- United States

- /

- Tech Hardware

- /

- NasdaqCM:SCKT

We Ran A Stock Scan For Earnings Growth And Socket Mobile (NASDAQ:SCKT) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Socket Mobile (NASDAQ:SCKT). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Socket Mobile

Socket Mobile's Improving Profits

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. Which is why EPS growth is looked upon so favourably. It is awe-striking that Socket Mobile's EPS went from US$0.049 to US$0.27 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. This could point to the business hitting a point of inflection.

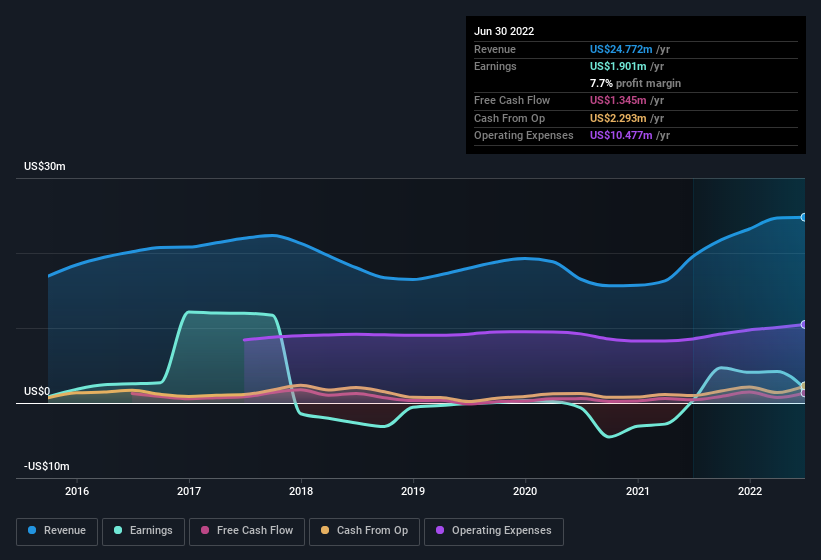

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Socket Mobile achieved similar EBIT margins to last year, revenue grew by a solid 27% to US$25m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Socket Mobile is no giant, with a market capitalisation of US$18m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Socket Mobile Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We haven't seen any insiders selling Socket Mobile shares, in the last year. With that in mind, it's heartening that Charlie Bass, the Independent Chairman of the Board of the company, paid US$35k for shares at around US$3.55 each. It seems that at least one insider is prepared to show the market there is potential within Socket Mobile.

It's commendable to see that insiders have been buying shares in Socket Mobile, but there is more evidence of shareholder friendly management. Specifically, the CEO is paid quite reasonably for a company of this size. For companies with market capitalisations under US$200m, like Socket Mobile, the median CEO pay is around US$768k.

Socket Mobile's CEO took home a total compensation package worth US$480k in the year leading up to December 2021. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Socket Mobile Deserve A Spot On Your Watchlist?

Socket Mobile's earnings per share have been soaring, with growth rates sky high. Better yet, we can observe insider buying and the chief executive pay looks reasonable. The strong EPS growth suggests Socket Mobile may be at an inflection point. For those attracted to fast growth, we'd suggest this stock merits monitoring. It is worth noting though that we have found 2 warning signs for Socket Mobile (1 can't be ignored!) that you need to take into consideration.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Socket Mobile, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SCKT

Socket Mobile

Provides data capture and delivery solutions in the United States, Europe, Asia, and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)