- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:ZBRA

Are Zebra Technologies’ (ZBRA) Profit Margin Pressures Hinting at Deeper Growth Challenges?

Reviewed by Sasha Jovanovic

- In the past week, Zebra Technologies reported third-quarter results that exceeded analyst expectations, completed a share buyback totaling over US$464 million since 2022, and provided positive guidance for the upcoming quarter, highlighting contributions from its Elo Touch Solutions acquisition and regional sales growth.

- Despite these developments, investor attention centered on ongoing challenges in organic growth and declining profit margins, raising questions about the sustainability of the company’s core business momentum.

- We’ll examine how concerns over profit margins, despite strong headline results, may influence the outlook for Zebra Technologies’ long-term growth narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Zebra Technologies Investment Narrative Recap

To own Zebra Technologies, you must believe in its ability to lead digital transformation across supply chains and retail through automation, despite growing pains from recent strategic shifts. The recent quarterly beat and raised guidance have not materially altered the main catalyst, expansion from the Elo Touch Solutions acquisition, nor do they fully alleviate the chief risk: ongoing margin compression as hardware-driven revenue grapples with competitive and integration pressures.

Among Zebra’s latest updates, the completed US$464 million share buyback since 2022 stands out. While a share repurchase signals confidence in future performance and can support per-share earnings, it does not directly solve the near-term pressure on operating margins, which remains the most discussed issue following the recent earnings release.

Yet, despite the upbeat headline results, investors should be aware that profit margins have continued to...

Read the full narrative on Zebra Technologies (it's free!)

Zebra Technologies is projected to reach $6.2 billion in revenue and $855.4 million in earnings by 2028. This outlook relies on 6.0% annual revenue growth and an earnings increase of $307.4 million from the current $548.0 million.

Uncover how Zebra Technologies' forecasts yield a $372.33 fair value, a 38% upside to its current price.

Exploring Other Perspectives

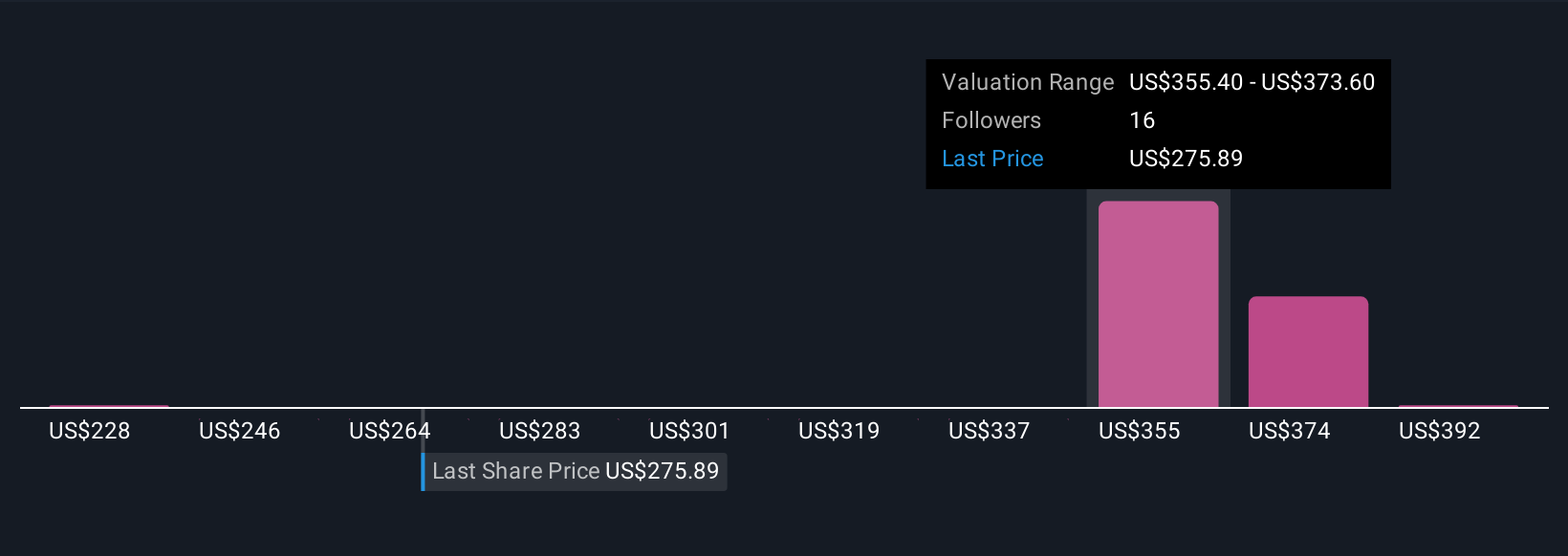

Five independent fair value estimates from the Simply Wall St Community range from US$228 to US$410, underscoring a wide spread in outlooks. With risk of persistent margin pressure still top of mind, consider how differing forecasts can shape your understanding of Zebra Technologies’ performance.

Explore 5 other fair value estimates on Zebra Technologies - why the stock might be worth 15% less than the current price!

Build Your Own Zebra Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zebra Technologies research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Zebra Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zebra Technologies' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zebra Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZBRA

Zebra Technologies

Provides enterprise asset intelligence solutions in the automatic identification and data capture solutions industry worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives