- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:RELL

Richardson Electronics' (NASDAQ:RELL) Dividend Will Be $0.06

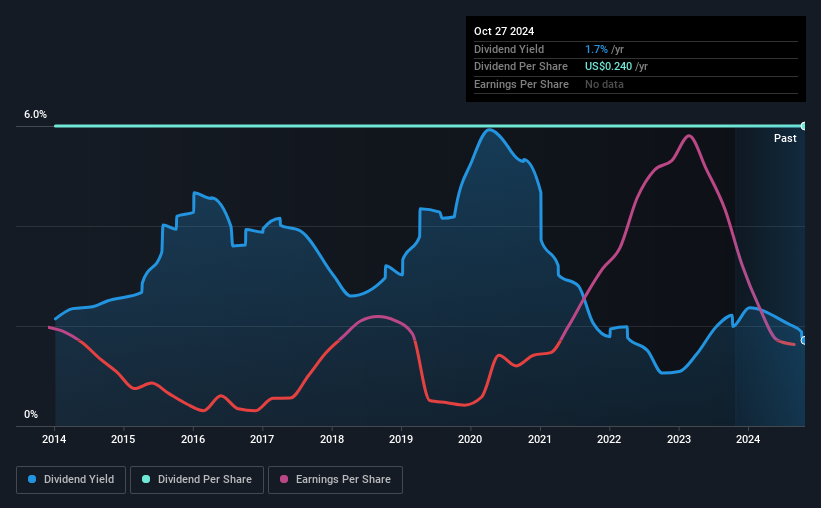

Richardson Electronics, Ltd.'s (NASDAQ:RELL) investors are due to receive a payment of $0.06 per share on 27th of November. Based on this payment, the dividend yield on the company's stock will be 1.7%, which is an attractive boost to shareholder returns.

Check out our latest analysis for Richardson Electronics

Richardson Electronics' Projections Indicate Future Payments May Be Unsustainable

Estimates Indicate Richardson Electronics' Could Struggle to Maintain Dividend Payments In The Future

Richardson Electronics' Future Dividends May Potentially Be At Risk

A big dividend yield for a few years doesn't mean much if it can't be sustained. Richardson Electronics is unprofitable despite paying a dividend, and it is paying out 165% of its free cash flow. This makes us feel that the dividend will be hard to maintain.

Over the next year, EPS is forecast to expand by 125.4%. However, if the dividend continues along recent trends, it could start putting pressure on the balance sheet with the payout ratio getting very high over the next year.

Richardson Electronics Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The payments haven't really changed that much since 10 years ago. Slow and steady dividend growth might not sound that exciting, but dividends have been stable for ten years, which we think makes this a fairly attractive offer.

The Company Could Face Some Challenges Growing The Dividend

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Richardson Electronics has seen EPS rising for the last five years, at 42% per annum. Even though the company is not profitable, it is growing at a solid clip. If this trajectory continues and the company can turn a profit soon, it could bode well for the dividend going forward.

The Dividend Could Prove To Be Unreliable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. We can't deny that the payments have been very stable, but we are a little bit worried about the very high payout ratio. We don't think Richardson Electronics is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 1 warning sign for Richardson Electronics that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RELL

Richardson Electronics

Provides engineered solutions, power grid and microwave tube, and related consumables in North America, the Asia Pacific, Europe, and Latin America.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

The Green Consolidator

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion