- United States

- /

- Communications

- /

- OTCPK:VISL

Introducing Vislink Technologies (NASDAQ:VISL), The Stock That Zoomed 154% In The Last Year

When you buy shares in a company, there is always a risk that the price drops to zero. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Vislink Technologies, Inc. (NASDAQ:VISL) share price had more than doubled in just one year - up 154%. Shareholders are also celebrating an even better 236% rise, over the last three months. Unfortunately the longer term returns are not so good, with the stock falling 95% in the last three years.

View our latest analysis for Vislink Technologies

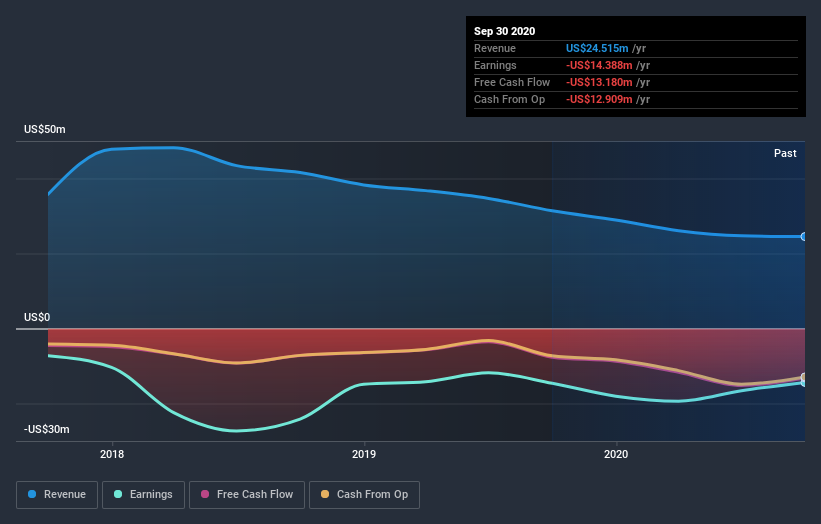

Because Vislink Technologies made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Vislink Technologies saw its revenue shrink by 22%. So we would not have expected the share price to rise 154%. This is a good example of how buyers can push up prices even before the fundamental metrics show much growth. Of course, it could be that the market expected this revenue drop.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Vislink Technologies stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's good to see that Vislink Technologies has rewarded shareholders with a total shareholder return of 154% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 15% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Vislink Technologies (2 don't sit too well with us!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Vislink Technologies, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:VISL

Vislink Technologies

Provides solutions for collecting live news, sports, entertainment, and news events for the broadcast, surveillance, and defense markets in North America, South America, Europe, Asia, and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026