- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:TTMI

How Investors Are Reacting To TTM Technologies (TTMI) Surpassing Revenue Forecasts and Raising EPS Guidance

Reviewed by Sasha Jovanovic

- TTM Technologies (NASDAQ:TTMI) recently reported quarterly results, surpassing analyst revenue expectations and delivering strong earnings per share guidance for the coming period.

- Analyst estimates for the latest quarter anticipate double-digit revenue growth, indicating renewed market confidence supported by the company's prior financial performance.

- With the company's recent beat on both revenue and earnings expectations, we'll explore how this positive momentum shapes TTM Technologies' investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

TTM Technologies Investment Narrative Recap

To be a TTM Technologies shareholder today, you’d need to believe in the company’s ability to capture demand in advanced PCB manufacturing driven by AI, cloud, and defense sector growth, while managing expansion risks and customer concentration. The recent beat on revenue and earnings helps highlight TTM’s execution strength, supporting near-term market optimism; however, the core risks around operational ramp-up in Malaysia and exposure to U.S.-China tensions are not immediately reduced by the news, so attention to these issues remains warranted. Among recent developments, the acquisition of the new 750,000 square-foot Wisconsin facility stands out as highly relevant, connecting directly with the company’s biggest catalyst: seizing opportunities from domestic and cloud data center infrastructure investment. This aligns with analyst consensus that TTM’s new U.S. capacity could support lasting revenue and earnings stability, if new customer demand and higher pricing materialize as required. On the other hand, investors should be aware that while the company's global diversification is promising, its large exposure to China means that escalations in geopolitical tensions could...

Read the full narrative on TTM Technologies (it's free!)

TTM Technologies' narrative projects $3.2 billion revenue and $251.1 million earnings by 2028. This requires 6.4% yearly revenue growth and a $157.9 million earnings increase from $93.2 million today.

Uncover how TTM Technologies' forecasts yield a $62.75 fair value, a 6% upside to its current price.

Exploring Other Perspectives

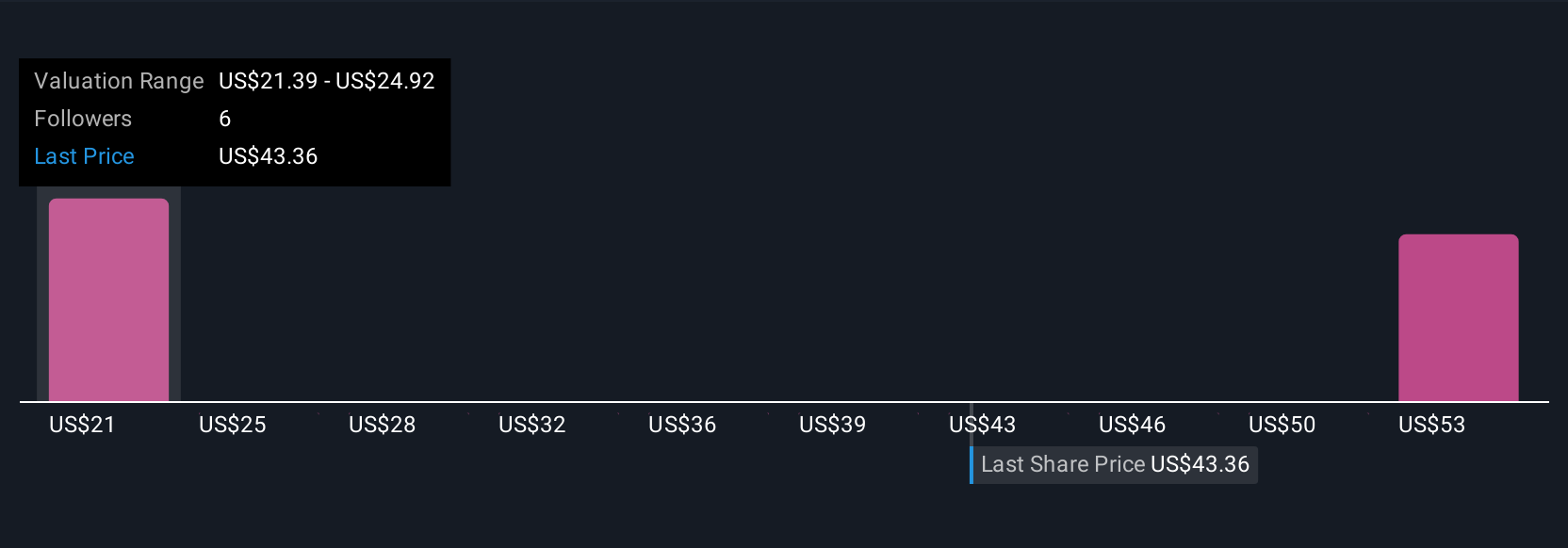

Three Simply Wall St Community members estimate fair value for TTM between US$32.36 and US$62.75 per share, showing a wide spectrum of individual opinions. With these differences in mind, consider that ongoing high capital expenditures and uncertainties around scaling new facilities could challenge future profit margins, investor viewpoints on TTM’s outlook can vary substantially, so you can explore several perspectives for a fuller picture.

Explore 3 other fair value estimates on TTM Technologies - why the stock might be worth as much as 6% more than the current price!

Build Your Own TTM Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TTM Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free TTM Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TTM Technologies' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TTM Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTMI

TTM Technologies

Manufactures and sells mission systems, radio frequency (RF) components and RF microwave/microelectronic assemblies, and printed circuit boards (PCB) in the United States, Taiwan, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives