- United States

- /

- Tech Hardware

- /

- NasdaqGS:WDC

Will Western Digital's (WDC) Big Data Push at ITAP 2025 Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this month, Western Digital presented at Industrial Transformation ASIA-PACIFIC 2025 in Singapore, where Senior Director Amit Chattopadhyay discussed advances in big data technology and industrial IoT solutions.

- This event showcased Western Digital's focus on data-driven innovation for industrial customers and came shortly before the company's anticipated earnings announcement.

- We'll explore how Western Digital's industry-leading role in big data technology frames the company's near-term investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Western Digital Investment Narrative Recap

The case for owning Western Digital centers on the belief that explosive growth in AI-generated data and cloud-based services will drive sustained demand for high-capacity storage, benefiting companies deeply embedded with leading hyperscalers. While Western Digital's recent industrial IoT presentation highlights its innovation, this event alone is unlikely to materially affect the near-term earnings outlook, which remains the primary catalyst for the stock. Biggest risks remain customer concentration in the cloud and competition from alternative storage technologies.

One of the most relevant recent announcements to this news event is the October 13 expansion of Western Digital’s System Integration and Test Lab, supporting rising storage needs tied to AI applications. This aligns directly with the catalyst of escalating AI-driven data requirements, reinforcing the company's positioning with enterprise and industrial customers ahead of earnings. But the real test for investors remains...

Read the full narrative on Western Digital (it's free!)

Western Digital is projected to achieve $11.9 billion in revenue and $2.2 billion in earnings by 2028. This outlook assumes a 7.6% annual revenue growth rate and a $0.6 billion increase in earnings from the current $1.6 billion.

Uncover how Western Digital's forecasts yield a $125.95 fair value, in line with its current price.

Exploring Other Perspectives

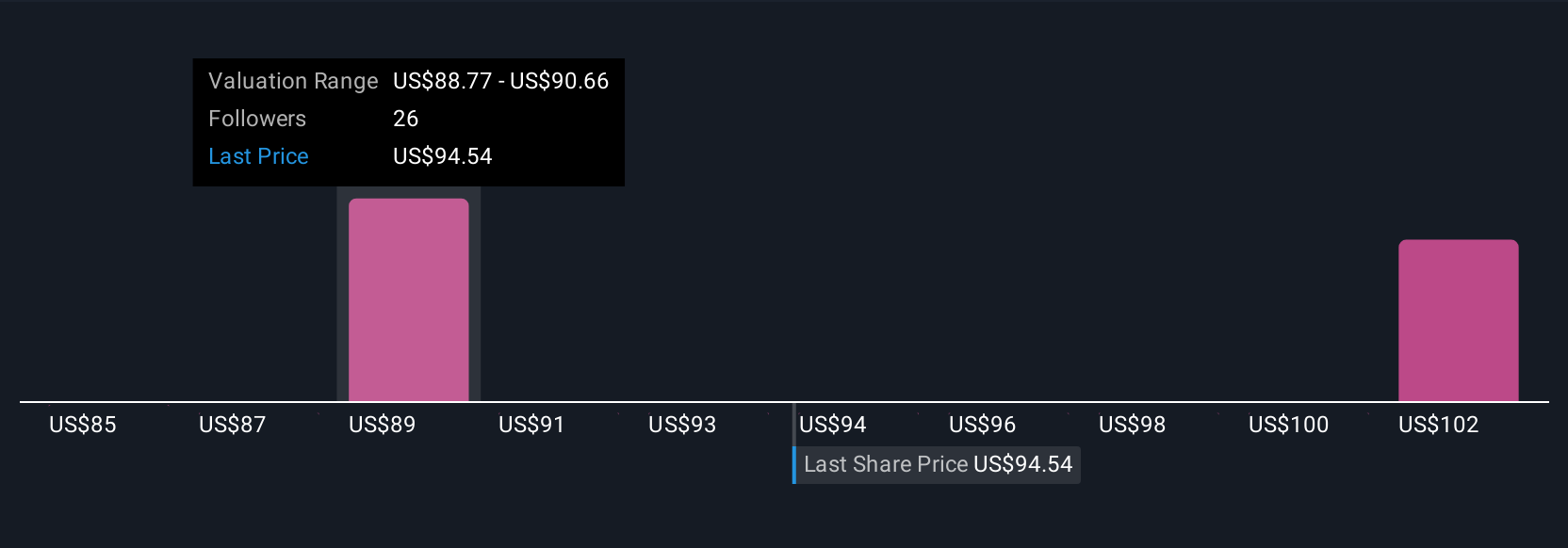

Three private investors in the Simply Wall St Community estimate Western Digital's fair value in the US$85 to US$125.95 range. With reliance on a handful of hyperscale customers a central risk, your view on long-term demand stability could shift your outlook.

Explore 3 other fair value estimates on Western Digital - why the stock might be worth 32% less than the current price!

Build Your Own Western Digital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Western Digital research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Western Digital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Western Digital's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDC

Western Digital

Develops, manufactures, and sells data storage devices and solutions based on hard disk drive (HDD) technology in the United States, Asia, Europe, the Middle East, and Africa.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives