- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:ZBRA

Evaluating Zebra Technologies (ZBRA) Valuation After Q3 Beat, Softer Outlook, and Elo Acquisition Shift Investor Sentiment

Reviewed by Simply Wall St

Zebra Technologies (ZBRA) grabbed attention following its third-quarter earnings report, which surpassed expectations. However, the stock took a hit as investors focused on a softer organic growth outlook and shrinking margins.

See our latest analysis for Zebra Technologies.

Even with its upbeat earnings and acquisition-fueled sales guidance, Zebra Technologies’ share price has tumbled nearly 30% year-to-date as investors weigh the knock-on effects of soft organic growth and thinner margins. While the company is integrating new capabilities and buying back stock, the market’s cautious stance is reflected in Zebra’s 1-year total shareholder return of -30%. This follows a strong run over the past three years. Put simply, near-term momentum has faded, but management is steering for brighter prospects ahead.

If you’re watching how automation leaders are navigating industry shifts, this is a great time to seek out new opportunities and discover fast growing stocks with high insider ownership

With shares down sharply despite upbeat guidance and a strong acquisition pipeline, the big question now is whether the selloff has gone too far or if the market has already factored in Zebra Technologies’ future growth potential.

Most Popular Narrative: 27.7% Undervalued

At $269.25, Zebra Technologies trades notably below the narrative fair value of $372.33. This gap is driven by bullish financial projections and evolving business drivers.

The strategic acquisition of Elo expands Zebra's addressable market by approximately $8 billion, enhances its presence in customer-facing automation and self-service technologies, and provides significant cross-selling and global distribution synergies. This acquisition is expected to be immediately accretive to earnings and to bolster long-term revenue growth.

What powers this optimistic price target? The answer lies in aggressive growth assumptions, ambitious profitability forecasts, and a future multiple that only top-tier tech companies typically achieve. The complete narrative exposes the bold logic and numbers that make up this underappreciated valuation story. Uncover the full rationale behind these projections for Zebra Technologies.

Result: Fair Value of $372.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain. Persistent tariff pressures and lackluster organic growth could limit upside and challenge the optimism around Zebra Technologies’ story.

Find out about the key risks to this Zebra Technologies narrative.

Another View: What Do Multiples Suggest?

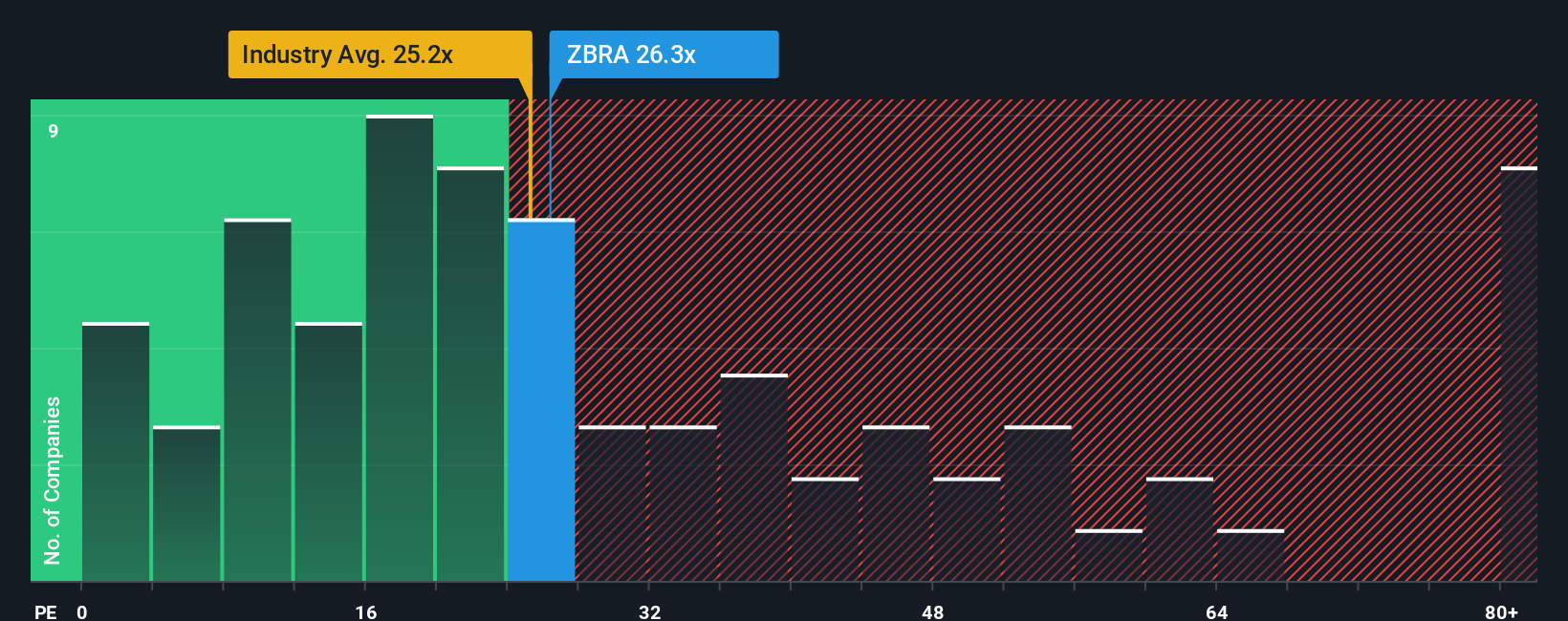

While the narrative approach and analyst price targets suggest Zebra Technologies is undervalued, a simple look at its price-to-earnings ratio tells a mixed story. The company trades at 26.6 times earnings, which is higher than both the US Electronic industry average of 24.3x and its peer group, but still below its fair ratio of 32.2x. This gap means the market is not fully pricing in upside, yet also signals risk if earnings disappoint or industry multiples slip. Could these numbers be hinting at hidden caution, or is there opportunity beneath the surface?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zebra Technologies Narrative

If you see the story differently or want to dive into your own analysis, you can easily craft a fresh perspective in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Zebra Technologies.

Looking for more investment ideas?

Don't wait on the sidelines while new opportunities emerge. The best time to act is when others hesitate, and the Simply Wall Street Screener is your smart shortcut to the next big idea.

- Spot potential breakout winners by tapping into these 3588 penny stocks with strong financials, which feature strong financials and fast-paced growth you won't want to miss.

- Unlock cutting-edge health technology trends by using these 33 healthcare AI stocks to find innovators leading AI-driven advancements in medicine.

- Boost your income strategy by adding these 22 dividend stocks with yields > 3% with attractive yields above 3% to your watchlist so your portfolio continues working for you.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zebra Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZBRA

Zebra Technologies

Provides enterprise asset intelligence solutions in the automatic identification and data capture solutions industry worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives