- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:RELL

Richardson Electronics (NASDAQ:RELL) Has Announced A Dividend Of $0.06

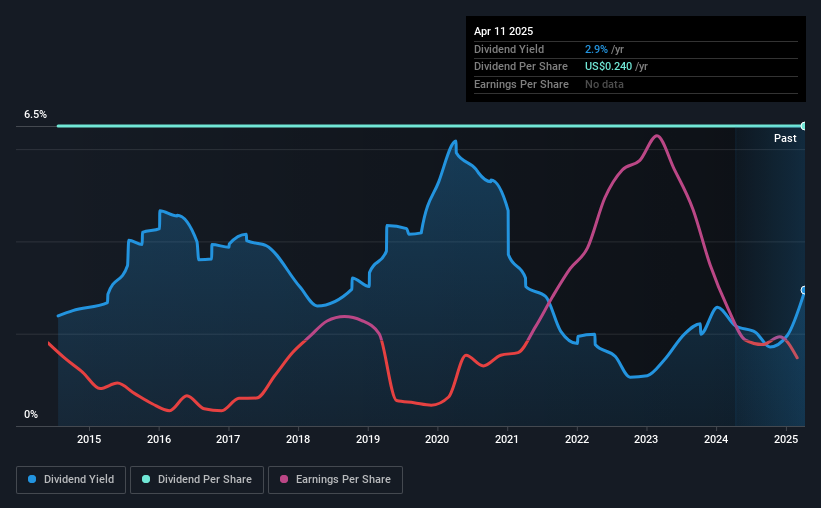

Richardson Electronics, Ltd. (NASDAQ:RELL) has announced that it will pay a dividend of $0.06 per share on the 28th of May. This makes the dividend yield 2.9%, which will augment investor returns quite nicely.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Richardson Electronics' stock price has reduced by 37% in the last 3 months, which is not ideal for investors and can explain a sharp increase in the dividend yield.

Richardson Electronics Might Find It Hard To Continue The Dividend

A big dividend yield for a few years doesn't mean much if it can't be sustained. Richardson Electronics is not generating a profit, but its free cash flows easily cover the dividend, leaving plenty for reinvestment in the business. We generally think that cash flow is more important than accounting measures of profit, so we are fairly comfortable with the dividend at this level.

Analysts are expecting EPS to grow by 68.0% over the next 12 months. We like to see the company moving towards profitability, but this probably won't be enough for it to post positive net income this year. The positive free cash flows give us some comfort, however, that the dividend could continue to be sustained.

View our latest analysis for Richardson Electronics

Richardson Electronics Has A Solid Track Record

The company has an extended history of paying stable dividends. The payments haven't really changed that much since 10 years ago. Although we can't deny that the dividend has been remarkably stable in the past, the growth has been pretty muted.

The Company Could Face Some Challenges Growing The Dividend

Investors could be attracted to the stock based on the quality of its payment history. Richardson Electronics has seen EPS rising for the last five years, at 17% per annum. It's not an ideal situation that the company isn't turning a profit but the growth recently is a positive sign. If the company can become profitable soon, continuing on this trajectory would bode well for the future of the dividend.

Our Thoughts On Richardson Electronics' Dividend

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Richardson Electronics' payments, as there could be some issues with sustaining them into the future. The company is generating plenty of cash, but we still think the dividend is a bit high for comfort. We don't think Richardson Electronics is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 1 warning sign for Richardson Electronics that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RELL

Richardson Electronics

Provides engineered solutions, power grid and microwave tube, and related consumables in North America, the Asia Pacific, Europe, and Latin America.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

The Green Consolidator

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion