- United States

- /

- Communications

- /

- NYSE:ANET

Why Arista Networks (ANET) Is Up 5.3% After Analyst Upgrades and Pre-Earnings Optimism

Reviewed by Simply Wall St

- Arista Networks recently outperformed the broader market after analysts raised their estimates and expressed optimism ahead of the company’s scheduled earnings release on August 5, 2025.

- Increasing analyst confidence and a top Zacks Rank highlight mounting expectations for strong business performance, especially in the context of anticipated earnings and revenue growth.

- We'll see how the surge in analyst optimism and upgraded expectations could reshape Arista Networks' investment narrative in the near term.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Arista Networks Investment Narrative Recap

To be an Arista Networks shareholder, you need to believe in the company’s ability to sustain growth through AI-driven data center innovation, strong revenue momentum, and efficient execution amid rapid sector evolution. Recent analyst upgrades and a surge in estimates leading up to the August 5 earnings announcement highlight optimism for near-term performance, but do not fundamentally alter the key catalyst, robust demand for AI infrastructure, or the biggest risk, which remains operational cost pressures linked to tariffs and complex supply chains.

Among recent announcements, Arista’s strong Q1 2025 results, showing revenue growth to US$2,004.8 million and healthy earnings expansion, are most relevant. This performance provided the backdrop for the current wave of analyst optimism, affirming the company’s core catalyst: scaling with increasing AI and cloud adoption, a factor likely front and center ahead of this quarter’s earnings.

However, in contrast, investors should also be aware of ongoing supply chain and cost challenges that...

Read the full narrative on Arista Networks (it's free!)

Arista Networks' outlook anticipates $12.3 billion in revenue and $4.7 billion in earnings by 2028. This implies an 18.3% annual revenue growth rate and an increase in earnings of $1.7 billion from the current $3.0 billion.

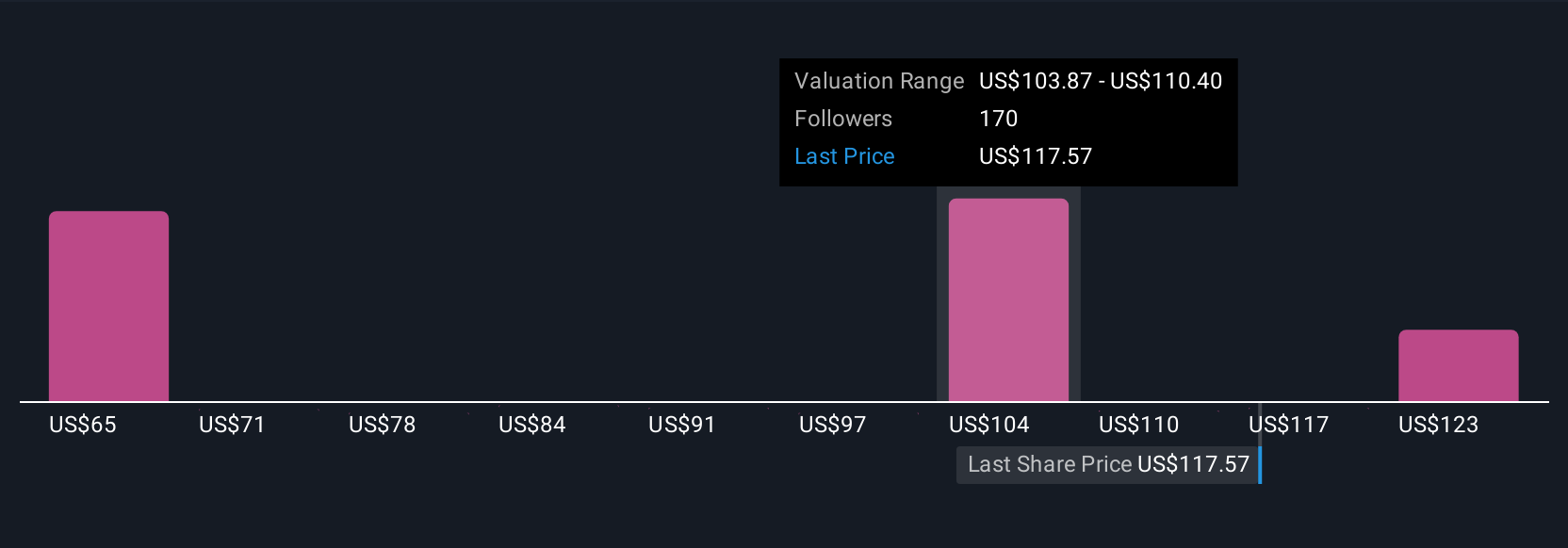

Uncover how Arista Networks' forecasts yield a $109.20 fair value, a 7% downside to its current price.

Exploring Other Perspectives

While most analysts saw steady growth for Arista, the highest estimates predicted annual revenues could hit US$15.3 billion by 2028. These bullish forecasts reflect greater optimism about AI and cloud-driven demand, but also carry heightened concerns about growing reliance on a few major customers, so it’s worth exploring how your expectations may differ from the consensus as this news develops.

Explore 23 other fair value estimates on Arista Networks - why the stock might be worth as much as 11% more than the current price!

Build Your Own Arista Networks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arista Networks research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Arista Networks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arista Networks' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANET

Arista Networks

Engages in the development, marketing, and sale of data-driven, client to cloud networking solutions for AI, data center, campus, and routing environments in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives