- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:SANM

Sanmina (SANM): Evaluating Valuation After Q4 Results and Upbeat Revenue Guidance

Reviewed by Simply Wall St

Sanmina (SANM) has just released its fourth quarter and full year earnings results, along with new guidance for the current quarter. These two major updates are sure to catch investors’ attention.

See our latest analysis for Sanmina.

Sanmina’s latest earnings and upbeat revenue guidance have reignited investor confidence, fueling a huge run. The stock is up 24.1% over the past month and has delivered a remarkable 108.4% total shareholder return in the last year, suggesting momentum remains strong.

If you want to build on this kind of growth, now’s the perfect moment to broaden your horizons and uncover fast growing stocks with high insider ownership

With the stock on a hot streak and new guidance raising expectations, the key question is whether Sanmina still offers untapped value at these levels, or if the market has already priced in its next stage of growth.

Most Popular Narrative: 15.6% Undervalued

Sanmina’s narrative fair value estimate stands out above its recent closing price of $160.37, signaling a sizable upside according to the prevailing consensus. This creates a compelling look at the expectations powering the company’s valuation narrative.

Expansion of capabilities and a strong financial position enable sustained margin improvement, operational efficiency, and long-term earnings growth across diverse markets. Broad-based demand for complex electronics manufacturing remains strong across end-markets, especially in communications networks, cloud infrastructure, medical, defense, aerospace, and industrial segments. These markets favor sophisticated EMS providers like Sanmina and are expected to support long-term revenue growth and earnings stability.

Want to know what financial ingredients are fueling this potential? One key forecast blends accelerating profit margins with robust revenue expansion across fast-changing markets. Interested in the bold growth bets underlying this narrative’s upside? Unlock the full story to see what could propel Sanmina to a whole new level.

Result: Fair Value of $190 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainties around integrating the ZT acquisition and the impact of macroeconomic shifts could challenge Sanmina’s ambitious growth narrative in the future.

Find out about the key risks to this Sanmina narrative.

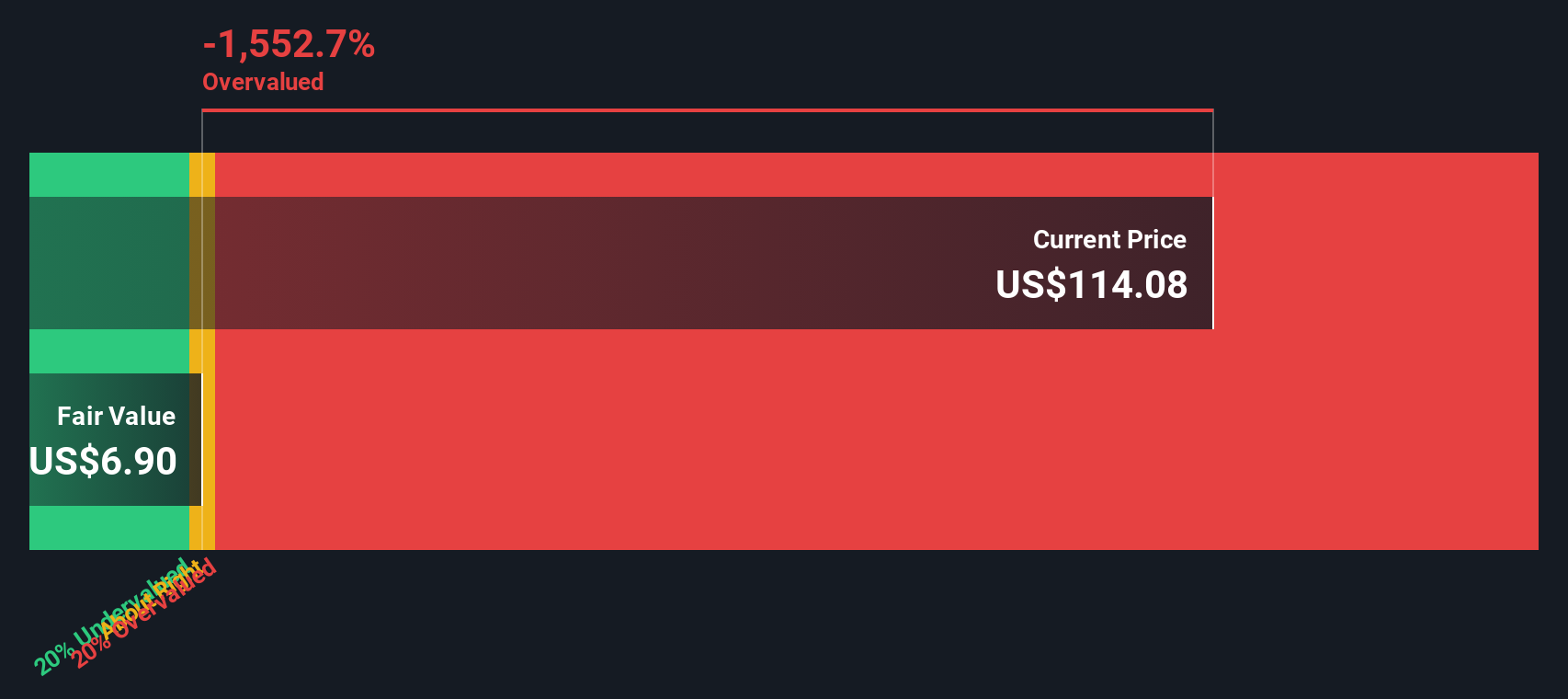

Another View: Discounted Cash Flow Tells a Different Story

Taking a fresh look using our SWS DCF model, the fair value estimate comes out far below Sanmina’s current market price. This suggests the shares may be significantly overvalued based on long-term cash flow assumptions. This result presents a clear contrast to expectations built around narrative and analyst targets. Which approach will prove more accurate as events unfold?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sanmina for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 886 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sanmina Narrative

Keep in mind, these conclusions are just one way to interpret the story. If you think differently or want your own perspective reflected, building a custom narrative takes just a few minutes, so why not Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Sanmina.

Looking for more investment ideas?

Don’t let a hot market leave you behind. Ramp up your investing strategy by taking advantage of targeted screens that pinpoint stocks with outstanding potential and unique advantages.

- Supercharge your growth portfolio by tapping into the AI-powered revolution with these 25 AI penny stocks transforming real-world industries right now.

- Capitalize on undervalued gems hiding in plain sight by screening for these 886 undervalued stocks based on cash flows that most investors overlook and regret missing.

- Boost your passive income by targeting these 16 dividend stocks with yields > 3% offering strong yields and stable fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SANM

Sanmina

Provides integrated manufacturing solutions, components, products and repair, logistics, and after-market services in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives