- United States

- /

- Communications

- /

- NasdaqGS:VIAV

Viavi Solutions (VIAV): Assessing Valuation After Growth Wins in High-Speed Optics, Defense and Quantum Security

Reviewed by Simply Wall St

Viavi Solutions (VIAV) is back in the spotlight after a cluster of growth signals, including an outperforming Inertial Labs acquisition, a new federal timing contract, and a quantum security partnership.

See our latest analysis for Viavi Solutions.

Those growth moves seem to be landing with investors, with the share price at $18.41 and a powerful 90 day share price return of 48.35 percent feeding into an 82.28 percent year to date share price gain and a 79.43 percent one year total shareholder return. This signals momentum that is still building rather than fading.

If Viavi's run has you thinking about what else could be setting up for the next leg higher, now is a good time to explore high growth tech and AI stocks.

With the stock now within touching distance of Wall Street targets after an 80 percent plus surge, the key question is whether Viavi still trades below its true potential or if markets are already discounting years of future growth.

Most Popular Narrative: 10% Undervalued

Compared with Viavi Solutions last close of $18.41, the most followed narrative anchors fair value slightly higher, implying more upside if its roadmap plays out.

Viavi is experiencing robust and sustained demand across the data center ecosystem, with customers updating optical connectivity to 400G, 800G, and now 1.6T, enabling multi year upgrade cycles and expanding its total addressable market, which should drive structural revenue growth through 2026 and beyond.

Want to see how this upgrade supercycle turns into hard numbers? The narrative leans on faster growth, fatter margins, and a future multiple that looks surprisingly restrained. Curious how that math still lands below many sector peers? Read on to see what assumptions really drive that fair value call.

Result: Fair Value of $18.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delayed recovery in wireless infrastructure and integration missteps from Spirent and Inertial Labs could quickly challenge the optimistic growth and margin expansion story.

Find out about the key risks to this Viavi Solutions narrative.

Another Lens on Valuation

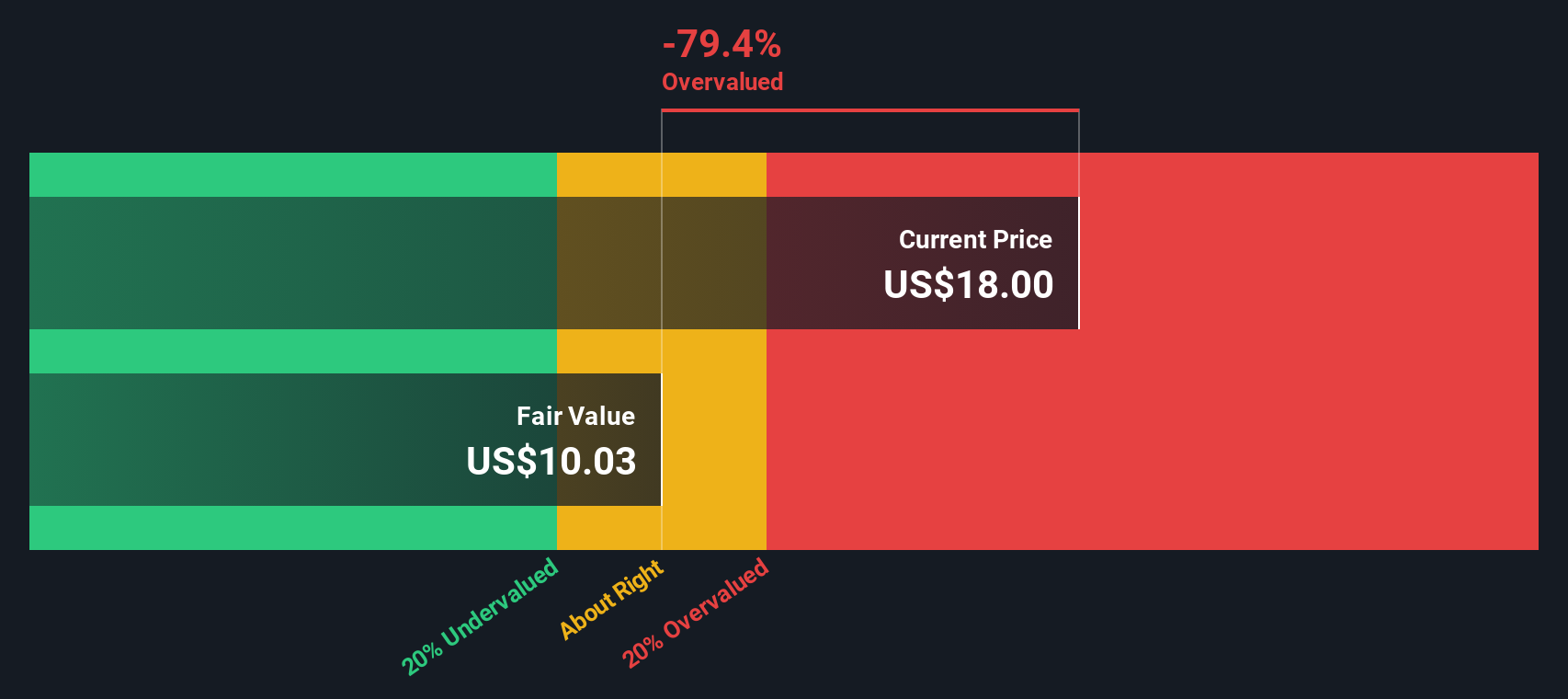

Our DCF model paints a very different picture, suggesting Viavi is trading well above its estimated fair value of $9.98, which screens as overvalued versus its current $18.41 share price. If cash flows say caution while narratives flag upside, which signal deserves more weight?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Viavi Solutions Narrative

If you see the story playing out differently or want to test your own assumptions against the numbers, you can spin up a custom view in just a few minutes. Do it your way.

A great starting point for your Viavi Solutions research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Do not stop with one strong idea. Stay ahead of the market by using the Simply Wall Street Screener to uncover fresh, data driven opportunities right now.

- Lock in growing income potential by targeting companies in these 10 dividend stocks with yields > 3% that aim to reward shareholders with reliable cash returns.

- Ride powerful innovation trends by focusing on these 24 AI penny stocks shaping the next wave of intelligent software and automation.

- Position yourself early in structural technology shifts by tracking these 28 quantum computing stocks reshaping computing, security, and data processing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VIAV

Viavi Solutions

Provides network test, monitoring, and assurance solutions for telecommunications, cloud, enterprises, first responders, military, aerospace, and critical infrastructures in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion