- United States

- /

- Communications

- /

- NYSE:ANET

Arista Networks (ANET): Evaluating Valuation After New AI Data Center and Campus Networking Launches

Reviewed by Simply Wall St

Arista Networks (ANET) has been busy, rolling out new AI focused campus and data center solutions while teaming with Fortinet on a Secure AI Data Center architecture that underscores its leadership in high performance networking.

See our latest analysis for Arista Networks.

Those moves come after a choppy stretch for the stock, with a recent pullback leaving the 90 day share price return at negative 16.7 percent, but a still solid 11.5 percent year to date, and a standout five year total shareholder return above 500 percent that shows long term momentum remains firmly intact.

If Arista’s AI networking story has your attention, it is worth seeing what else is setting up for growth in high growth tech and AI stocks.

With shares now trading at a steep discount to Wall Street targets despite rising AI demand and robust profitability, are investors overlooking Arista’s next leg of growth, or has the market already priced in its AI networking upside?

Most Popular Narrative Narrative: 24.1% Undervalued

With the latest fair value estimate sitting well above Arista Networks’ last close, the most followed narrative sees meaningful upside still on the table.

The analysts have a consensus price target of $140.25 for Arista Networks based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $160.0, and the most bearish reporting a price target of just $103.0.

Want to see how strong double digit revenue growth, robust margins, and a rich future earnings multiple can still justify upside from here? The narrative lays out the precise growth runway, profit profile, and valuation math that underpin this higher fair value. Curious which long term assumptions really carry the model? Dive in to unpack the numbers driving this call.

Result: Fair Value of $164.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors should watch concentration in a few hyperscaler customers and rising competition in open Ethernet and AI networking, which could limit both margins and growth.

Find out about the key risks to this Arista Networks narrative.

Another Angle on Valuation

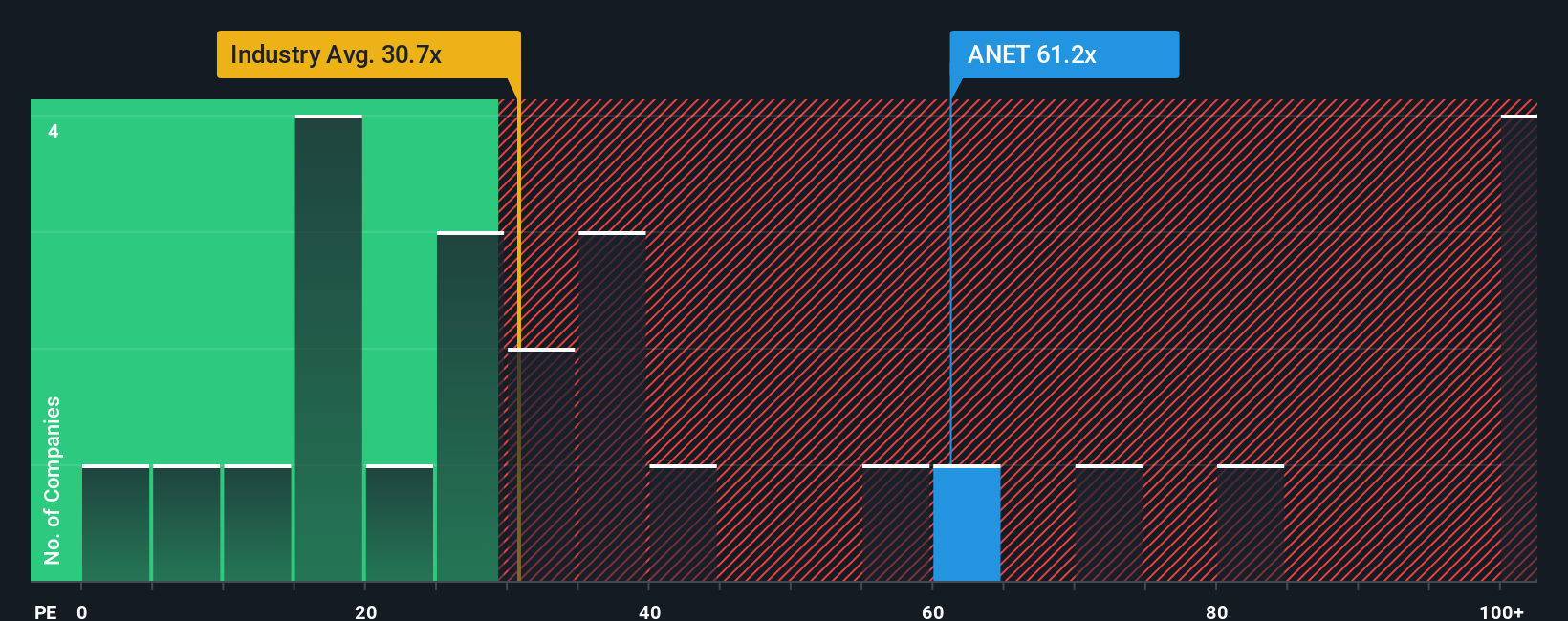

On earnings based valuation, Arista looks pricey, trading on a 46.8x price to earnings ratio versus 30.7x for the US Communications industry, 30.5x for peers, and a 38.8x fair ratio. That premium bakes in a lot of AI optimism, so what happens if growth expectations cool?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arista Networks Narrative

If you are not fully aligned with this view or prefer digging into the numbers yourself, you can build a custom narrative in minutes, Do it your way.

A great starting point for your Arista Networks research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next investing edge?

Do not stop at one great story. Use the Simply Wall St screener to uncover fresh opportunities before the crowd spots them and prices move away.

- Capture early stage potential with these 3629 penny stocks with strong financials that already show stronger balance sheets and fundamentals than typical speculative names.

- Position your portfolio for structural growth by targeting these 24 AI penny stocks shaping the next wave of automation, productivity, and data driven business models.

- Lock in cash flow backed bargains through these 918 undervalued stocks based on cash flows that trade below intrinsic value while still delivering resilient earnings power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANET

Arista Networks

Engages in the development, marketing, and sale of data-driven, client to cloud networking solutions for AI, data center, campus, and routing environments in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion