- United States

- /

- Electronic Equipment and Components

- /

- OTCPK:TAIT

Taitron Components (NASDAQ:TAIT) Will Pay A Dividend Of US$0.04

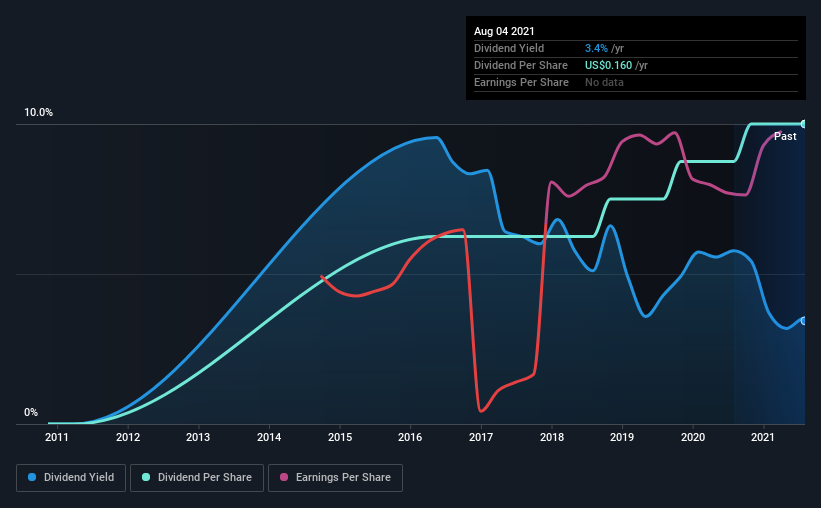

Taitron Components Incorporated (NASDAQ:TAIT) has announced that it will pay a dividend of US$0.04 per share on the 31st of August. The dividend yield will be 3.4% based on this payment which is still above the industry average.

View our latest analysis for Taitron Components

Taitron Components' Dividend Is Well Covered By Earnings

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. The last dividend was quite easily covered by Taitron Components' earnings. This indicates that quite a large proportion of earnings is being invested back into the business.

Looking forward, earnings per share could rise by 52.0% over the next year if the trend from the last few years continues. If the dividend continues on this path, the payout ratio could be 45% by next year, which we think can be pretty sustainable going forward.

Taitron Components Is Still Building Its Track Record

Taitron Components' dividend has been pretty stable for a little while now, but we will continue to be cautious until it has been demonstrated for a few more years. Since 2016, the dividend has gone from US$0.10 to US$0.16. This means that it has been growing its distributions at 9.9% per annum over that time. Taitron Components has been growing its dividend at a decent rate, and the payments have been stable. However, the payment history is very short, so there is no evidence yet that the dividend can be sustained over a full economic cycle.

The Dividend Looks Likely To Grow

The company's investors will be pleased to have been receiving dividend income for some time. Taitron Components has seen EPS rising for the last five years, at 52% per annum. Taitron Components is clearly able to grow rapidly while still returning cash to shareholders, positioning it to become a strong dividend payer in the future.

We Really Like Taitron Components' Dividend

Overall, we think that this is a great income investment, and we think that maintaining the dividend this year may have been a conservative choice. Earnings are easily covering distributions, and the company is generating plenty of cash. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. For instance, we've picked out 4 warning signs for Taitron Components that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you decide to trade Taitron Components, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Taitron Components might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:TAIT

Taitron Components

Engages in the supply of original designed and manufactured (ODM) electronic components, and distribution of brand name electronic components.

Flawless balance sheet with moderate risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion