- United States

- /

- Tech Hardware

- /

- NasdaqGS:SMCI

Supermicro (SMCI): Margin Decline Challenges Bullish Growth Narratives Despite Strong Revenue Outlook

Reviewed by Simply Wall St

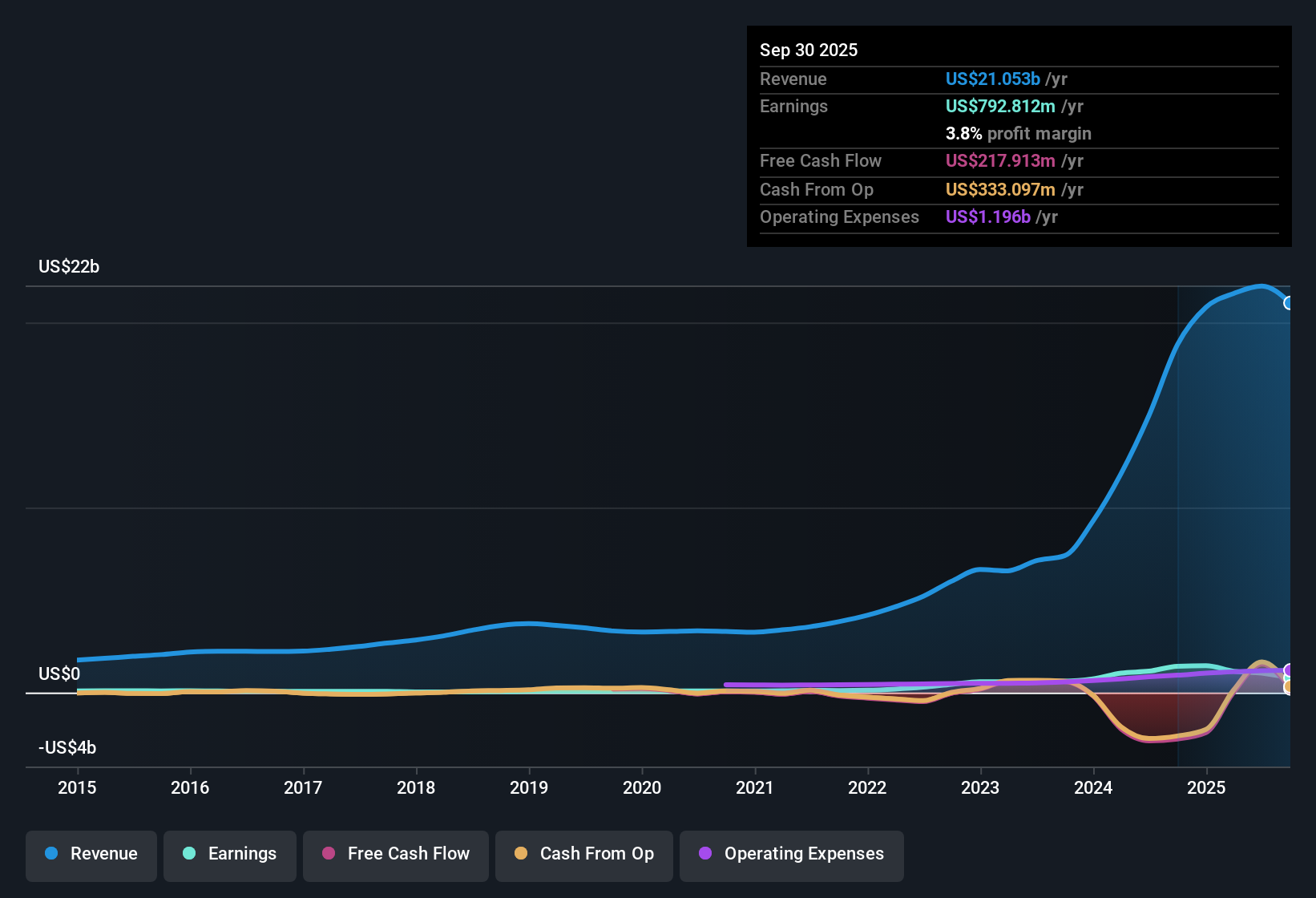

Super Micro Computer (SMCI) reported revenue is expected to grow at 12.5% per year, outpacing the broader US market growth forecast of 10.5%. Over the past five years, the company’s earnings have surged by an average of 50.2% per year, while current net profit margins sit at 4.8%, lower than the previous year’s 7.7%. For investors, robust revenue growth stands out as a key positive. However, the dip in profit margins compared to last year remains a notable risk in the latest results.

See our full analysis for Super Micro Computer.Next, we will see how these headline results measure up against the narratives that investors and analysts have built around Super Micro Computer. Some stories may get a boost, while others might not stand up to the numbers.

See what the community is saying about Super Micro Computer

Guidance Hints at 29.9% Annual Revenue Jump

- Analysts see Super Micro Computer's revenue climbing 29.9% annually over the next three years. This pace is nearly triple the broader US market's forecasted rate and highlights major growth momentum within the company.

- Analysts' consensus view expects this rapid top-line growth to drive both earnings expansion and overall margin improvement, assuming recent launches like the Data Center Building Block Solution (DCBBS) gain further traction.

- Consensus notes that gross margin expansion is linked to the company’s push into higher-margin, energy-efficient AI data center solutions, potentially stabilizing profitability as scale takes effect.

- This scenario is supported by analyst estimates that predict net profit margins inching up from 4.8% today to 5.0% within the next three years, underscoring the importance of successful platform adoption.

- Notably, if analyst forecasts are achieved, earnings could reach $2.4 billion by September 2028, more than doubling the company’s current level. This suggests significant upside for patient investors. See how these growth ambitions stack up in the full consensus narrative: 📊 Read the full Super Micro Computer Consensus Narrative.

Margin Pressure Linked to Customer Concentration

- Super Micro Computer’s net profit margin has narrowed to 4.8%, down from last year’s 7.7%. Margin expansion is being limited by reliance on a few large customers, with the single largest accounting for 21% of revenue.

- Analysts' consensus view highlights that while advanced solutions set the stage for margin recovery, there is a real risk that major buyers delaying or reducing orders could result in choppier revenues and sustained margin stress.

- Consensus highlights hardware commoditization and competition on pricing as ongoing challenges, with the risk that both revenue and profit outlooks could weaken if the customer mix does not diversify soon.

- While the move into enterprise, edge, and telco markets may help offset these risks, the company’s earnings growth remains highly sensitive to changes in spending among top clients.

Premium Valuation Versus Peers and Tech Sector

- Super Micro Computer trades at a PE multiple of 24.3x, which is above both the global tech industry average and peer group multiples. This indicates that investors are paying a premium for its rapid growth outlook.

- Analysts' consensus view suggests that to justify the consensus price target of $50.94 (compared to a current share price of $42.03), the company needs to deliver on strong multi-year revenue growth and push profit margins past current levels so its future PE drops to 16.1x.

- Consensus recognizes a wide range in analyst expectations, with price targets ranging from $15.00 to $93.00. This reflects ongoing debate about whether the premium valuation can withstand near-term margin pressure.

- This gap signals that market confidence in Super Micro’s ability to translate sales growth into sustainable earnings remains a key swing factor for the stock’s valuation trajectory over the next few years.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Super Micro Computer on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the story behind the figures looks different to you? Take just a few minutes to shape your interpretation and share your view. Do it your way

A great starting point for your Super Micro Computer research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Super Micro Computer’s premium valuation and narrowing profit margins leave its future gains highly dependent on sustained growth and improved profitability.

If you’d prefer opportunities that combine lower price risk with attractive fundamentals, use these 836 undervalued stocks based on cash flows to find companies trading below what their cash flows suggest they’re worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SMCI

Super Micro Computer

Develops and sells server and storage solutions based on modular and open-standard architecture in the United States, Asia, Europe, and internationally.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion