- United States

- /

- Tech Hardware

- /

- NasdaqGS:SMCI

Super Micro Computer (NASDAQ:SMCI) stock performs better than its underlying earnings growth over last three years

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But in contrast you can make much more than 100% if the company does well. For example, the Super Micro Computer, Inc. (NASDAQ:SMCI) share price has soared 250% in the last three years. How nice for those who held the stock! On top of that, the share price is up 37% in about a quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

Since it's been a strong week for Super Micro Computer shareholders, let's have a look at trend of the longer term fundamentals.

Before we look at the performance, you might like to know that our analysis indicates that SMCI is potentially undervalued!

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

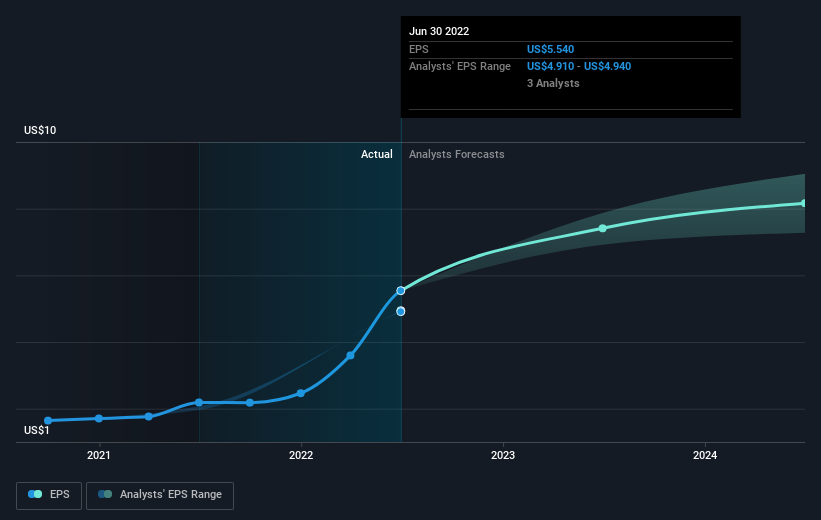

During three years of share price growth, Super Micro Computer achieved compound earnings per share growth of 56% per year. We don't think it is entirely coincidental that the EPS growth is reasonably close to the 52% average annual increase in the share price. That suggests that the market sentiment around the company hasn't changed much over that time. Rather, the share price has approximately tracked EPS growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Super Micro Computer's earnings, revenue and cash flow.

A Different Perspective

It's good to see that Super Micro Computer has rewarded shareholders with a total shareholder return of 83% in the last twelve months. That gain is better than the annual TSR over five years, which is 23%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Super Micro Computer (at least 1 which is concerning) , and understanding them should be part of your investment process.

We will like Super Micro Computer better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SMCI

Super Micro Computer

Develops and sells server and storage solutions based on modular and open-standard architecture in the United States, Asia, Europe, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Credo Technology Group (CRDO): High-Speed Growth Meets Margin Compression in 2026.

MongoDB Inc. (MDB): The Data Platform Pivot – Navigating the FY2027 Outlook in 2026.

Seagate Technology Holdings PLC (STX): The HAMR of AI – Forging the High-Capacity Storage Moat in 2026.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks