- United States

- /

- Electronic Equipment and Components

- /

- OTCPK:TAIT

Is Taitron Components Incorporated (NASDAQ:TAIT) A Good Fit For Your Dividend Portfolio?

Today we'll take a closer look at Taitron Components Incorporated (NASDAQ:TAIT) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

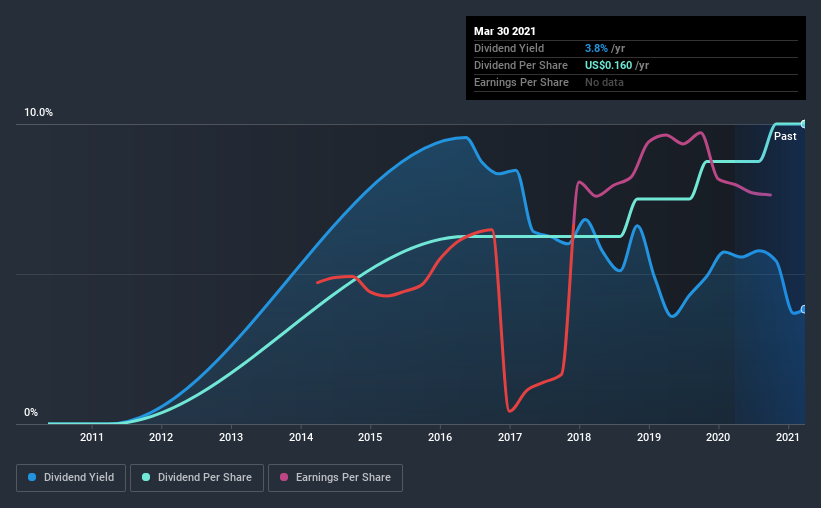

In this case, Taitron Components likely looks attractive to dividend investors, given its 3.8% dividend yield and five-year payment history. It sure looks interesting on these metrics - but there's always more to the story. That said, the recent jump in the share price will make Taitron Components's dividend yield look smaller, even though the company prospects could be improving. There are a few simple ways to reduce the risks of buying Taitron Components for its dividend, and we'll go through these below.

Explore this interactive chart for our latest analysis on Taitron Components!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Looking at the data, we can see that 161% of Taitron Components' profits were paid out as dividends in the last 12 months. Unless there are extenuating circumstances, from the perspective of an investor who hopes to own the company for many years, a payout ratio of above 100% is definitely a concern.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. Taitron Components' cash payout ratio in the last year was 40%, which suggests dividends were well covered by cash generated by the business. It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and Taitron Components fortunately did generate enough cash to fund its dividend. Still, if the company repeatedly paid a dividend greater than its profits, we'd be concerned. Very few companies are able to sustainably pay dividends larger than their reported earnings.

While the above analysis focuses on dividends relative to a company's earnings, we do note Taitron Components' strong net cash position, which will let it pay larger dividends for a time, should it choose.

Consider getting our latest analysis on Taitron Components' financial position here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Looking at the data, we can see that Taitron Components has been paying a dividend for the past five years. During the past five-year period, the first annual payment was US$0.1 in 2016, compared to US$0.2 last year. Dividends per share have grown at approximately 9.9% per year over this time.

The dividend has been growing at a reasonable rate, which we like. We're conscious though that one of the best ways to detect a multi-decade consistent dividend-payer, is to watch a company pay dividends for 20 years - a distinction Taitron Components has not achieved yet.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. It's good to see Taitron Components has been growing its earnings per share at 49% a year over the past five years. The company has been growing its EPS at a very rapid rate, while paying out virtually all of its income as dividends. While EPS could grow fast enough to make the dividend sustainable, in this type of situation, we'd want to pay extra attention to any fragilities in the company's balance sheet.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. We're a bit uncomfortable with its high payout ratio, although at least the dividend was covered by free cash flow. We were also glad to see it growing earnings, although its dividend history is not as long as we'd like. In sum, we find it hard to get excited about Taitron Components from a dividend perspective. It's not that we think it's a bad business; just that there are other companies that perform better on these criteria.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 5 warning signs for Taitron Components that investors should take into consideration.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you decide to trade Taitron Components, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Taitron Components might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:TAIT

Taitron Components

Engages in the supply of original designed and manufactured (ODM) electronic components, and distribution of brand name electronic components.

Flawless balance sheet with moderate risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion