- United States

- /

- Tech Hardware

- /

- NasdaqGS:STX

We Wouldn't Be Too Quick To Buy Seagate Technology Holdings plc (NASDAQ:STX) Before It Goes Ex-Dividend

Seagate Technology Holdings plc (NASDAQ:STX) stock is about to trade ex-dividend in 4 days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. In other words, investors can purchase Seagate Technology Holdings' shares before the 21st of March in order to be eligible for the dividend, which will be paid on the 6th of April.

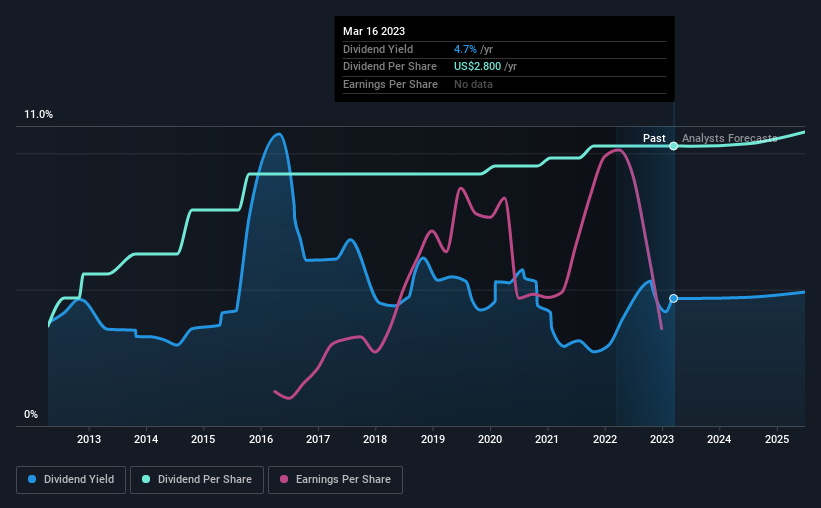

The company's next dividend payment will be US$0.70 per share, and in the last 12 months, the company paid a total of US$2.80 per share. Last year's total dividend payments show that Seagate Technology Holdings has a trailing yield of 4.7% on the current share price of $59.85. If you buy this business for its dividend, you should have an idea of whether Seagate Technology Holdings's dividend is reliable and sustainable. So we need to investigate whether Seagate Technology Holdings can afford its dividend, and if the dividend could grow.

Check out our latest analysis for Seagate Technology Holdings

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Last year, Seagate Technology Holdings paid out 96% of its income as dividends, which is above a level that we're comfortable with, especially if the company needs to reinvest in its business. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. It paid out 79% of its free cash flow as dividends, which is within usual limits but will limit the company's ability to lift the dividend if there's no growth.

It's good to see that while Seagate Technology Holdings's dividends were not well covered by profits, at least they are affordable from a cash perspective. Still, if the company continues paying out such a high percentage of its profits, the dividend could be at risk if business turns sour.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If earnings fall far enough, the company could be forced to cut its dividend. This is why it's a relief to see Seagate Technology Holdings earnings per share are up 2.8% per annum over the last five years.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Seagate Technology Holdings has delivered 11% dividend growth per year on average over the past 10 years. It's encouraging to see the company lifting dividends while earnings are growing, suggesting at least some corporate interest in rewarding shareholders.

Final Takeaway

From a dividend perspective, should investors buy or avoid Seagate Technology Holdings? While earnings per share have been growing slowly, Seagate Technology Holdings is paying out an uncomfortably high percentage of its earnings. However it did pay out a lower percentage of its cashflow. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

With that being said, if you're still considering Seagate Technology Holdings as an investment, you'll find it beneficial to know what risks this stock is facing. Be aware that Seagate Technology Holdings is showing 5 warning signs in our investment analysis, and 2 of those are concerning...

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:STX

Seagate Technology Holdings

Engages in the provision of data storage technology and infrastructure solutions in Singapore, the United States, the Netherlands, and internationally.

Reasonable growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026