- United States

- /

- Tech Hardware

- /

- NasdaqGS:STX

Seagate Technology (STX): Examining Valuation as AI Momentum and Insider Stake Spark Investor Interest

Reviewed by Simply Wall St

Seagate Technology Holdings (STX) is catching extra attention after a recent stake purchase by Congresswoman Lisa McClain’s spouse. This comes at a time of increased interest in companies supporting rising AI-driven storage demand.

See our latest analysis for Seagate Technology Holdings.

Momentum has been building for Seagate Technology Holdings, with buyers inspired by its AI storage narrative and high-profile insider interest. The stock’s 30-day share price return of 29.04% and a year-to-date surge of 227.89% highlight just how strongly sentiment has shifted. The three- and five-year total shareholder returns above 480% remind us this is not just a short-term story. Recent debt-related transactions have not slowed excitement, as investors remain focused on Seagate’s long-term growth prospects and the buzz around AI-fueled demand.

If you’re curious to see what else is capturing investor attention in the tech and AI space, consider exploring See the full list for free..

Yet with shares surging so dramatically and trading just above the average analyst price target, the pressing question is whether Seagate still offers more room to run, or if the market has already priced in the company's future growth potential.

Most Popular Narrative: 2.2% Overvalued

Seagate’s last close of $283.26 sits just above the most followed narrative's fair value of $277.25, signaling a slight premium. The scene is set for ongoing debate as investors weigh recent optimism against future expectations and supply chain realities.

Strong secular trends, including accelerating demand driven by artificial intelligence and robust cloud infrastructure investments, are expected to fuel top-line growth and exabyte shipments well into 2026. Supply remains tight in the hard disk drive market, with extended lead times and incremental price increases. This supports higher margins and expansion in valuation multiples.

Want to unlock the math behind this valuation? The secret mix includes confident forecasts, rising margins, and aggressive top-line assumptions. The real shocker? See which growth levers are expected to drive value even higher. Full details are just a click away.

Result: Fair Value of $277.25 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, volatility could arise if trade policy disruptions or a sudden drop in AI spending slow market growth and challenge Seagate’s recent momentum.

Find out about the key risks to this Seagate Technology Holdings narrative.

Another View: Multiples Tell a Different Story

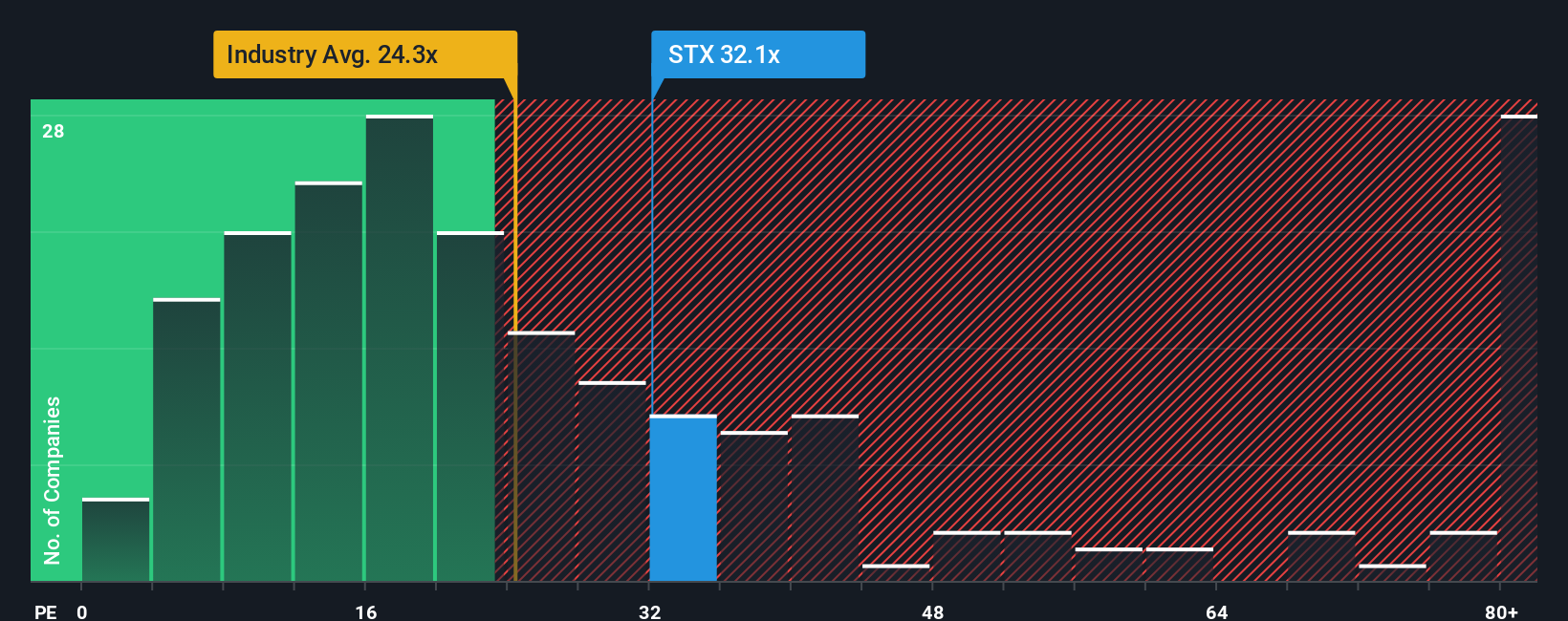

While the popular valuation suggests Seagate trades at a modest premium, looking at its price-to-earnings ratio paints a starker picture. Seagate’s ratio of 35.3x is far higher than peers at 19.4x and the global tech industry average of 22.9x, and even above its fair ratio of 40.8x. This gap highlights real valuation risk if growth does not keep pace with expectations. Could this premium persist, or will the market demand more proof?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Seagate Technology Holdings Narrative

If you see things differently or want to dive deeper on your own, it takes just a few minutes to build your own view and narrative for Seagate Technology Holdings. Do it your way.

A great starting point for your Seagate Technology Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Your next big winner could be closer than you think. Take action now and equip yourself with smart ideas other investors might overlook by checking out these standout opportunities:

- Tap into strong yield potential across the market by reviewing these 14 dividend stocks with yields > 3% with consistently attractive payouts and robust financials.

- Fuel your ambition with these 27 AI penny stocks innovating at the forefront of artificial intelligence and shaping the future of tomorrow’s tech landscape.

- Go after deep value and long-term upside with these 882 undervalued stocks based on cash flows that could be flying under the radar. Don’t let undervalued gems pass you by.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STX

Seagate Technology Holdings

Engages in the provision of data storage technology and infrastructure solutions in Singapore, the United States, the Netherlands, and internationally.

Reasonable growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives