- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:TTMI

TTM Technologies (TTMI): Evaluating Valuation After Strong Recent Share Price Gains

TTM Technologies (TTMI) has caught investor attention lately, as its shares have delivered double-digit growth over the past month and significant gains across the past year. For many, the company’s recent trajectory raises fresh questions about its valuation and future prospects.

See our latest analysis for TTM Technologies.

TTM Technologies’ strong 30-day share price return of nearly 14% and an even more remarkable year-to-date climb of over 170% have clearly turned heads, with investors interpreting the latest moves as validation of long-term momentum and growth potential. Whether you are tracking the company’s rapid ascent or evaluating risk, these recent gains showcase a confident market mood. With a five-year total shareholder return topping 420%, the bigger picture suggests momentum is very much on its side.

If you want to see what other tech and electronics names are making waves right now, it is the perfect moment to discover See the full list for free.

But with the stock’s rapid gains and shares trading just below analyst targets, investors are now left wondering if there is still untapped value in TTM Technologies or if future growth is already fully reflected in the price.

Most Popular Narrative: 11.6% Undervalued

Based on the most widely followed narrative, TTM Technologies' projected fair value sits notably above the last close. As excitement builds around growth catalysts, the narrative sets bold financial expectations for the next several years.

Large-scale data center buildouts announced by tech giants (e.g., Google, CoreWeave, Meta) and TTM's new Wisconsin facility position the company to capture outsized demand for advanced PCBs and interconnects required for AI and cloud infrastructure. This directly supports revenue growth and long-term customer relationships.

Want to know why analysts are forecasting a valuation jump? The real drivers behind this price target are aggressive growth in high-demand sectors and a profit surge. Curious about which numbers anchor these projections? Check the full narrative to discover what’s fueling this upbeat outlook.

Result: Fair Value of $75.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing operational challenges and reliance on key customers could quickly shift sentiment if execution or demand trends weaken.

Find out about the key risks to this TTM Technologies narrative.

Another View: High Valuation Multiples Raise Questions

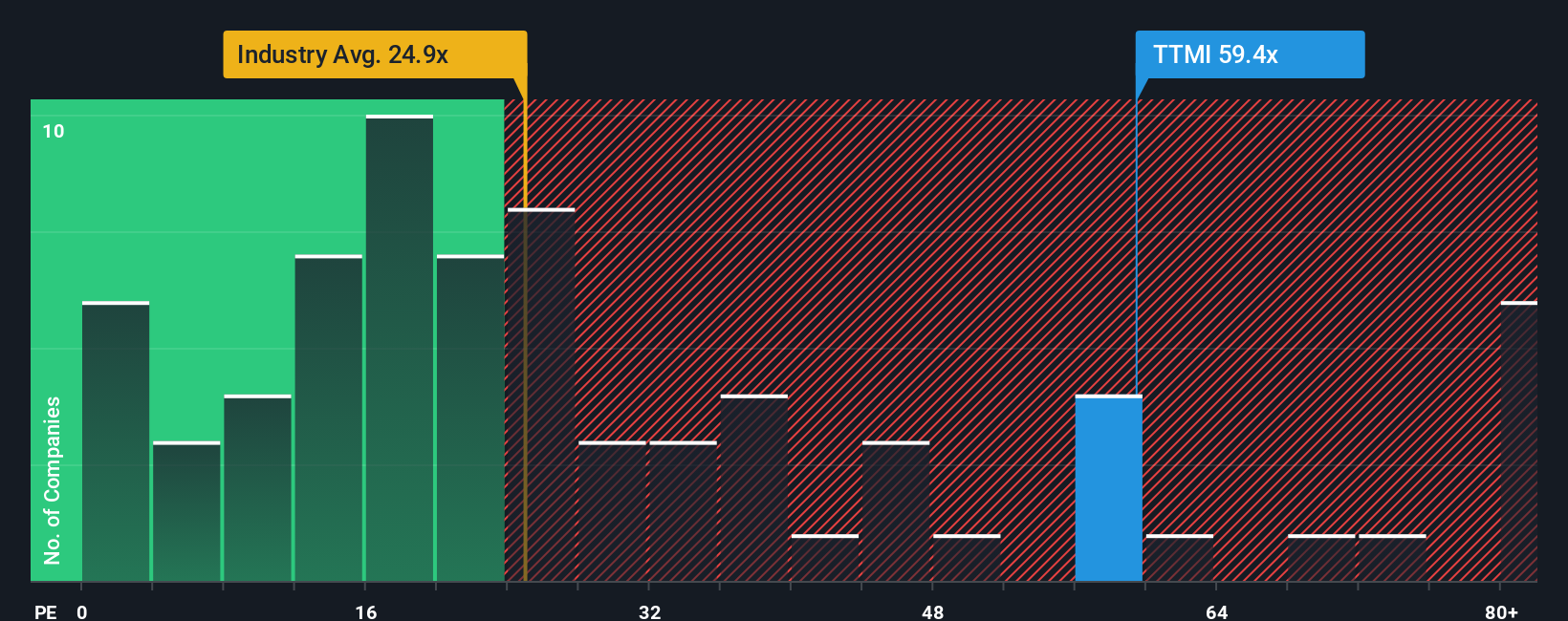

While the most popular narrative argues that TTM Technologies is undervalued, a second look through the lens of company earnings tells a different story. The shares currently trade at a steep 52.3 times earnings, which is much higher than the US Electronic industry average of 24.9 times and also well above key peers at 32.9 times.

Even when compared to the market's fair ratio of 35.9, this high number suggests investors are paying a premium for future growth. This premium could mean there is less room for upside if growth expectations are not met. The optimism embedded in today's price could leave the stock vulnerable to disappointments.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TTM Technologies Narrative

If you are looking to dig deeper or want to build your own perspective on TTM Technologies, it only takes a few minutes to analyze the data for yourself. Do it your way

A great starting point for your TTM Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Investment Ideas?

Act now to spot tomorrow’s opportunities before the crowd does. Simply Wall Street’s powerful tools help you discover stocks that fit your strategy and goals.

- Benefit from stable passive income streams by assessing companies through these 16 dividend stocks with yields > 3% yielding over 3% annually.

- Capture market-shifting innovations by reviewing these 24 AI penny stocks making waves at the intersection of artificial intelligence and business growth.

- Target undervalued gems with upside potential by screening these 870 undervalued stocks based on cash flows that may be mispriced based on their cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TTM Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTMI

TTM Technologies

Manufactures and sells mission systems, radio frequency (RF) components, RF microwave/microelectronic assemblies, and printed circuit boards (PCBs) and substrates in the United States, Taiwan, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

A high-quality defensive business with limited growth but strong cash generation.

The Infrastructure AI Cannot Be Built Without

ASML: Durable Advantage, Limited Margin for Error

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks