- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:TRMB

Is Trimble Stock a Hidden Opportunity After Tech Expansion and 5% Price Dip?

Reviewed by Bailey Pemberton

- Wondering if Trimble stock is a hidden gem or already fully priced? You are not alone, and we're here to break it down with you.

- Despite a 5.2% dip over the last week and a modest 2.4% slide in the past month, Trimble is still up 8.4% year-to-date, showing signs of resilience and longer-term growth potential.

- Recently, the company's strategic moves, such as new technology deployments in its construction and geospatial segments and fresh partnerships, have piqued market interest and signaled Trimble's push to expand core capabilities. Such headlines have driven both excitement about future growth and caution about shifting risk profiles.

- When it comes to valuation, Trimble currently scores 3 out of 6 on undervaluation checks, meaning it's undervalued in half of the areas we examine. We'll break down how those scores are calculated in a moment and, even better, offer a more holistic view of the company's value at the end of this article.

Find out why Trimble's 8.1% return over the last year is lagging behind its peers.

Approach 1: Trimble Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting future free cash flows and then discounting those back to reflect today’s value. This method is often favored for companies with stable and predictable cash flow generation over time.

For Trimble, analysts estimate current free cash flow at $307.6 million. Projections see free cash flow climbing to $1.01 billion by 2027, with further growth anticipated over the next decade. These forward-looking estimates involve analyst input for the next five years. Longer-term projections are based on trend extrapolation by Simply Wall St. Notably, cash flows are expected to surpass $1 billion within just a few years, reflecting confidence in both expansion and operational strength.

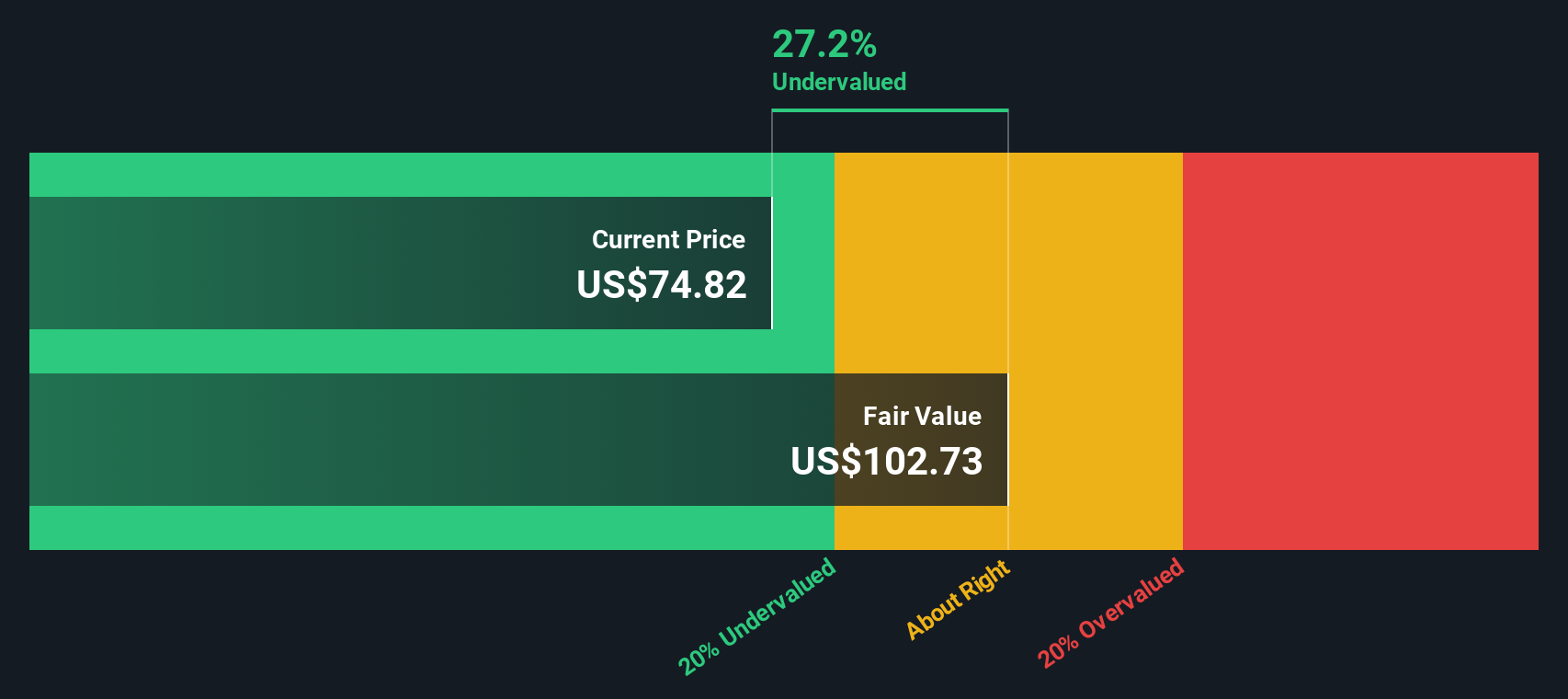

The DCF calculation delivers an estimated fair value of $102.80 per share for Trimble. Based on this figure, Trimble stock is currently trading at a 26.5% discount to its intrinsic value. This suggests that the share price is meaningfully lower than what the underlying financial fundamentals would indicate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Trimble is undervalued by 26.5%. Track this in your watchlist or portfolio, or discover 894 more undervalued stocks based on cash flows.

Approach 2: Trimble Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a useful metric for valuing profitable companies like Trimble, as it relates a company’s share price to its per-share earnings. Investors often look to the PE ratio to gauge how the market values a company’s current profits and future earnings potential.

Growth expectations and perceived risks strongly influence what a fair PE ratio should be. Companies with faster projected earnings growth or lower risks usually warrant higher PE multiples. Those with slower growth or higher risks typically trade at lower PE ratios. Comparing these ratios to industry and peer averages offers some context, but does not capture company-specific differences.

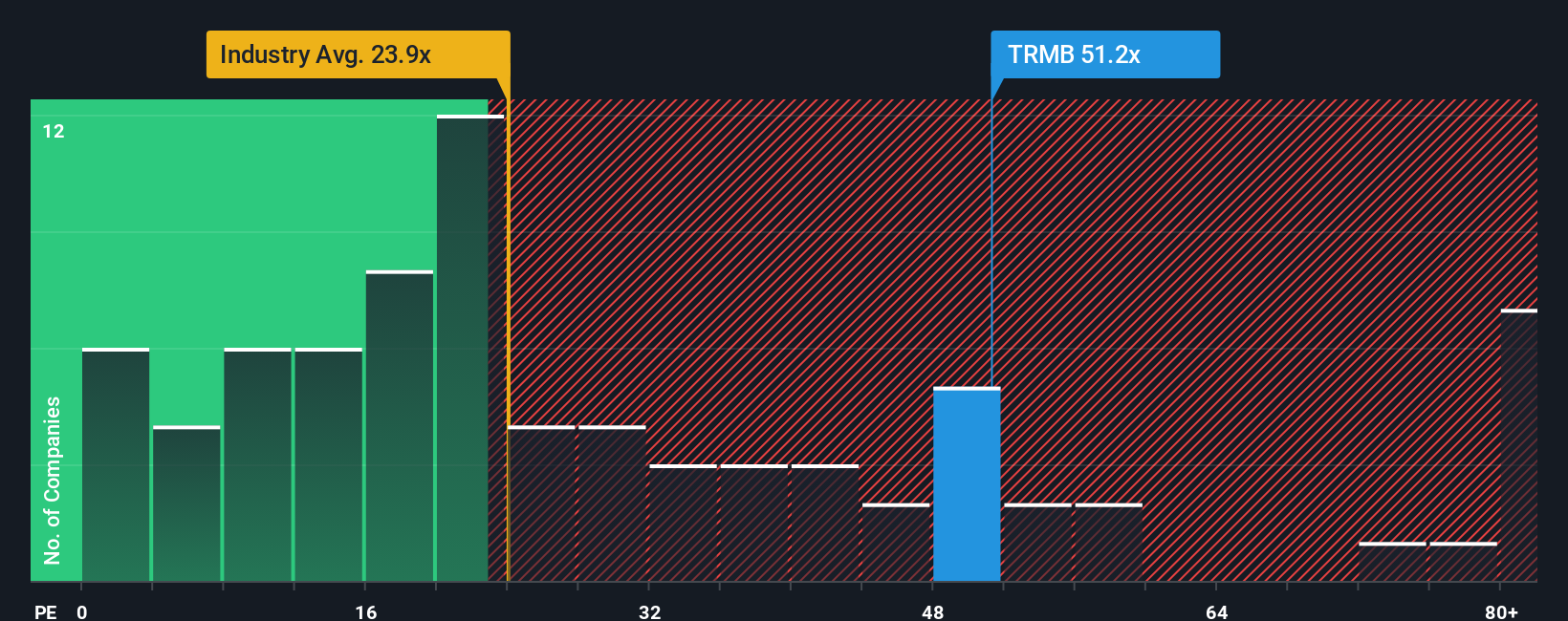

Trimble’s current PE ratio stands at 50.3x, which is notably higher than the electronic industry average of 23.0x and above the peer average of 39.6x. To provide a more nuanced benchmark, Simply Wall St’s proprietary “Fair Ratio” adjusts for Trimble's growth prospects, profit margins, size, and risk profile. The Fair Ratio for Trimble is calculated at 33.4x, reflecting what would be justified considering all these factors together. This approach gives a more tailored and comprehensive comparison than looking at industry or peer multiples alone.

With Trimble’s actual PE ratio of 50.3x sitting well above its Fair Ratio of 33.4x, the stock currently appears to be trading at a premium to its fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1417 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Trimble Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, approachable way to tie your personal perspective or "story" about a company—for instance, your view on its future revenue, earnings, and margins—to a custom financial forecast and fair value estimate. Narratives make investing more accessible by connecting what you believe about Trimble to the numbers, helping you see how your outlook stacks up with, or differs from, the community.

This tool is available right now on Simply Wall St's platform, inside the Community page, so you can join millions of investors in building, sharing, and comparing Narratives. Narratives clearly lay out whether a stock is overvalued or undervalued by comparing your derived Fair Value to the current market Price, making it easier to decide when to buy or sell based on your own assumptions.

Even better, Narratives update dynamically when new data like fresh earnings or news is released, ensuring your thesis always reflects the latest information. For Trimble, for example, some investors may forecast strong recurring revenue growth, arriving at a bullish fair value close to $100 per share. Others might focus on competitive risks and forecast a more cautious target around $84. Your Narrative truly puts your view into action.

Do you think there's more to the story for Trimble? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trimble might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRMB

Trimble

Provides technology solutions that enable professionals and field mobile workers to enhance or transform their work processes in North America, Europe, the Asia Pacific, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives