- United States

- /

- Tech Hardware

- /

- NasdaqCM:SCKT

Return Trends At Socket Mobile (NASDAQ:SCKT) Aren't Appealing

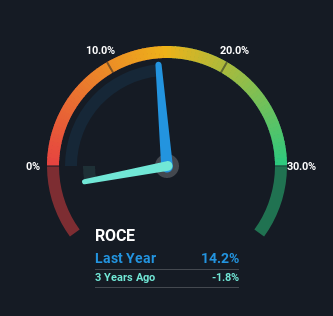

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. In light of that, when we looked at Socket Mobile (NASDAQ:SCKT) and its ROCE trend, we weren't exactly thrilled.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Socket Mobile is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.14 = US$2.9m ÷ (US$26m - US$5.3m) (Based on the trailing twelve months to March 2022).

So, Socket Mobile has an ROCE of 14%. On its own, that's a standard return, however it's much better than the 9.6% generated by the Tech industry.

See our latest analysis for Socket Mobile

Historical performance is a great place to start when researching a stock so above you can see the gauge for Socket Mobile's ROCE against it's prior returns. If you're interested in investigating Socket Mobile's past further, check out this free graph of past earnings, revenue and cash flow.

How Are Returns Trending?

Over the past five years, Socket Mobile's ROCE and capital employed have both remained mostly flat. It's not uncommon to see this when looking at a mature and stable business that isn't re-investing its earnings because it has likely passed that phase of the business cycle. So don't be surprised if Socket Mobile doesn't end up being a multi-bagger in a few years time.

The Key Takeaway

We can conclude that in regards to Socket Mobile's returns on capital employed and the trends, there isn't much change to report on. And investors appear hesitant that the trends will pick up because the stock has fallen 16% in the last five years. All in all, the inherent trends aren't typical of multi-baggers, so if that's what you're after, we think you might have more luck elsewhere.

On a final note, we found 4 warning signs for Socket Mobile (2 are a bit concerning) you should be aware of.

While Socket Mobile may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SCKT

Socket Mobile

Provides data capture and delivery solutions in the United States, Europe, Asia, and internationally.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Lynas Rare Earths: Owning the Policy-Backed Growth Regime, Not Just the Ore Body.

Bunker Hill Mine: A Case For $5 Per Share by 2030

VTEX - A hidden Latin American growth opportunity?

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026