- United States

- /

- Tech Hardware

- /

- NasdaqGS:SNDK

A Look at Sandisk (SNDK) Valuation as Investors Anticipate Fiscal 2026 Q1 Results and Analyst Upgrades

Reviewed by Simply Wall St

Sandisk (SNDK) shares have caught the market’s attention as the company prepares to release its first quarter results for fiscal 2026. Many investors are moving portfolios ahead of the official announcement.

See our latest analysis for Sandisk.

Sandisk has been on a tear lately, with a staggering 32.8% 7-day share price return, capped off by a 417.1% year-to-date surge. Recent momentum has accelerated sharply as investors rally ahead of earnings. Bullish sentiment and anticipation have powered the share price climb to $186.16.

If Sandisk’s rapid run-up caught your attention, this could be the perfect moment to branch out and discover fast growing stocks with high insider ownership

But with shares soaring well above analyst price targets, the key question now is whether Sandisk’s remarkable rally signals more room to run or if the market has already priced in all the upside. Is this a real buying opportunity? Or is anticipated future growth baked into today’s price?

Price-to-Sales Ratio of 3.7x: Is it justified?

Sandisk's last close of $186.16 places the company well above typical valuation benchmarks, with a Price-to-Sales (P/S) ratio of 3.7x. This means shares are trading at a significant premium to both industry and peer averages.

The P/S ratio is important for tech stocks with volatile or negative profits, as it values companies based on their revenues rather than earnings. For Sandisk, this multiple means investors are paying over three times the company’s annual revenue for a share of ownership, a valuation that can only be justified by robust growth expectations or undisputed market leadership.

However, Sandisk's 3.7x P/S stands out against the US Tech industry average of 2.4x and a peer average of 3.5x. This highlights just how much the market is anticipating future gains or rewarding recent momentum. Compared to an estimated fair P/S ratio of 2.9x, the current multiple suggests a notable premium, and there may be significant downside risk if growth fails to materialize as hoped.

Explore the SWS fair ratio for Sandisk

Result: Price-to-Sales of 3.7x (OVERVALUED)

However, investors should note Sandisk’s negative net income and significant discount to analyst price targets, as both of these factors could temper further upside.

Find out about the key risks to this Sandisk narrative.

Another View: Discounted Cash Flow Perspective

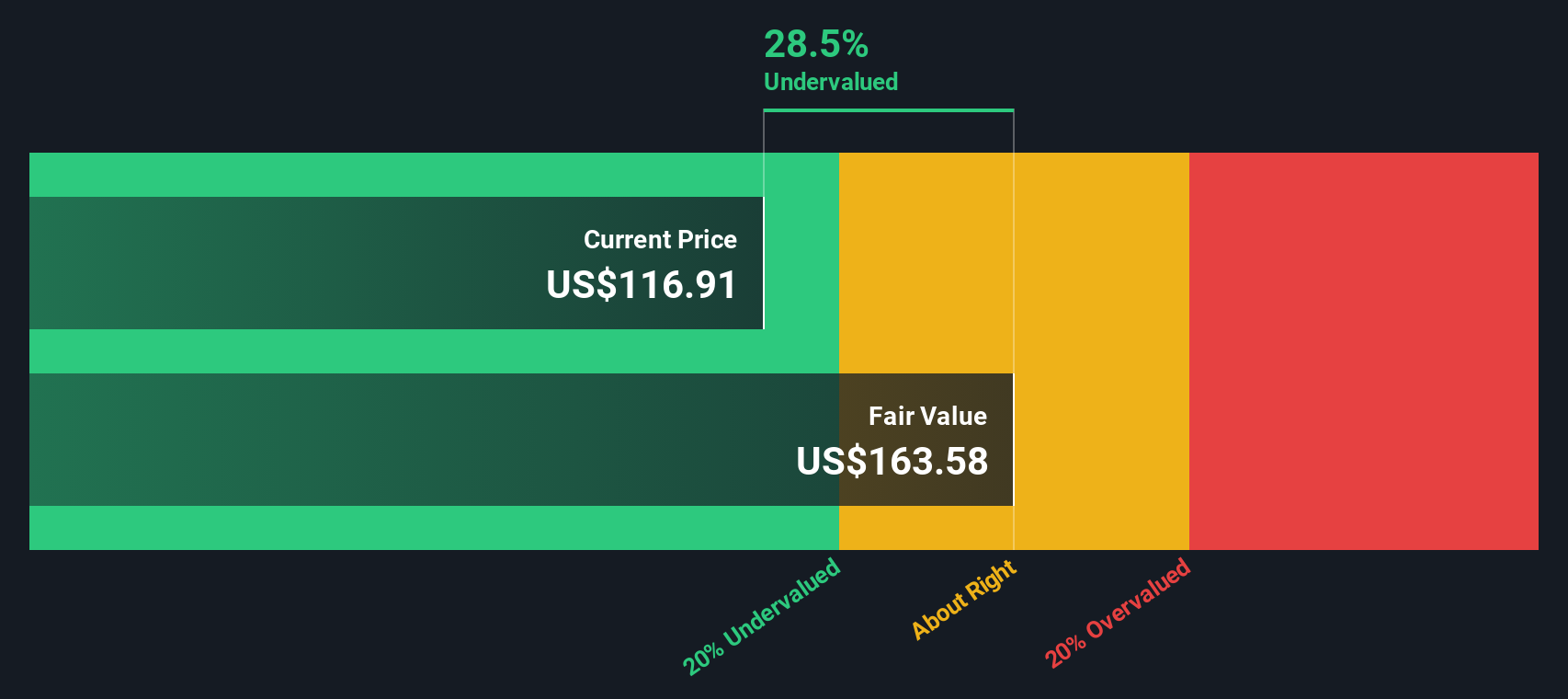

To challenge the current valuation, let’s turn to the SWS DCF model. This method estimates Sandisk's value by projecting future cash flows and discounting them back to today. According to our DCF analysis, Sandisk is trading above its fair value, suggesting the shares are overvalued on this basis. Does this DCF warning call for more caution, or will Sandisk’s momentum carry it higher?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sandisk for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sandisk Narrative

If these numbers inspire a different perspective or you want to dig into the data yourself, shaping your personal narrative for Sandisk takes only a few minutes. Do it your way

A great starting point for your Sandisk research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Build an edge in your portfolio by checking out unique opportunities beyond Sandisk. Don’t wait and let these fast-moving investment trends pass you by.

- Tap into untapped growth by reviewing these 877 undervalued stocks based on cash flows with solid fundamentals and pricing potential that others may have overlooked.

- Capitalize on the rise of medical technology when you analyze these 33 healthcare AI stocks which are revolutionizing healthcare with artificial intelligence.

- Boost your income strategy and stability through these 17 dividend stocks with yields > 3% that offer reliable returns with yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNDK

Sandisk

Develops, manufactures, and sells data storage devices and solutions using NAND flash technology in the United States, Europe, the Middle East, Africa, Asia, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives