- United States

- /

- Tech Hardware

- /

- NasdaqGS:STX

Is Accelerating AI Data Storage Demand Reshaping the Investment Case for Seagate Technology (STX)?

Reviewed by Sasha Jovanovic

- Earlier this week, Seagate Technology was highlighted by analysts as a beneficiary of accelerating AI-driven data storage demand, with its transition toward mass-capacity solutions for data centers receiving particular focus.

- An interesting development is Seagate's increased appeal among momentum growth investors, partly due to rising gross margins, improved free cash flow, and management's resumption of share repurchases.

- We'll examine how Seagate’s expanding role in large-scale AI data storage strengthens its long-term investment outlook and business growth prospects.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Seagate Technology Holdings Investment Narrative Recap

Owning Seagate Technology typically comes down to believing in the ongoing surge in data storage demand, especially as AI and cloud adoption drive data center growth globally. While the recent rise in Seagate’s share price following analyst optimism highlights momentum in the AI-driven storage market, it doesn’t fundamentally change the primary short-term catalyst, accelerating mass-capacity drive adoption, or the continued biggest risk around competitive technology shifts, such as SSDs challenging HDD market share. For now, the latest news reinforces current trends without fundamentally altering the near-term outlook.

Among recent company developments, Seagate’s July announcement of shipping over one million Mozaic hard drives and launching new 30TB HAMR-based models stands out, aligning closely with the catalyst of product innovation to capture growth in high-capacity storage markets. These technological advances are geared toward capturing the expanding needs of large data center and cloud customers, which is at the heart of what’s fueling current analyst enthusiasm for the stock.

Yet, despite sector tailwinds, investors should also consider the ongoing risk of rapid technology shifts in storage hardware, since...

Read the full narrative on Seagate Technology Holdings (it's free!)

Seagate Technology Holdings is projected to reach $12.0 billion in revenue and $2.5 billion in earnings by 2028. This outlook assumes annual revenue growth of 9.5% and a $1.0 billion increase in earnings from the current $1.5 billion.

Uncover how Seagate Technology Holdings' forecasts yield a $204.35 fair value, a 13% downside to its current price.

Exploring Other Perspectives

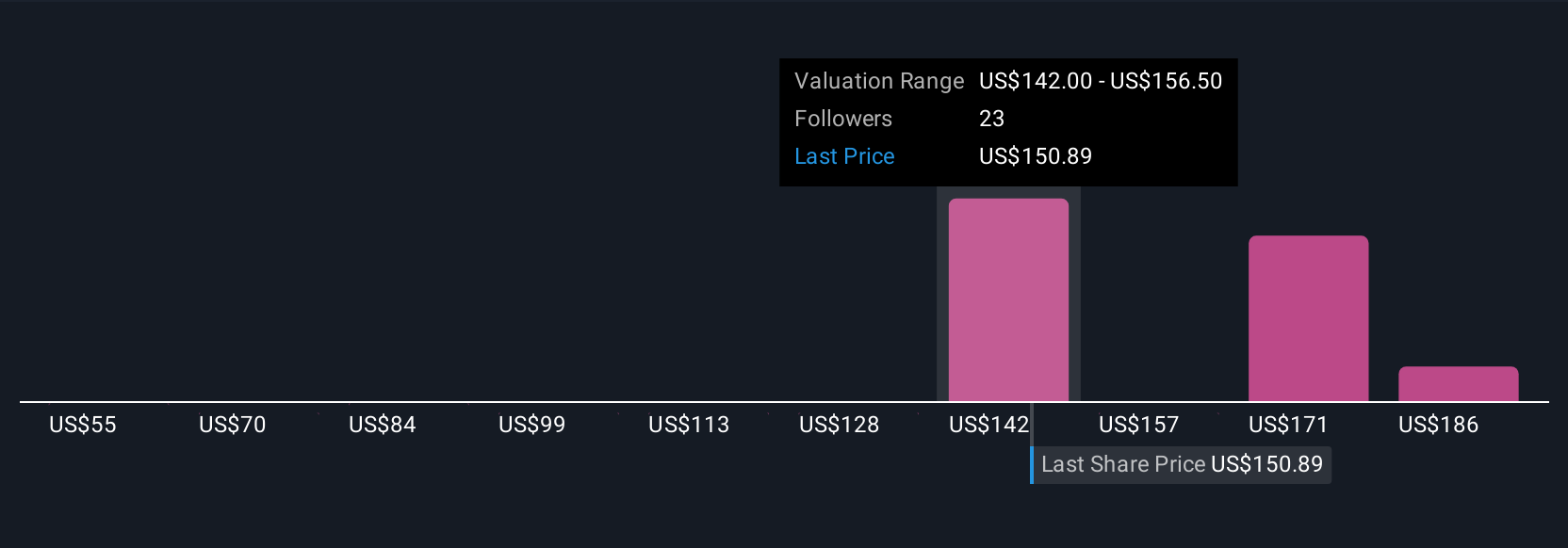

Simply Wall St Community fair value estimates for Seagate Technologies range from US$97 to US$230 based on four analyses, showing wide opinion differences. While mass-capacity storage demand may boost growth, technology competition remains a key consideration for the company's outlook.

Explore 4 other fair value estimates on Seagate Technology Holdings - why the stock might be worth as much as $230.17!

Build Your Own Seagate Technology Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Seagate Technology Holdings research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Seagate Technology Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Seagate Technology Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STX

Seagate Technology Holdings

Engages in the provision of data storage technology and infrastructure solutions in Singapore, the United States, the Netherlands, and internationally.

Reasonable growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion