- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:PLXS

Plexus (PLXS): Assessing Valuation as New Evolv Partnership Strengthens Global Growth Platform

Reviewed by Simply Wall St

Plexus (PLXS) just announced a strategic contract manufacturing partnership with Evolv Technologies Holdings, aiming to support Evolv's growth with Plexus' global design, supply chain, and manufacturing strengths. This move deepens Plexus' role in enabling international expansion and operational resilience for its clients.

See our latest analysis for Plexus.

Plexus’ new partnership with Evolv comes at a time when the market’s been a bit cautious on the stock. After a strong 90-day share price return of 7.2%, the year-to-date share price return remains down 9.6%. Momentum has faded from last year’s highs, reflected in the 1-year total shareholder return of -10.1%. However, investors further out are still sitting on solid long-term gains like a 31% total return over three years and nearly 82% over five years. This suggests near-term uncertainty, but the long-run story points to resilience and value creation.

If you’re curious what else is driving market performance lately, now’s a great time to broaden your view and discover fast growing stocks with high insider ownership

With the stock trading below analyst targets and showing healthy financial momentum, the question now is whether Plexus offers rare value at today’s prices, or if the market has already accounted for its growth prospects.

Most Popular Narrative: 11.7% Undervalued

Plexus closed at $140.37, while the most closely followed narrative sees fair value at $159. This meaningful gap suggests upside. The narrative’s positive stance reflects both robust sector demand and strategic execution, but also builds its case on a series of bold underlying assumptions.

The company's increasing success in winning programs in high-margin, complex sectors such as healthcare/life sciences, aerospace, and defense (including strong defense pipeline in Europe and record sector wins) is shifting the revenue mix toward segments with higher pricing power and more stable, long-term contracts. This should positively impact both revenue consistency and net margin expansion.

Want the secret behind this double-digit upside? The fair value call comes down to ambitious growth targets, projected margin expansion, and a big leap in future profitability. Find out which expectations and hard numbers shape this bullish estimate. Read the full narrative for the surprising details that could change your view.

Result: Fair Value of $159 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing customer demand uncertainty and margin pressures from rising costs could quickly challenge the optimistic outlook that supports Plexus’s current valuation narrative.

Find out about the key risks to this Plexus narrative.

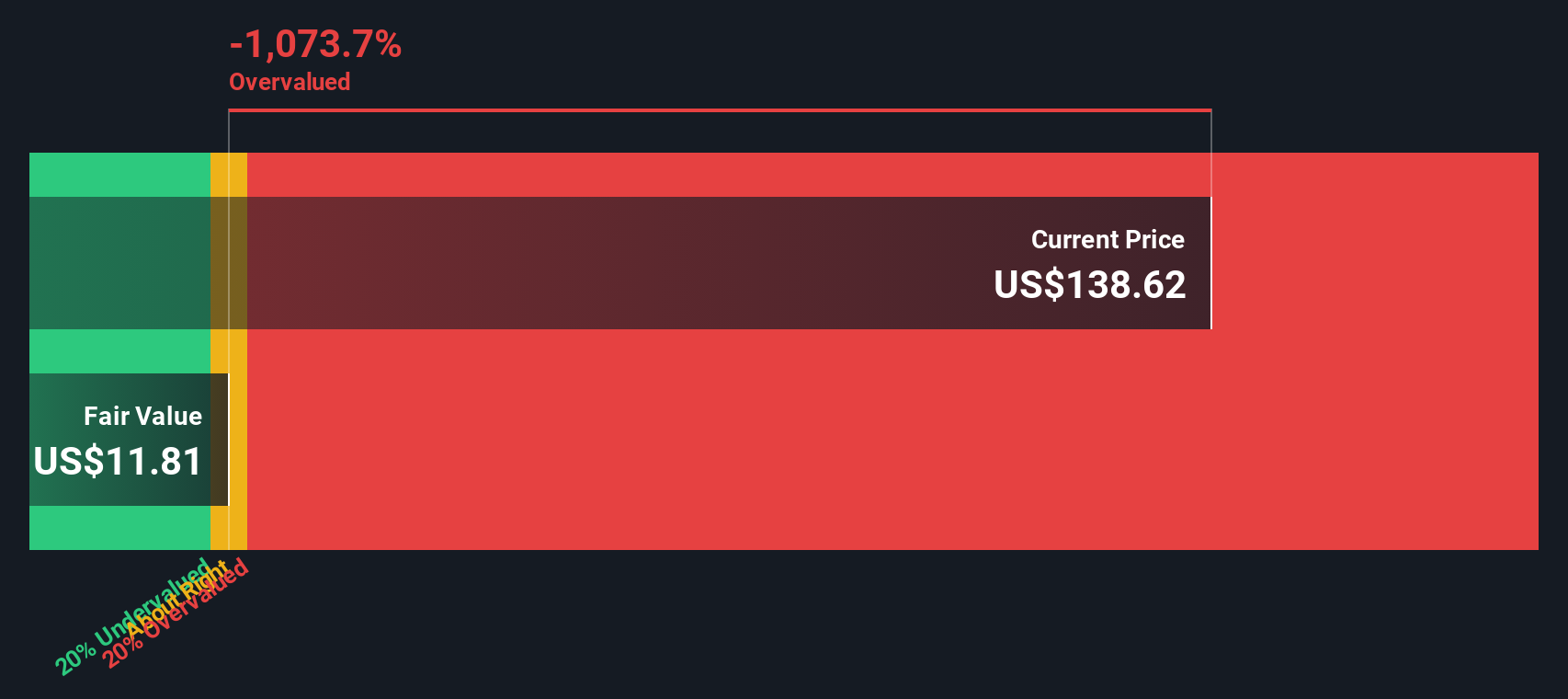

Another View: SWS DCF Model Says Otherwise

While the consensus narrative points to upside, our SWS DCF model paints a different picture for Plexus. Its current share price of $140.37 stands well above our DCF estimate of fair value at $63.75. This suggests the stock could be substantially overvalued if long-term cash flow projections prove less optimistic. Does this conservative model set a reality check, or does the truth lie somewhere in between?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Plexus for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Plexus Narrative

If you think there’s another angle to the story or want to dig deeper yourself, it only takes a few minutes to shape your own perspective. Do it your way

A great starting point for your Plexus research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop at just one opportunity. Don’t miss out on unique trends and innovations. Expand your portfolio horizons by checking out these hand-picked investing ideas today:

- Fuel your search for tomorrow’s potential winners and tap into growth with these 3577 penny stocks with strong financials.

- Capitalize on artificial intelligence breakthroughs by spotting promising opportunities in these 26 AI penny stocks shaping smarter industries worldwide.

- Take advantage of reliable passive income and maximize your returns with these 16 dividend stocks with yields > 3% offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLXS

Plexus

Provides electronic manufacturing services in the United States, the Asia-Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives