- United States

- /

- Tech Hardware

- /

- NasdaqGM:QMCO

Quantum (QMCO): Valuation in Focus as Accounting Restatements and Leadership Shakeup Rattle Investors

Reviewed by Kshitija Bhandaru

Quantum (QMCO) is back in the headlines, as the company’s announcement of financial restatements and the CEO’s sudden departure have grabbed investor attention. Legal actions now add another layer of uncertainty to the stock’s outlook.

See our latest analysis for Quantum.

Quantum’s share price has drifted sideways despite newsworthy events such as restated financials, CEO turnover, and a new Veeam Ready qualification for its storage products on the technical side. While 12-month total shareholder return squeaked out a modest 2.4% gain, overall momentum appears tepid after several lackluster years and recent legal headwinds.

If you’re weighing what’s next for your portfolio, this could be the right moment to broaden your search and discover fast growing stocks with high insider ownership

With the stock’s long-term returns still deep in the red and mounting uncertainty from restated earnings and leadership turnover, investors face a critical question: is Quantum now attractively undervalued, or is the market already pricing in a tough road ahead?

Most Popular Narrative: 2% Overvalued

Quantum’s narrative valuation sits slightly above the current share price, with analysts sharply lowering their fair value target in the wake of recent events. The stage is set for a closer look into the catalysts that drive this perspective.

Significant growth in secondary storage revenue, driven by new DXi data protection appliances, suggests strong future revenue potential in this high-margin product line. Strategic wins in large international deals and ongoing partnerships with defense and technology sectors indicate an expansion in customer base and revenue streams, impacting future earnings positively.

What is the secret behind this new valuation? The narrative’s boldest projections rest on future earnings power and a turnaround in profit margins. Find out which core financial shifts and revenue bets analysts are counting on in the full breakdown.

Result: Fair Value of $11.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain delays and the company’s significant outstanding debt could quickly derail the narrative if these issues are not addressed soon.

Find out about the key risks to this Quantum narrative.

Another View: Sales Ratio Perspective

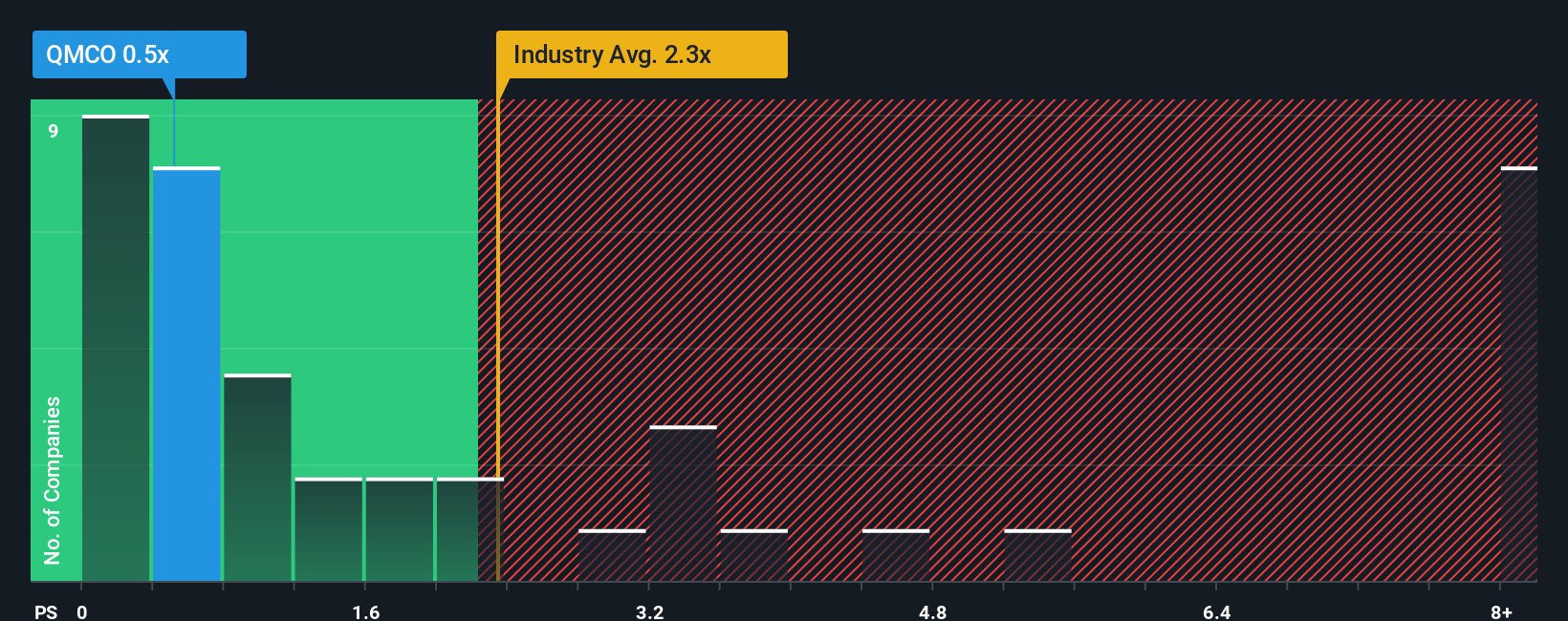

Looking at valuation through the lens of the price-to-sales ratio, Quantum comes in well below the US Tech industry average and its peers, at 0.6x versus 2.2x and 1.1x respectively. Notably, this is also much lower than the fair ratio of 1.8x, which could signal a potential opportunity if the market adjusts upward in the future. But does a bargain sales ratio outweigh current profit challenges?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Quantum Narrative

If you’re inclined to question these viewpoints or want to dig into the numbers yourself, you can craft your own insights in just a few minutes with Do it your way

A great starting point for your Quantum research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Ready for Fresh Investment Ideas?

Sharpen your investing edge and unlock more growth opportunities. Don’t just settle for the usual picks when standout stocks with untapped potential could be one click away.

- Grab your chance for impressive yields by scanning these 19 dividend stocks with yields > 3% featuring companies with healthy payouts and sustainable income streams.

- Spot innovation early as you browse these 24 AI penny stocks where artificial intelligence is propelling small caps into tomorrow’s market leaders.

- Position yourself for the next breakthrough in computing power through these 26 quantum computing stocks filled with businesses shaping the quantum future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quantum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:QMCO

Quantum

Provides products for storing and managing digital video and unstructured data in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with moderate risk.

Similar Companies

Market Insights

Community Narratives