- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:PLXS

Plexus (PLXS) Valuation in Focus After Rare-Earth Export Controls Heighten US-China Trade Tensions

Reviewed by Kshitija Bhandaru

Plexus (PLXS) shares reacted as investors digested new tensions between the US and China, following China’s introduction of export limits on rare-earth minerals. These minerals are central to technology manufacturing and global supply chains.

See our latest analysis for Plexus.

After a rocky week shaped by escalating US-China trade tensions, Plexus’ share price found its footing, closing at $139.94 after a 1.36% gain over the past day. While the share price has seen some ups and downs, down nearly 10% year-to-date, it is worth noting that total shareholder return for the past year stands at a modest 2.97%. A robust 52.59% three-year return suggests long-term momentum is still intact. Recent events seem to be fueling shifts in risk perception, rather than derailing the underlying growth story.

If the latest developments have you rethinking your portfolio, this is a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With these external pressures shaping sentiment and a modest long-term return profile, investors now face a crucial question: Is Plexus trading at a bargain, or has the market already accounted for all of its potential growth?

Most Popular Narrative: 9.5% Undervalued

Compared to the latest closing price of $139.94, the most widely followed narrative pegs Plexus’ fair value at $154.6. This sets expectations for potential upside if projections materialize. The valuation places the target above the current market price, increasing expectations for the company's future performance and highlighting the importance of strong execution.

The company's increasing success in winning programs in high-margin, complex sectors such as healthcare/life sciences, aerospace, and defense (including a strong defense pipeline in Europe and record sector wins) is shifting the revenue mix toward segments with higher pricing power and more stable, long-term contracts. This could positively impact both revenue consistency and net margin expansion.

Curious what’s fueling this bullish call? The most popular narrative is betting on profit and revenue gains beyond what the market expects, hinging on a handful of critical assumptions. Want to uncover the growth benchmarks and financial projections baked into this valuation? See how this price target gets justified: the full breakdown may surprise you.

Result: Fair Value of $154.6 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing trade uncertainties and customer-specific demand slowdowns could quickly disrupt momentum and challenge the case for sustained earnings growth at Plexus.

Find out about the key risks to this Plexus narrative.

Another View: What Does the SWS DCF Model Show?

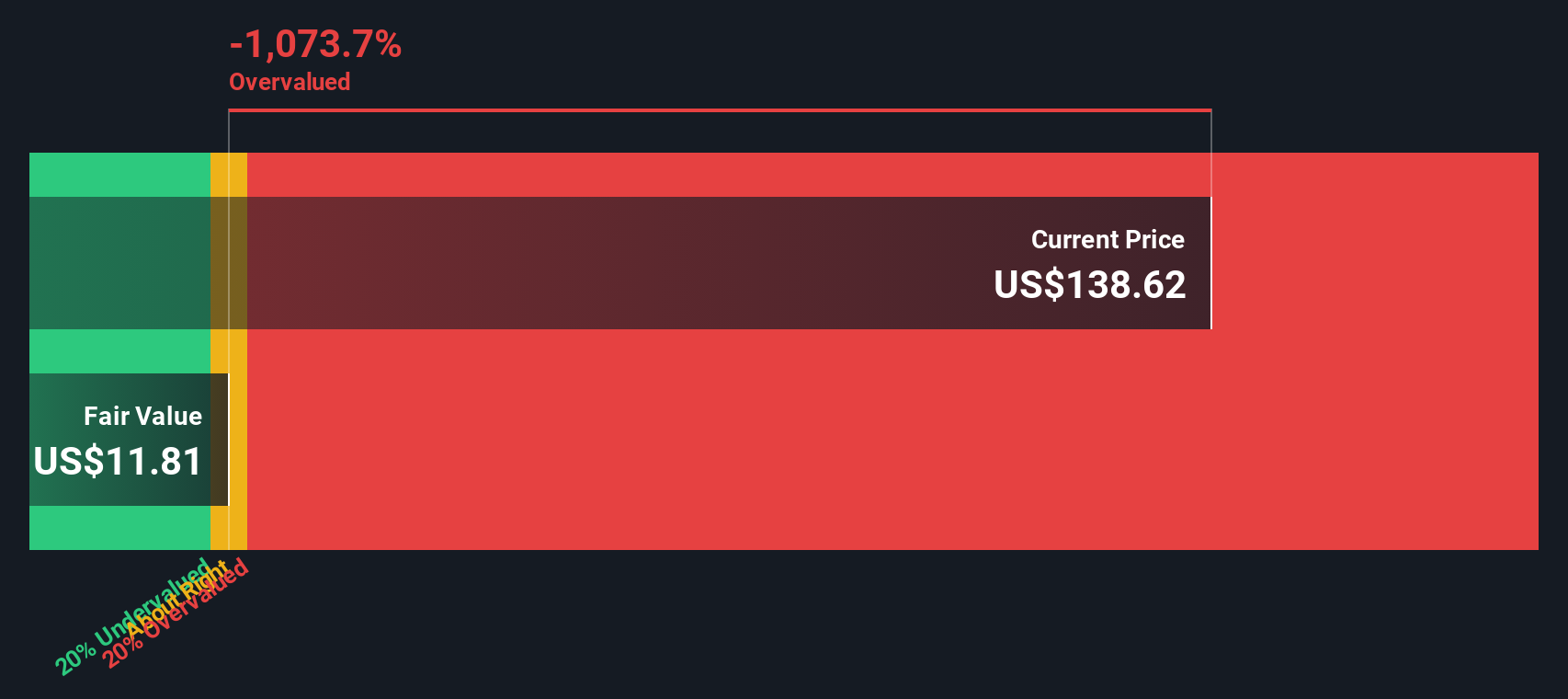

While analysts' price targets suggest Plexus could be undervalued, the SWS DCF model paints a different picture. According to this approach, Plexus may actually be trading above its estimated fair value. This contrast raises the question of whether optimism about future growth is already reflected in today’s price or if longer-term risks are underestimated.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Plexus for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Plexus Narrative

If you see things differently, or want to dive deeper on your own terms, you can shape your own story about Plexus in just a few minutes. Do it your way

A great starting point for your Plexus research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t let great opportunities slip through your fingers. The market is packed with stocks poised for growth, high yield, or next-level innovation. Start making moves that could set you apart.

- Power up your income strategy by targeting companies with steady, attractive yields through these 18 dividend stocks with yields > 3%, designed to spotlight top dividend performers.

- Ride the wave of artificial intelligence and get ahead of major trends with these 25 AI penny stocks, poised for breakthroughs in this fast-evolving sector.

- Capitalize on overlooked bargains and unlock hidden value by tapping into these 881 undervalued stocks based on cash flows, filled with stocks the market may have undervalued based on their cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLXS

Plexus

Provides electronic manufacturing services in the United States, the Asia-Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion