- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:PLXS

How Record Manufacturing Wins Could Shape Plexus (PLXS) Revenue Growth and Investor Outlook

Reviewed by Sasha Jovanovic

- Plexus recently reported fourth-quarter fiscal 2025 adjusted earnings per share and revenues that exceeded consensus estimates, supported by 28 new manufacturing program wins expected to significantly contribute to annualized revenues.

- The company's strong fiscal 2025 performance and forward-looking guidance point to confidence in achieving targeted revenue growth for fiscal 2026, underpinned by robust new program bookings.

- We’ll explore how Plexus’s record number of new manufacturing wins may impact its long-term revenue growth and investment outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Plexus Investment Narrative Recap

To be a Plexus shareholder, you need to believe in the company’s ability to consistently secure new program wins and grow in high-margin sectors like healthcare, aerospace, and defense. The recent earnings beat and upbeat fiscal 2026 guidance reinforce market confidence, though near-term results still hinge on the pace of customer ramp-ups, while customer concentration remains a key risk if orders are delayed or reduced. The immediate effect of the news does not fundamentally change these main drivers.

Among recent announcements, Plexus’s strategic manufacturing partnership with Evolv Technologies stands out as it aligns closely with the company’s growth catalysts, leveraging Plexus’s engineering and supply chain expertise to support Evolv’s expansion and ensure operational resilience. This collaboration highlights how Plexus’s industry reputation and global capabilities are translating into real contract wins, which are essential for meeting growth forecasts and maintaining investor optimism.

Yet, in contrast to recent wins and guidance, investors should also be aware that customer-specific demand pushouts in critical sectors could still...

Read the full narrative on Plexus (it's free!)

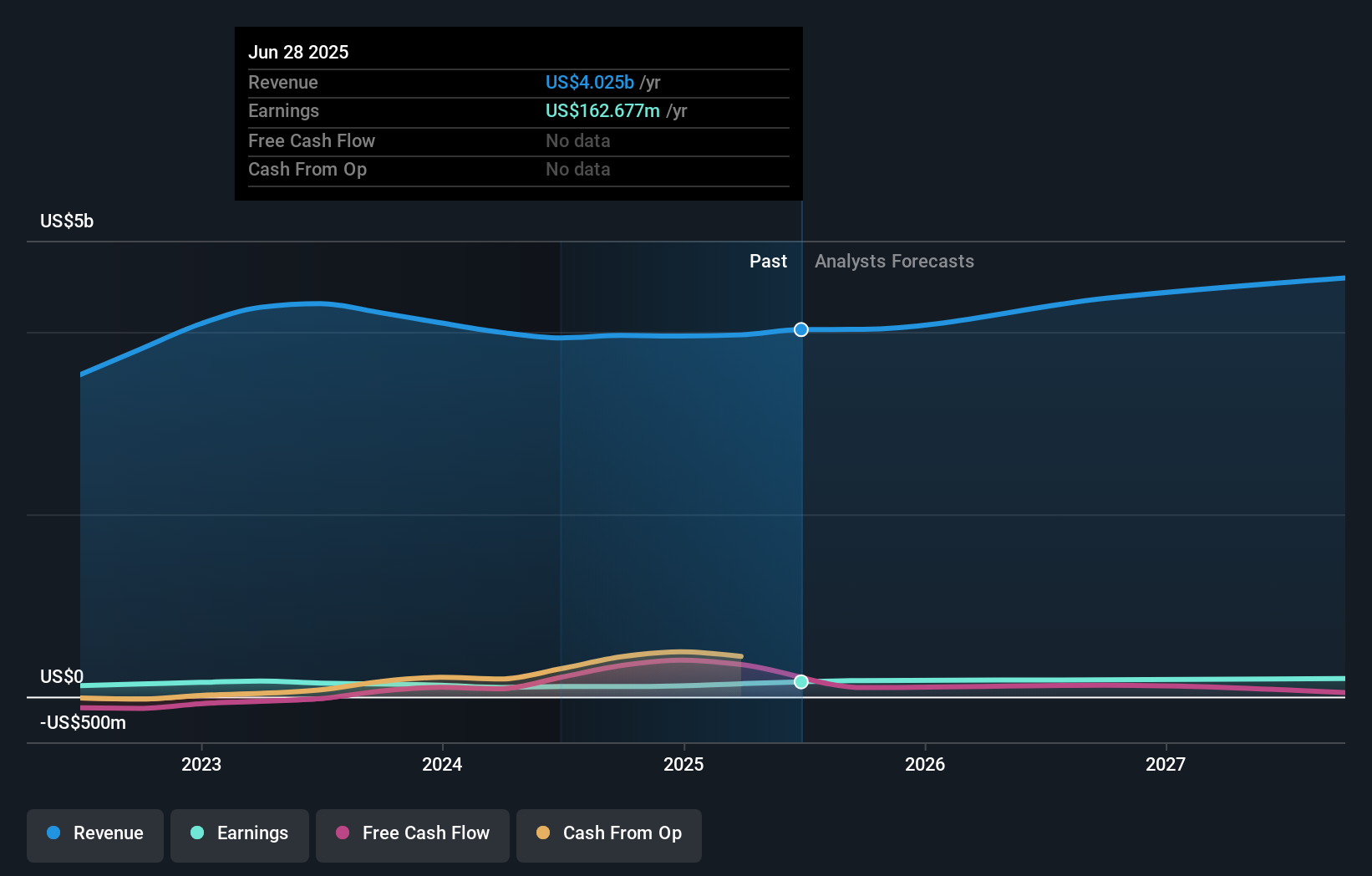

Plexus' narrative projects $4.8 billion in revenue and $202.1 million in earnings by 2028. This requires 6.1% yearly revenue growth and a $39.4 million earnings increase from current earnings of $162.7 million.

Uncover how Plexus' forecasts yield a $159.00 fair value, a 15% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s single fair value estimate sits at US$114.18. Many point to Plexus’s ability to win large contracts and manage sector demand shifts as critical to performance, so consider these varied insights when reviewing competing opinions.

Explore another fair value estimate on Plexus - why the stock might be worth 18% less than the current price!

Build Your Own Plexus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Plexus research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Plexus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Plexus' overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLXS

Plexus

Provides electronic manufacturing services in the United States, the Asia-Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives