- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:SPCB

SuperCom Ltd. (NASDAQ:SPCB) Looks Inexpensive After Falling 49% But Perhaps Not Attractive Enough

SuperCom Ltd. (NASDAQ:SPCB) shareholders that were waiting for something to happen have been dealt a blow with a 49% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 84% share price decline.

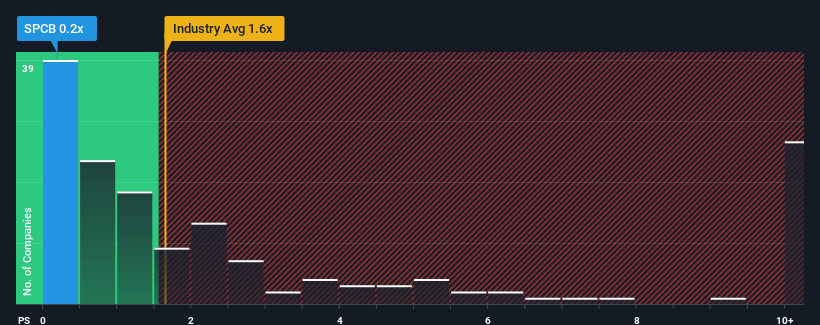

After such a large drop in price, SuperCom may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Electronic industry in the United States have P/S ratios greater than 1.6x and even P/S higher than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for SuperCom

How SuperCom Has Been Performing

SuperCom certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think SuperCom's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For SuperCom?

There's an inherent assumption that a company should underperform the industry for P/S ratios like SuperCom's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 106% gain to the company's top line. Pleasingly, revenue has also lifted 114% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 8.7% during the coming year according to the only analyst following the company. That's not great when the rest of the industry is expected to grow by 10%.

With this in consideration, we find it intriguing that SuperCom's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From SuperCom's P/S?

SuperCom's recently weak share price has pulled its P/S back below other Electronic companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of SuperCom's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, SuperCom's poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

We don't want to rain on the parade too much, but we did also find 5 warning signs for SuperCom (3 are concerning!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SPCB

SuperCom

Provides traditional and digital identity, Internet of Things (IoT) and connectivity, and cyber security products and solutions to governments, and private and public organizations worldwide.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

A Quality Compounder Marked Down on Overblown Fears

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion