- United States

- /

- Tech Hardware

- /

- NasdaqCM:QUBT

Why Quantum Computing (QUBT) Is Up 12.6% After Landmark Orders from Major Auto and Banking Clients

Reviewed by Simply Wall St

- Quantum Computing Inc. recently sold its EmuCore reservoir computing device to a major global automotive manufacturer and secured a US$332,000 purchase order from a top-five U.S. bank for its quantum cybersecurity solutions.

- These developments underscore growing enterprise adoption of quantum technologies, highlighting real-world validation and rising demand in both industrial and financial sectors.

- We'll examine how QUBT’s major orders from leading automotive and banking players reshape its investment narrative around enterprise adoption.

Uncover the next big thing with financially sound penny stocks that balance risk and reward .

What Is Quantum Computing's Investment Narrative?

Quantum Computing Inc.’s string of major client wins, especially the US$332,000 order from a top-five U.S. bank and the sale of its EmuCore device to a major automaker, could be a pivotal moment for the company’s story. Until this news, the most pressing short-term catalyst had been whether QUBT could demonstrate real, large-scale commercial traction rather than remain a promising, but speculative, player in quantum innovation. Now, the company is showing signs of moving past early-stage adoption hurdles and shifting conversations toward scaling and integrating its tech with major enterprises. However, risks remain. QUBT is still unprofitable, with rising losses and a history of shareholder dilution, and leadership turnover reflects a business in transition. The recent orders are a positive signal, but investors still need to watch for execution risks and whether QUBT can turn orders into meaningful, recurring revenue. Yet, amid all this progress, shareholder dilution could impact returns sooner than expected.

According our valuation report, there's an indication that Quantum Computing's share price might be on the expensive side.

Exploring Other Perspectives

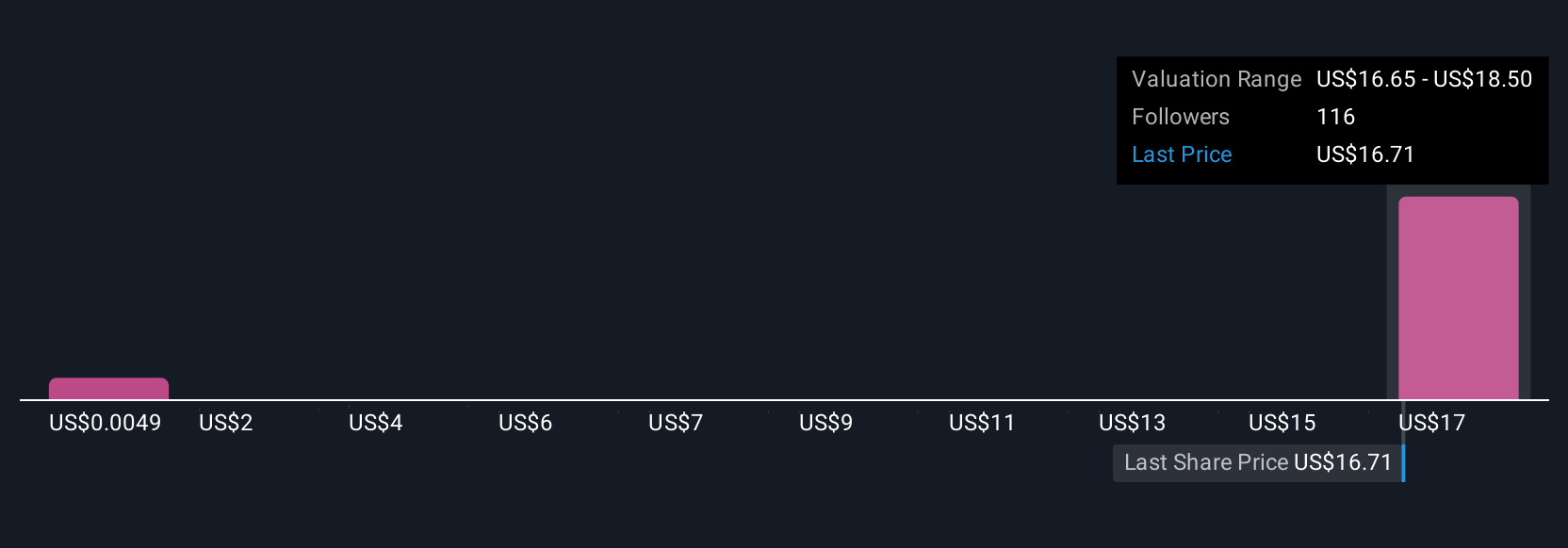

With 27 individual fair value estimates from the Simply Wall St Community, valuations for QUBT range widely from as low as US$0.0049 up to US$18.50 per share. While this wide spread reflects real differences in outlook on commercial potential, the company’s new enterprise orders could shift these opinions dramatically as QUBT works to address ongoing risks around profitability and cash flow. Take a look at how other investors are sizing up both the opportunity and the risk.

Explore 27 other fair value estimates on Quantum Computing - why the stock might be worth as much as 9% more than the current price!

Build Your Own Quantum Computing Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Quantum Computing research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Quantum Computing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Quantum Computing's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year . See the full list for free.

- This technology could replace computers: discover 25 stocks that are working to make quantum computing a reality .

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery . The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quantum Computing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:QUBT

Quantum Computing

An integrated photonics company, provides quantum machines to commercial and government markets in the United States.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A Quality Compounder Marked Down on Overblown Fears

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion