- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:SPCB

SuperCom (NASDAQ:SPCB) Is Making Moderate Use Of Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that SuperCom Ltd. (NASDAQ:SPCB) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

What Is SuperCom's Net Debt?

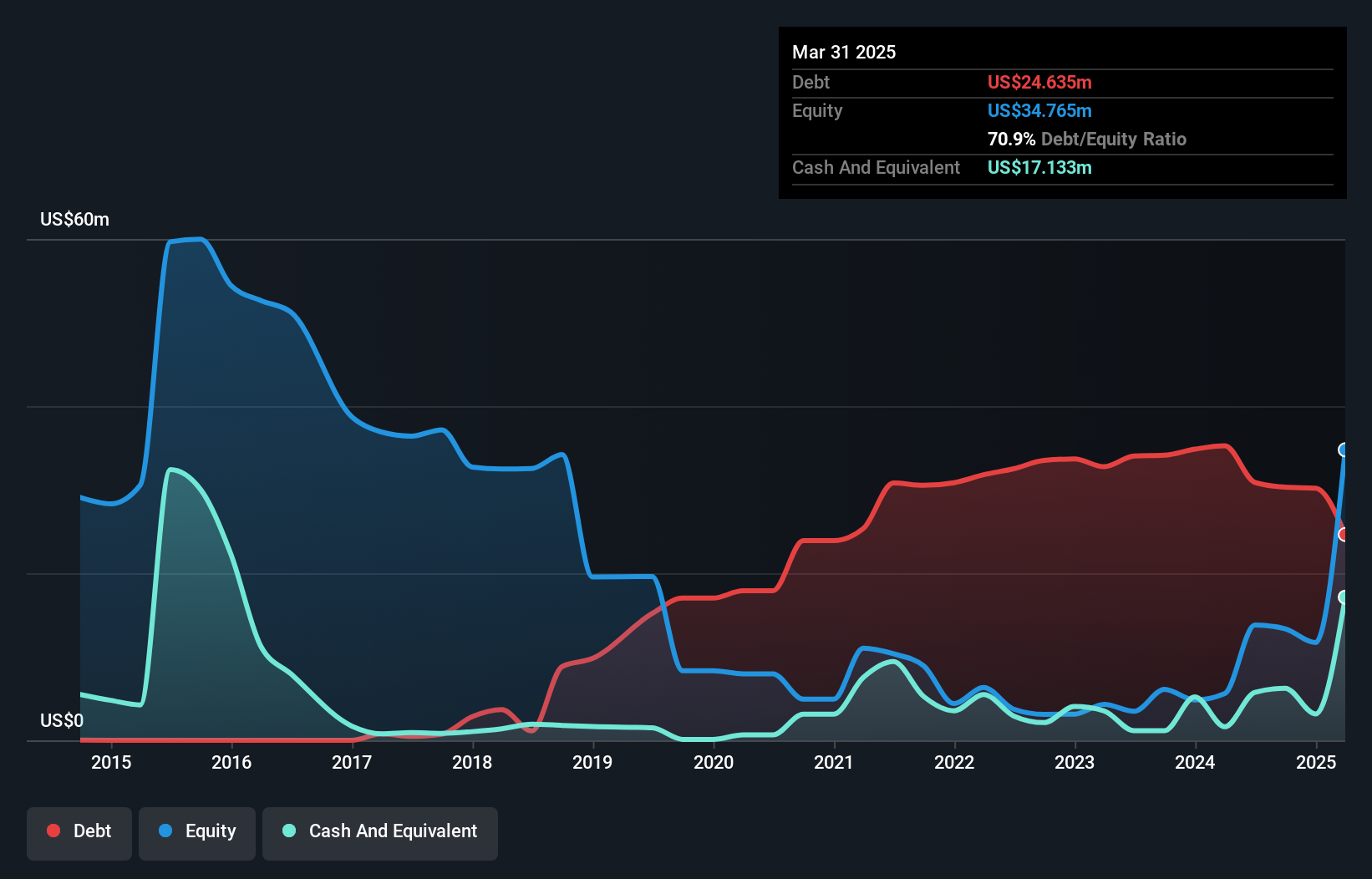

You can click the graphic below for the historical numbers, but it shows that SuperCom had US$24.6m of debt in March 2025, down from US$35.2m, one year before. However, it also had US$17.1m in cash, and so its net debt is US$7.50m.

How Strong Is SuperCom's Balance Sheet?

According to the last reported balance sheet, SuperCom had liabilities of US$4.48m due within 12 months, and liabilities of US$24.4m due beyond 12 months. Offsetting this, it had US$17.1m in cash and US$17.7m in receivables that were due within 12 months. So it actually has US$5.97m more liquid assets than total liabilities.

It's good to see that SuperCom has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Due to its strong net asset position, it is not likely to face issues with its lenders. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if SuperCom can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Check out our latest analysis for SuperCom

Over 12 months, SuperCom reported revenue of US$28m, which is a gain of 2.9%, although it did not report any earnings before interest and tax. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Importantly, SuperCom had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost US$280k at the EBIT level. On a more positive note, the company does have liquid assets, so it has a bit of time to improve its operations before the debt becomes an acute problem. But we'd want to see some positive free cashflow before spending much time on trying to understand the stock. This one is a bit too risky for our liking. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 4 warning signs for SuperCom you should be aware of, and 2 of them are a bit unpleasant.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SPCB

SuperCom

Provides traditional and digital identity, Internet of Things (IoT) and connectivity, and cyber security products and solutions to governments, and private and public organizations worldwide.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026