected in recent record operating margins and sequential improvement in profitability.

Can Amphenol maintain this premium status? The assumptions behind that fair value depend on a bold combination of rising profit margins, optimism about end-market demand, and an earnings growth leap that rivals even some high-flying tech names. Want to see how all those pieces supposedly fit together?

Result: Fair Value of $144.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent volatility in tech demand and potential integration issues from recent acquisitions could quickly challenge these optimistic growth assumptions for Amphenol.

Find out about the key risks to this Amphenol narrative.

Another View: How Do Traditional Ratios Stack Up?

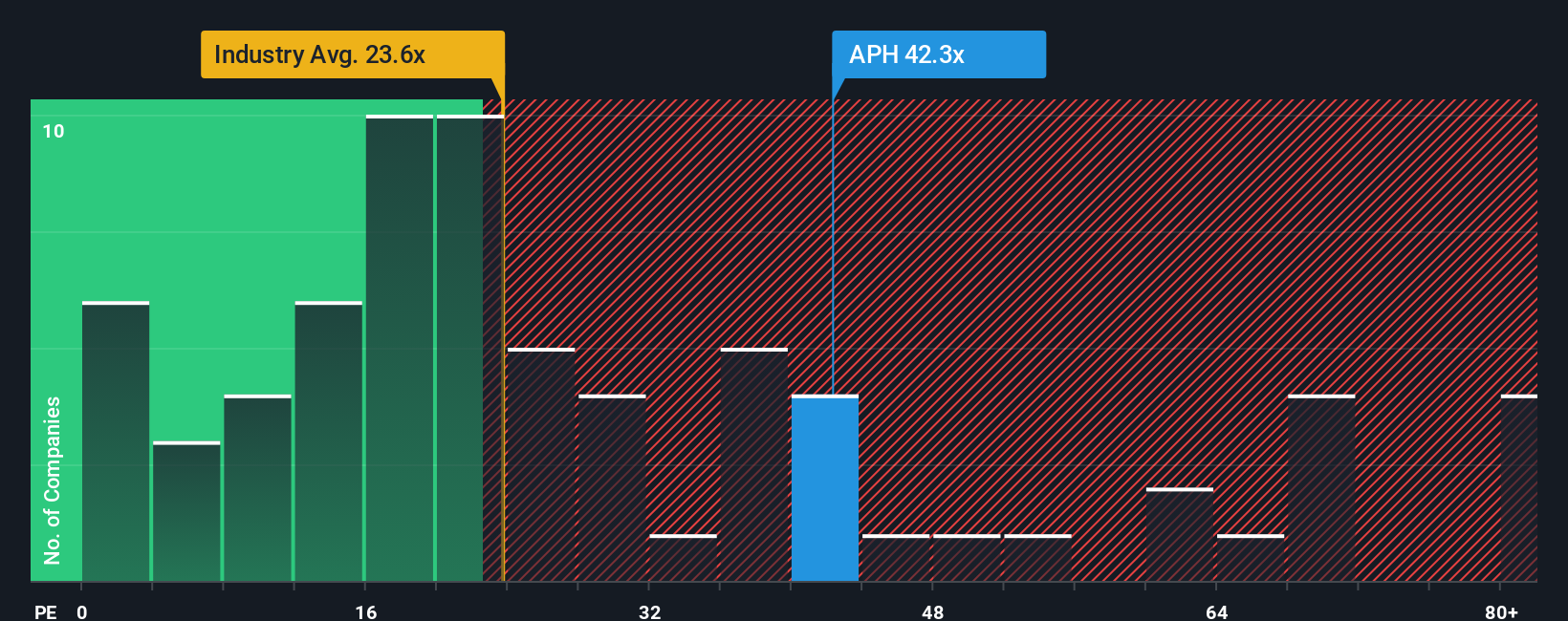

Looking at valuation through the lens of price-to-earnings, Amphenol stands out as more expensive than its industry peers. The market is asking investors to pay about 43 times earnings versus an industry average of 24, and even above its own fair ratio of 39. Do these lofty expectations introduce more risk than reward?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amphenol Narrative

If you see the story differently, or want to dig into the facts firsthand, you can craft your own narrative in just a few minutes: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Amphenol.

Looking for More Smart Investment Ideas?

Don't wait on the sidelines while others uncover tomorrow's winners. The Simply Wall Street Screener curates opportunities you won't want to overlook. Start your next research streak here:

- Tap into high yields and steady returns by checking out these 15 dividend stocks with yields > 3% with payouts above 3% for reliable income potential.

- Uncover rapid growth prospects among these 27 AI penny stocks leading transformative changes in artificial intelligence and automation.

- Seize chances in next-generation tech advancements by exploring these 27 quantum computing stocks paving the way in quantum computing innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APH

Amphenol

Designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives