- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:RELL

Do Richardson Electronics’ (RELL) Earnings Beat and Dividend Signal Enduring Profit Growth?

- Richardson Electronics reported its first quarter 2026 results on October 8, 2025, posting sales of US$54.61 million and net income of US$1.91 million, both higher than the same period last year, and reaffirmed its quarterly dividend of US$0.06 per common share and US$0.054 per Class B share.

- These results reflect both revenue and earnings growth paired with continued shareholder returns, highlighting stronger profitability and an ongoing commitment to dividends.

- With the earnings growth outpacing last year's results, we'll examine how this improved financial performance may influence Richardson Electronics' investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Richardson Electronics Investment Narrative Recap

To own shares of Richardson Electronics, an investor needs to believe in the company’s ability to transition from its legacy component businesses toward faster-growing energy and automation markets. While the latest earnings release showed solid revenue and net income growth, the impact on overcoming the biggest short-term risk, quarterly volatility tied to the project-based Green Energy Solutions segment, remains limited, and the company’s exposure to mature markets is still a consideration for the investment case.

Among recent announcements, the ongoing affirmation of Richardson Electronics’ quarterly dividend stands out. Continued dividend payments, even through volatile periods, signal management’s confidence in underlying cash flows, which may appeal to income-focused investors and support sentiment as the company navigates growth initiatives and unpredictable project timelines.

Yet, despite robust short-term performance, investors should also weigh the potential downside if the company’s reliance on project-based revenues means another quarter of...

Read the full narrative on Richardson Electronics (it's free!)

Richardson Electronics' outlook anticipates $265.0 million in revenue and $16.7 million in earnings by 2028. This scenario assumes an annual revenue growth rate of 8.2% and a $17.8 million increase in earnings from the current $-1.1 million.

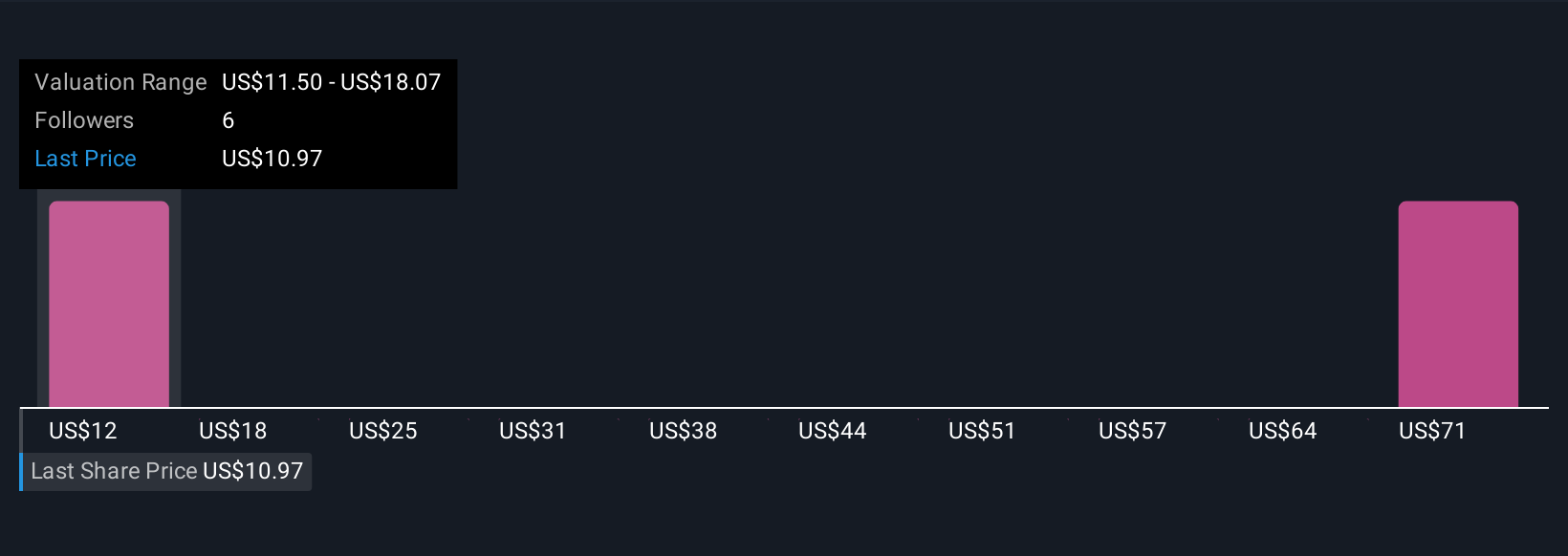

Uncover how Richardson Electronics' forecasts yield a $11.50 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Richardson Electronics span from US$11.50 to US$77.82, with just two individual perspectives shaping this wide range. As you consider these differing views, keep in mind that ongoing volatility in project-based revenue may influence how the company performs relative to both market expectations and peer groups.

Explore 2 other fair value estimates on Richardson Electronics - why the stock might be worth just $11.50!

Build Your Own Richardson Electronics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Richardson Electronics research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Richardson Electronics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Richardson Electronics' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RELL

Richardson Electronics

Provides engineered solutions, power grid and microwave tube, and related consumables in North America, the Asia Pacific, Europe, and Latin America.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Why EnSilica is Worth Possibly 13x its Current Price

SoFi Technologies will ride a 33% revenue growth wave in the next 5 years

Safaricom: Why I'm Holding Long

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.