- United States

- /

- Tech Hardware

- /

- NasdaqGS:SMCI

A Look At Super Micro Computer (SMCI) Valuation As Margin And Execution Risks Draw Focus Before Earnings

Recent commentary around Super Micro Computer (SMCI) has focused on margin pressure, execution risks on large AI server orders, and lingering internal control issues as the company heads into an earnings update.

See our latest analysis for Super Micro Computer.

Those margin and execution worries have come after a sharp pullback, with the 90 day share price return at a 39.93% decline, even though the 1 year total shareholder return is 8.97% and the 5 year total shareholder return is very large at roughly 9x. Recent weakness therefore contrasts with what has been a powerful longer term run.

If you are watching how AI hardware sentiment swings around earnings, it can also be useful to scan other high growth tech and AI names using high growth tech and AI stocks.

With SMCI shares down about 40% over 90 days yet still showing strong multi year returns, and analysts split between cautious ratings and higher price targets, is the current weakness a fresh entry point, or is potential future growth already reflected in the share price?

Most Popular Narrative: 38% Undervalued

According to the most followed narrative, Super Micro Computer's fair value of $50.30 sits meaningfully above the last close at $31.21, setting up a sharp valuation gap for investors to weigh.

The primary drivers for SMCI's growth opportunity are rooted in the booming AI sector:

• AI Server Market Expansion: The market is forecast to grow from $124 billion in 2024 to $854 billion by 2030, a compound annual growth rate (CAGR) of ~39%. This growth is fueled by massive investments from hyperscalers in generative AI.

Want to see how that demand story turns into a $50 plus fair value? The narrative leans on earnings power, revenue momentum, and firmer margins ahead. Curious which specific assumptions do the heavy lifting in that model, and how they stack up against current profitability and growth?

Result: Fair Value of $50.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on SMCI easing margin pressure and demonstrating that recent order timing issues are genuine delays rather than demand shifting to rivals.

Find out about the key risks to this Super Micro Computer narrative.

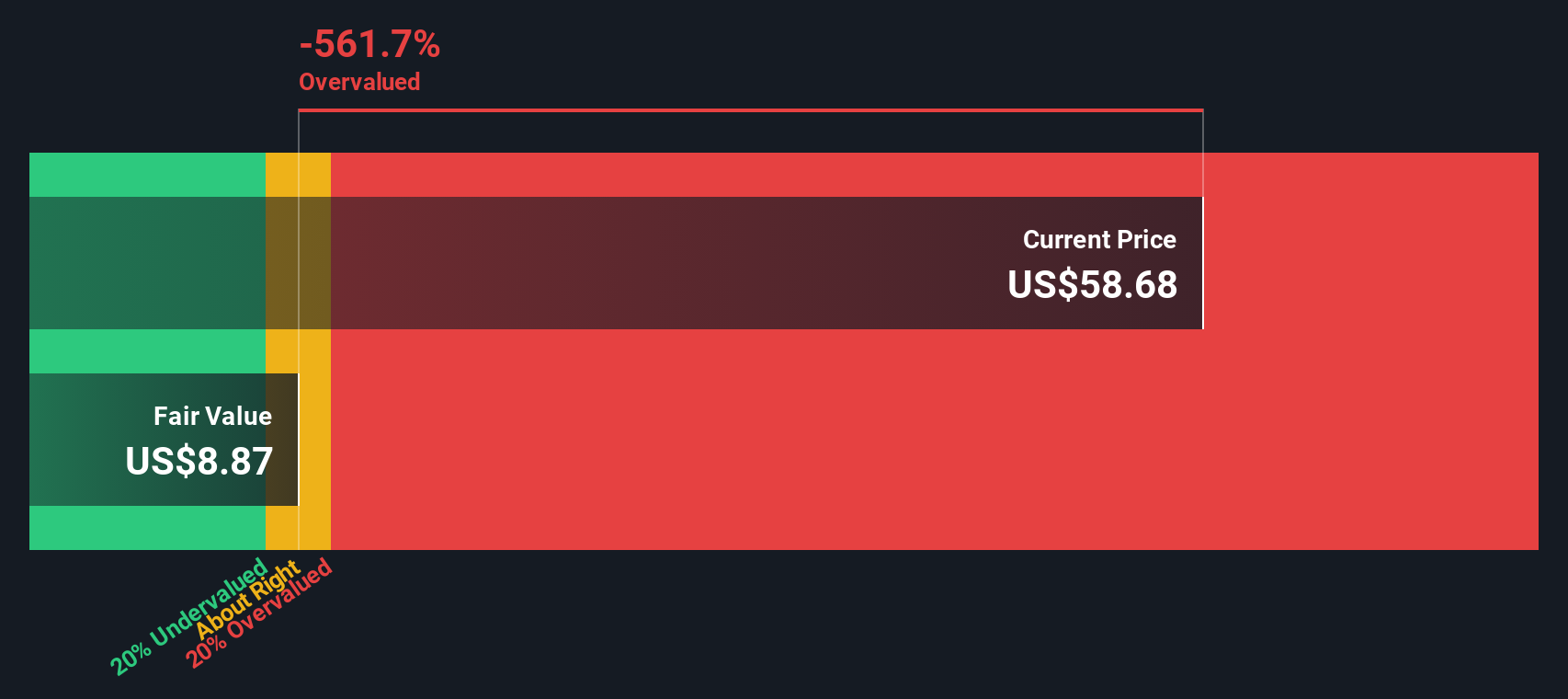

Another View: Cash Flows Paint a Tougher Picture

That $50.30 fair value and 38% discount look appealing, but our DCF model tells a very different story, with SMCI trading at $31.21 versus an estimated future cash flow value of $15.37, which screens as overvalued rather than cheap on this lens.

If earnings power is the hero of the popular narrative, the DCF work is more cautious on how much cash ultimately reaches shareholders. The gap between the two approaches raises a simple question for you: which set of assumptions do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Super Micro Computer for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Super Micro Computer Narrative

If you look at the numbers and come to a different conclusion, or simply prefer your own work, you can build a custom SMCI view in just a few minutes, starting with Do it your way.

A great starting point for your Super Micro Computer research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If SMCI has your attention, do not stop there. Widen your watchlist with a few focused stock idea sets that could help inform your next move.

- Scan for potential bargains by checking out these 877 undervalued stocks based on cash flows that might be trading below what their underlying cash flows suggest.

- Target future growth themes by reviewing these 24 AI penny stocks that are tied to ongoing advances in artificial intelligence and related infrastructure.

- Explore potential income streams by focusing on these 14 dividend stocks with yields > 3% that may offer yields above 3% and steadier cash return profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SMCI

Super Micro Computer

Develops and sells server and storage solutions based on modular and open-standard architecture in the United States, Asia, Europe, and internationally.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Hotel101 Global: A Scalable Hospitality Platform Built to Compound

Tesla’s Nvidia Moment – The AI & Robotics Inflection Point

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Trending Discussion