- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:ZBRA

Is Zebra Technologies a Hidden Gem After Recent Automation Investments and 32% Price Drop?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Zebra Technologies stock is a hidden gem or an overhyped play, you are in the right place.

- Despite a long-term run of 11.0% growth over three years, the stock has tumbled sharply, falling 5.1% this past week and a striking 14.6% over the last month, compounding to 32.2% year-to-date.

- Recent news has centered around Zebra Technologies’ ongoing investments in automation and inventory tracking solutions, which have sparked debate among analysts about the company’s position in a rapidly evolving tech landscape. At the same time, broader market volatility and shifting sentiment around tech stocks have clearly influenced its share price swings.

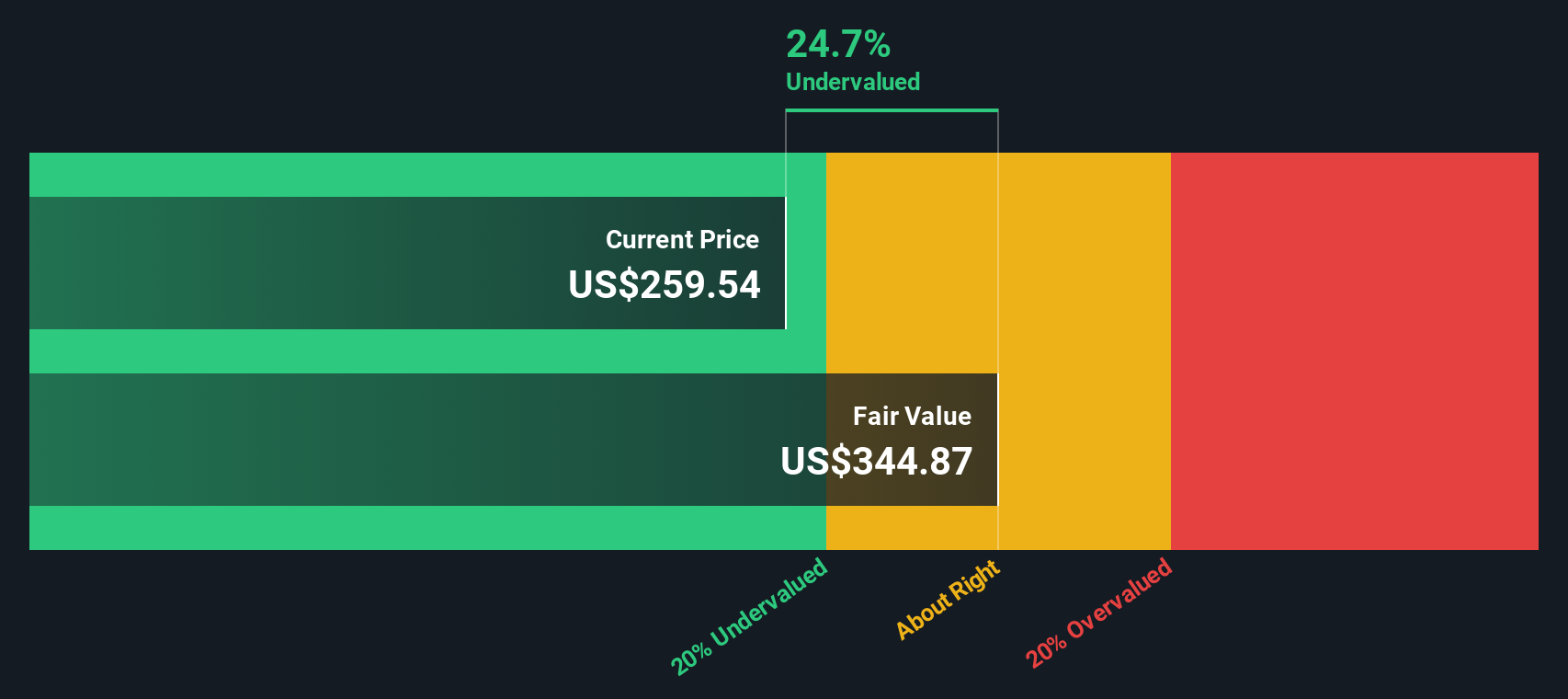

- As a result, the company currently boasts a valuation score of 5 out of 6 for undervaluation, which signals plenty to dig into. We will walk through the key valuation approaches next, and stick around for an even smarter way to look at value coming up later in the article.

Find out why Zebra Technologies's -31.4% return over the last year is lagging behind its peers.

Approach 1: Zebra Technologies Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model evaluates the intrinsic value of a company by projecting its future cash flows and discounting them back to today's dollars. This approach aims to estimate what all those future millions in profits are worth right now.

For Zebra Technologies, the DCF analysis starts with current Free Cash Flow of $786.8 Million. Analyst estimates suggest Free Cash Flow will continue to grow, reaching $1,059 Million by 2029. Although exact analyst projections only extend five years into the future, further values are extrapolated based on reasonable assumptions from Simply Wall St.

Taking these forecasts together, the DCF model calculates a fair value for Zebra Technologies stock of $351.51 per share. This suggests the shares are trading at a 25.9% discount compared to their intrinsic value.

Based on this significant discount, the DCF approach indicates that Zebra Technologies is currently undervalued in the market.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Zebra Technologies is undervalued by 25.9%. Track this in your watchlist or portfolio, or discover 844 more undervalued stocks based on cash flows.

Approach 2: Zebra Technologies Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is widely used to value profitable companies because it shows how much investors are willing to pay for each dollar of earnings. For established tech firms generating steady profits, the PE ratio helps compare valuation with industry standards and market expectations.

Generally, companies with higher growth prospects and lower risks can justify higher PE ratios, while those with more uncertainty or lower growth should trade at lower ratios. Growth expectations, profit consistency, and company-specific risks all play a role in determining what a “normal” or “fair” PE should look like at any given time.

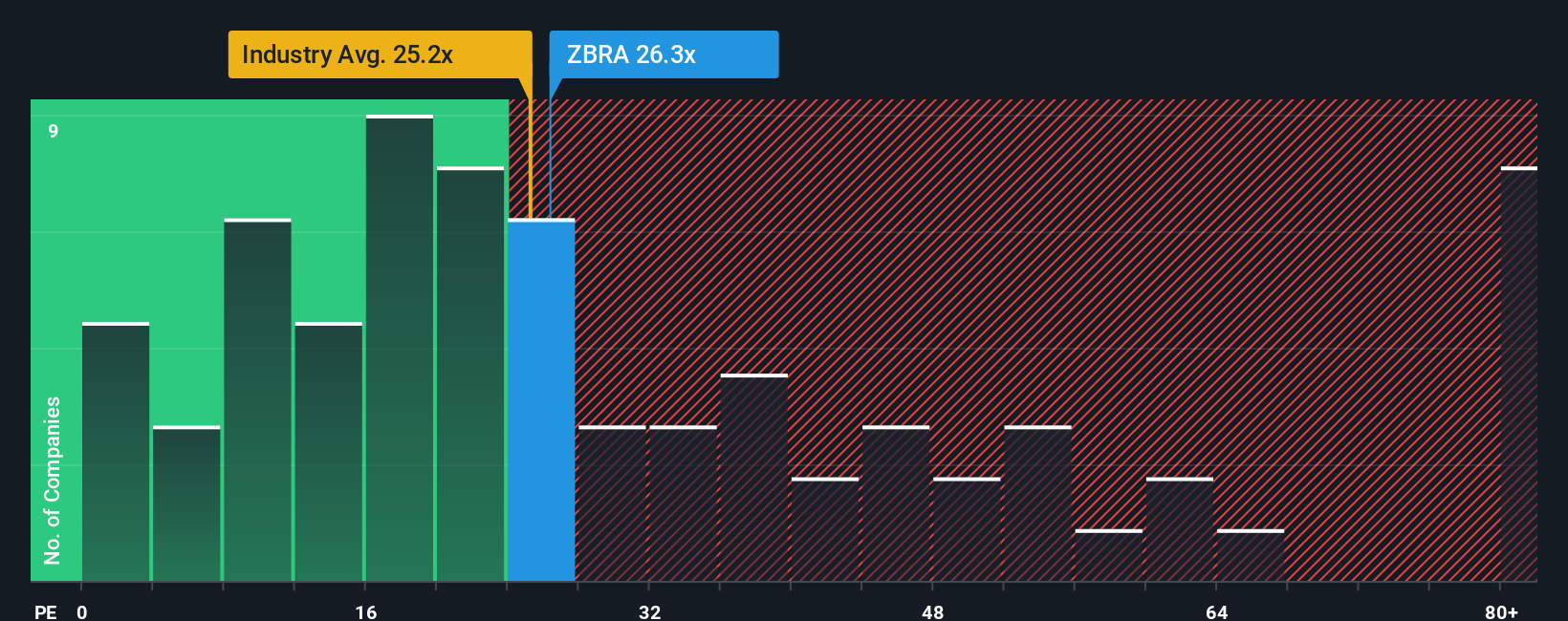

Zebra Technologies is currently trading at a PE ratio of 25.8x. This sits almost exactly at the Electronic industry average of 25.2x, but it is well below the peer group average of 60.4x, suggesting the market is applying a more conservative lens compared to similar companies.

Rather than simply comparing to industry averages, Simply Wall St uses a proprietary “Fair Ratio” to model the multiple Zebra Technologies should trade at, given factors like its earnings growth, profit margin, size, and specific risks. In this case, Zebra’s fair PE ratio is calculated at 32.2x. This approach is more reliable than broad peer comparisons because it directly accounts for the company’s unique strengths and risks, not just its sector.

Since Zebra’s actual PE ratio of 25.8x is notably below the calculated fair ratio of 32.2x, this points to Zebra Technologies being undervalued on a PE basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Zebra Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your own, personalized story about a company, tying together your view of Zebra Technologies’ business, its future growth, earnings, and profit margins, and what you think the shares should be worth. Instead of just looking at numbers in isolation, Narratives help you connect the company’s strategy and outlook to a clear financial forecast, and then straight to a fair value. This gives your investment thesis both context and a price tag.

On Simply Wall St’s Community page, Narratives make it easy and accessible for anyone to express why they believe in a company (or don't) by sharing their assumptions and seeing projected fair values update instantly. Because Narratives update dynamically whenever new news or earnings are released, they always reflect the most up-to-date information. This helps you decide when a stock’s price offers enough value to buy or when it is time to consider selling.

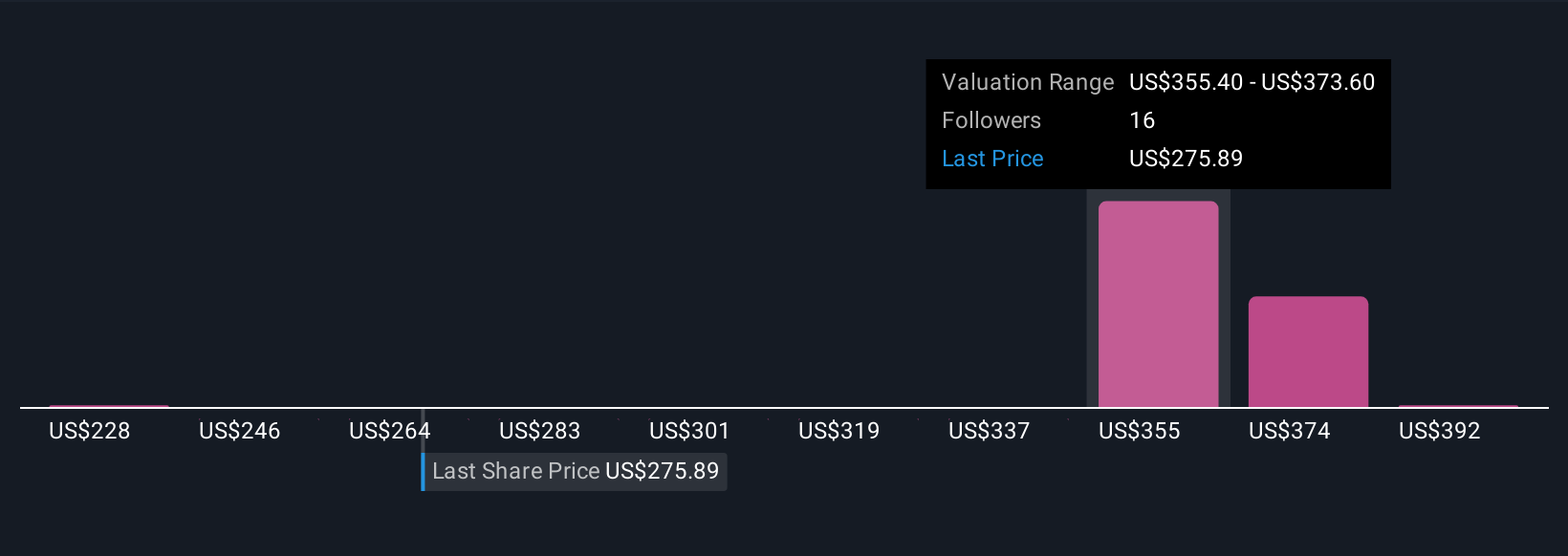

For Zebra Technologies, for example, some investors see robust automation demand, a successful Elo acquisition, and margin improvements leading to higher fair values (like $421.00). Others fear margin risks and international softness, resulting in more cautious targets (as low as $300.00). This demonstrates how Narratives allow you to weigh both the story and the numbers in your decision.

Do you think there's more to the story for Zebra Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zebra Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZBRA

Zebra Technologies

Provides enterprise asset intelligence solutions in the automatic identification and data capture solutions industry worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives