- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGM:RFIL

Improved Revenues Required Before RF Industries, Ltd. (NASDAQ:RFIL) Stock's 25% Jump Looks Justified

RF Industries, Ltd. (NASDAQ:RFIL) shares have continued their recent momentum with a 25% gain in the last month alone. The annual gain comes to 134% following the latest surge, making investors sit up and take notice.

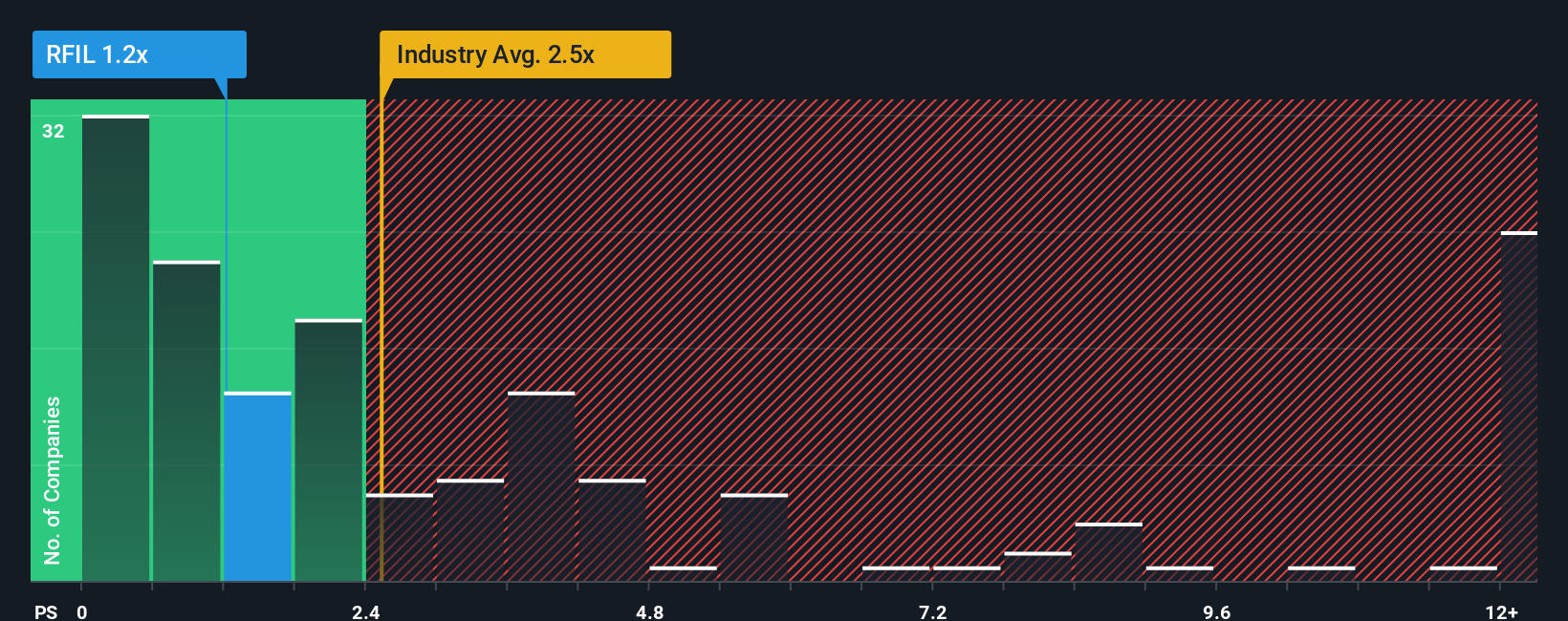

Even after such a large jump in price, RF Industries may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.2x, since almost half of all companies in the Electronic industry in the United States have P/S ratios greater than 2.5x and even P/S higher than 6x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for RF Industries

What Does RF Industries' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, RF Industries has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think RF Industries' future stacks up against the industry? In that case, our free report is a great place to start.How Is RF Industries' Revenue Growth Trending?

In order to justify its P/S ratio, RF Industries would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 23%. Still, revenue has fallen 8.4% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 4.9% over the next year. Meanwhile, the rest of the industry is forecast to expand by 13%, which is noticeably more attractive.

With this in consideration, its clear as to why RF Industries' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

The latest share price surge wasn't enough to lift RF Industries' P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of RF Industries' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for RF Industries you should know about.

If these risks are making you reconsider your opinion on RF Industries, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:RFIL

RF Industries

Designs, manufactures, and markets interconnect products and systems in the United States, Canada, Italy, China, the United Kingdom, and internationally.

Adequate balance sheet and fair value.

Market Insights

Community Narratives