- United States

- /

- Tech Hardware

- /

- NasdaqGS:WDC

Western Digital’s Buyback and Dividend Boost: What Do They Reveal About WDC’s Long-Term Strategy?

Reviewed by Sasha Jovanovic

- Western Digital recently reported strong first-quarter earnings, initiated a buyback of 9.2 million shares for US$702.41 million, and raised its quarterly dividend by 25% to US$0.125 per share, to be paid in December 2025.

- In addition, the company announced that Brad Feller will become Chief Accounting Officer in mid-November 2025, highlighting ongoing changes to its executive team as it executes on growth plans.

- We’ll now examine how Western Digital’s robust earnings growth and capital return policies align with its longer-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Western Digital Investment Narrative Recap

To be a Western Digital shareholder today, you need to believe that explosive demand from AI, cloud, and data center customers will sustain outsize growth, outweighing risks from high customer concentration and evolving storage trends. While the recent earnings beat, dividend hike, and buyback reflect management confidence and enhance capital return, they do not materially shift the near-term catalyst, the pace and scale of hyperscaler orders, or the core risk, which remains revenue dependence on a handful of large customers.

One announcement of particular relevance is the $702.41 million share buyback (2.66% of shares), completed as of October 2025. This sizable repurchase underscores the company’s commitment to enhancing shareholder value, but in the context of Western Digital’s key catalyst, strong hyperscaler demand, it serves mainly as a supporting pillar rather than a transformational driver for future performance.

In contrast, investors should keep close watch on how Western Digital’s reliance on top hyperscale clients can suddenly shift if...

Read the full narrative on Western Digital (it's free!)

Western Digital's outlook anticipates $11.9 billion in revenue and $2.2 billion in earnings by 2028. This relies on a 7.6% annual revenue growth rate and an earnings increase of $0.6 billion from current earnings of $1.6 billion.

Uncover how Western Digital's forecasts yield a $167.48 fair value, in line with its current price.

Exploring Other Perspectives

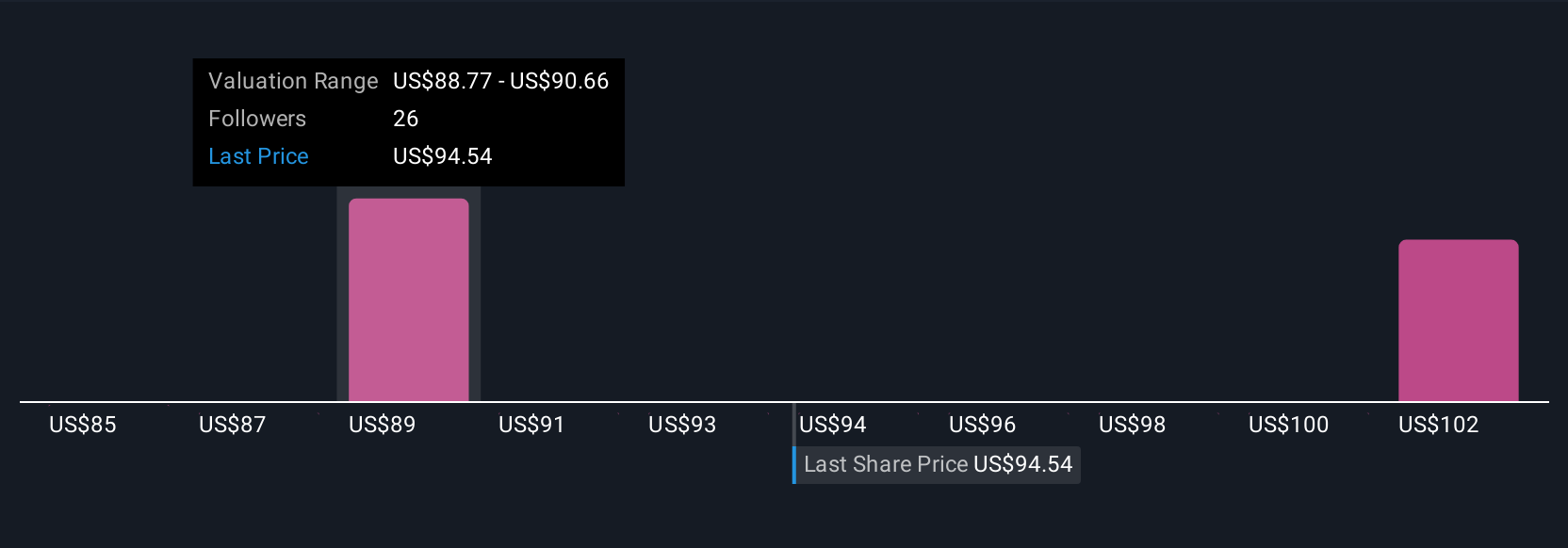

Four fair value estimates from the Simply Wall St Community range from US$85 to US$230.72 per share, highlighting wide-ranging views among private investors. As Western Digital’s earnings are driven by major cloud customers, these diverse perspectives reflect different expectations for its long-term growth and risk profile.

Explore 4 other fair value estimates on Western Digital - why the stock might be worth as much as 39% more than the current price!

Build Your Own Western Digital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Western Digital research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Western Digital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Western Digital's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDC

Western Digital

Develops, manufactures, and sells data storage devices and solutions based on hard disk drive (HDD) technology in the United States, Asia, Europe, the Middle East, and Africa.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives