- United States

- /

- Tech Hardware

- /

- NasdaqCM:QUBT

Quantum Computing (NasdaqCM:QUBT) Ships First Commercial Photon Source to South Korea

Quantum Computing (NasdaqCM:QUBT) recently joined several major indices, enhancing its visibility among investors. Its 172% surge this quarter can be further illuminated by recent changes, including a successful private placement and executive leadership updates, as well as shipping its first commercial photon source to South Korea. The addition to indices and these strategic initiatives align with the broader market's rise, buoyed by tech sector resilience and positive economic data, which saw the S&P 500 and Nasdaq achieving new highs. While the company's index inclusions and placements align with the market rally, they offer additional impetus to its price trajectory.

The company’s total shareholder return over the past year, reaching a very large percentage, highlights the dramatically positive performance of Quantum Computing Inc.'s stock. While recent developments in indices inclusion, a private placement, and executive changes helped drive a rise in share price, the broader tech sector's resilience further supported this upswing. Compared to a tech industry decline of 4.5% over the past year, Quantum Computing Inc.'s returns stand out significantly. Meanwhile, the general market delivered a 13.2% increase over the same period, against which the company's longer-term performance is quite exceptional.

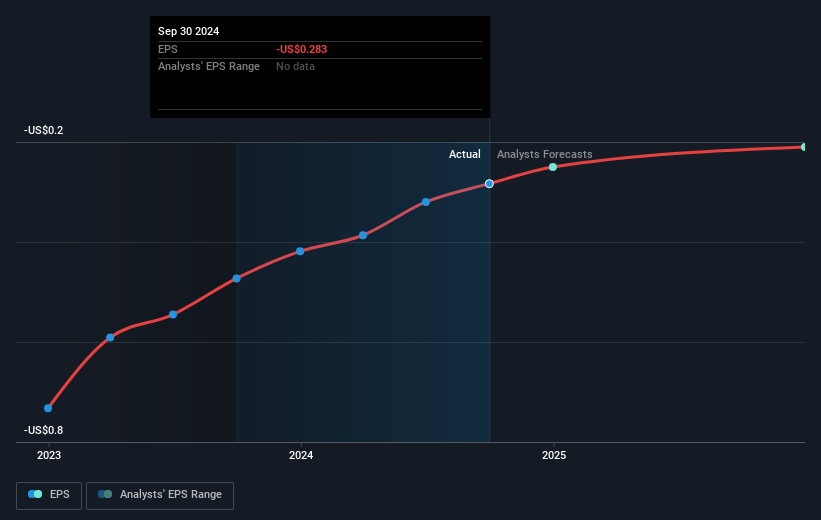

The introduction of commercial photon technology, coupled with recent index inclusions, could positively influence revenue forecasts, suggested to grow swiftly at over 114.4% annually. Despite this, earnings predictions remain less optimistic amid dilution and operational challenges, with profitability not in sight for the next three years. The current share price, trading under its consensus price target of US$18.50, reflects market tensions and speculative investor sentiment. However, the high valuation relative to peers and industry could continue to play a pivotal role in future pricing dynamics.

Our valuation report here indicates Quantum Computing may be overvalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quantum Computing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:QUBT

Quantum Computing

An integrated photonics company, provides quantum machines to commercial and government markets in the United States.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Tesla will achieve a 392% PE ratio increase according to recent forecasts

Lynas Rare Earths: Owning the Policy-Backed Growth Regime, Not Just the Ore Body.

Bunker Hill Mine: A Case For $5 Per Share by 2030

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026