- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:TTMI

A Look at TTM Technologies (TTMI) Valuation Following Strong Q3 Earnings and Growing Sector Demand

Reviewed by Simply Wall St

TTM Technologies (TTMI) delivered a standout third quarter, topping both revenue and earnings forecasts. Strong customer demand in sectors such as AI, Data Center Computing, and Aerospace appears to be fueling optimism about the company's growth trajectory.

See our latest analysis for TTM Technologies.

After a stellar quarter, TTM Technologies' shares are riding a powerful wave of momentum. The 1-day share price return of 7.75% is just the latest in a remarkable run, with a 30-day return of nearly 19% and a massive 176.6% share price gain since the start of the year. This surge follows upbeat Q3 results and growing demand in key areas like AI and Aerospace. However, recent volatility hints at changing risk perceptions and some investor caution around lofty tech valuations. Long-term shareholders have seen impressive total returns, with a 1-year total shareholder return of 192% and five-year gains near 439%, underscoring both short-term excitement and substantial long-term performance.

If TTM’s growth story has your attention, it might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With impressive gains and bullish analyst targets, the question now is whether TTM Technologies offers further upside for investors, or if the market has already priced in the company’s future growth. Is there still a buying opportunity?

Most Popular Narrative: 9.9% Undervalued

According to the most widely followed narrative, TTM Technologies' fair value estimate is notably higher than the recent close. This points to ongoing optimism from analysts and investors, who see further upside based on strong operational and sector trends.

Large-scale data center buildouts announced by tech giants (e.g., Google, CoreWeave, Meta) and TTM's new Wisconsin facility position the company to capture outsized demand for advanced PCBs and interconnects required for AI and cloud infrastructure. This directly supports revenue growth and long-term customer relationships.

Want to know which industry giants drive this bullish outlook? The secret sauce lies in future contracts, margin expansion, and bold top-line growth assumptions. Think earnings power most companies only dream about. Curious about the exact projections fueling this optimism? Unlock the full narrative to get the details behind the target price and what could power TTM much higher.

Result: Fair Value of $75.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower-than-expected progress at TTM's Penang facility or a sharp drop in demand from key customers could quickly challenge this positive outlook.

Find out about the key risks to this TTM Technologies narrative.

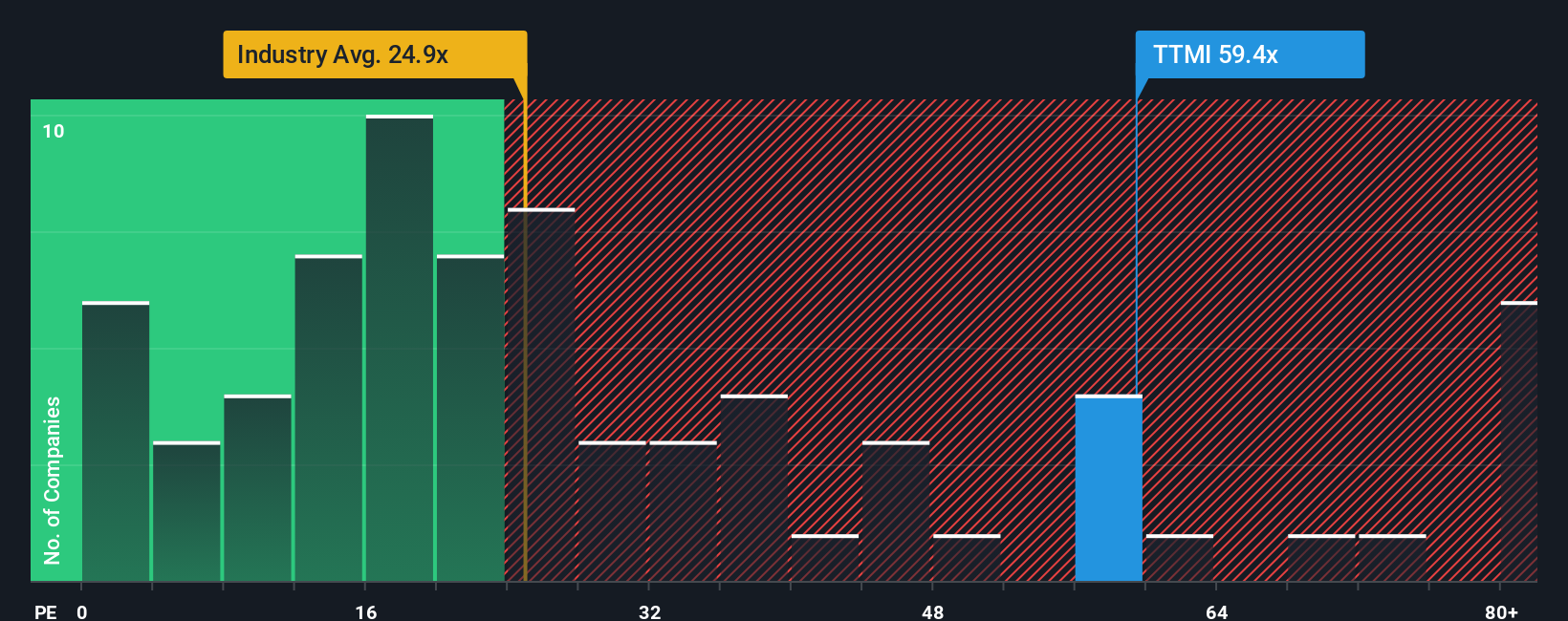

Another View: Market Multiples Raise Questions

While the fair value estimate suggests TTM Technologies is undervalued, the market's favored price-to-earnings ratio presents a different perspective. At 53.3 times earnings, TTM trades well above both the US Electronic industry average of 23.7x and its own fair ratio of 36.5x. This significant difference indicates a premium that could decrease if market sentiment changes. Does this premium reflect confidence, or should investors prepare for a reality check?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TTM Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 886 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TTM Technologies Narrative

Prefer to draw your own conclusions? Dive into the numbers, challenge the outlook, and craft your personal take on TTM Technologies in just a few minutes. Do it your way

A great starting point for your TTM Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your next big opportunity pass by. Level up your investing strategy and see what’s catching smart investors’ attention right now with these standout ideas:

- Spot companies with strong cash flow potential and explore these 886 undervalued stocks based on cash flows that might be trading below their true worth today.

- Tap into the growth of artificial intelligence by checking out these 25 AI penny stocks at the forefront of transforming entire industries.

- Capture stable income and future growth by browsing these 16 dividend stocks with yields > 3% delivering yields above 3% and a track record of reliable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TTM Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTMI

TTM Technologies

Manufactures and sells mission systems, radio frequency (RF) components and RF microwave/microelectronic assemblies, and printed circuit boards (PCB) in the United States, Taiwan, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives