- United States

- /

- Tech Hardware

- /

- NasdaqGS:STX

Seagate (STX) Delivers Strong Revenue but Tighter Margins: What Does This Signal for the Future?

Reviewed by Simply Wall St

- Seagate Technology Holdings recently reported its fourth quarter results, with sales rising to US$2.44 billion from US$1.89 billion a year earlier, while net income saw a modest year-over-year decrease to US$488 million.

- An interesting point is that the strong sales growth was offset by a slight drop in earnings per share, reflecting ongoing shifts in costs and profitability.

- We will explore how Seagate’s revenue growth amid changing profit margins could influence its outlook and the broader investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Seagate Technology Holdings Investment Narrative Recap

To see value in Seagate Technology Holdings, you need to believe in ongoing demand for mass capacity storage, especially for cloud and AI data center expansion, and the company’s ability to innovate with next-generation Mozaic drives. The latest results, with higher sales but slightly lower net income and earnings per share, do little to change the immediate catalyst: whether Seagate can convert new technology launches into sustained, profitable growth. Short-term risks, including supply constraints and margin pressure, remain largely unaffected by this quarter’s numbers.

Among recent announcements, Seagate’s launch of Mozaic 3+-powered Exos M and IronWolf Pro drives stands out. This release is squarely in focus given the company’s dependence on ramping up its novel HAMR technology as a path to revenue and margin expansion, a key catalyst in the investment case.

But on the flip side, investors should watch for signs of increasing competition from newer technologies that...

Read the full narrative on Seagate Technology Holdings (it's free!)

Seagate Technology Holdings is projected to reach $12.1 billion in revenue and $2.4 billion in earnings by 2028. This outlook assumes a 12.2% annual revenue growth rate and a $0.9 billion increase in earnings from the current $1.5 billion.

Uncover how Seagate Technology Holdings' forecasts yield a $143.07 fair value, a 6% downside to its current price.

Exploring Other Perspectives

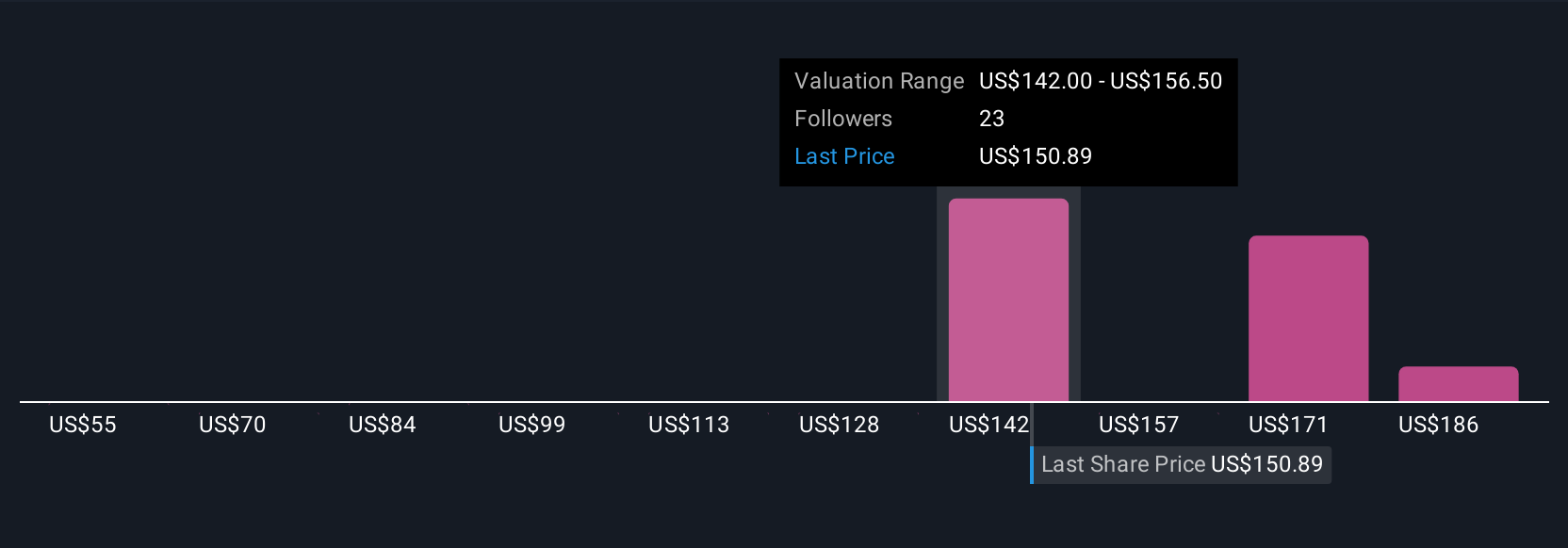

Five community members on Simply Wall St estimate Seagate’s fair value between US$55 and US$200. While many are optimistic about revenue growth from new product launches, others highlight persistent margin risk as a challenge. Explore how your viewpoint measures up alongside this diversity.

Explore 5 other fair value estimates on Seagate Technology Holdings - why the stock might be worth as much as 31% more than the current price!

Build Your Own Seagate Technology Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Seagate Technology Holdings research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Seagate Technology Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Seagate Technology Holdings' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STX

Seagate Technology Holdings

Engages in the provision of data storage technology and infrastructure solutions in Singapore, the United States, the Netherlands, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives