- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:PLXS

Can Plexus (PLXS) Turn Operational Gains Into Lasting Competitive Strength?

Reviewed by Sasha Jovanovic

- Plexus Corp. recently reported fourth quarter and full year earnings for fiscal 2025, highlighting year-over-year increases in sales and net income, alongside updated revenue and earnings guidance for the first quarter of 2026.

- Operational improvements, including efficient inventory management and automation, have underpinned stable margins and contributed to consistent performance in the latest results.

- We'll now examine how these operational gains and incremental earnings support Plexus’s broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Plexus Investment Narrative Recap

To be a shareholder in Plexus, I believe one must have confidence in the company’s ability to drive growth through operational efficiency and execution in high-complexity, high-margin sectors. The latest earnings reveal continued gains in sales and profit, but the incremental progress is unlikely to materially impact the most important near-term catalyst, securing and ramping new customer programs. However, risks from cyclical demand slowdowns or order delays tied to key customers remain a constraint on any near-term upside.

Among the latest announcements, the company’s updated revenue and earnings guidance for Q1 2026 directly reflects management’s outlook on navigating potential volatility in sector demand. While guidance indicates stability, it also shows that near-term growth depends on the timing and success of new contract wins, an area still exposed to variability from customer decisions and macroeconomic conditions.

By contrast, one factor that investors should especially watch for is the risk of order reductions from large customers and...

Read the full narrative on Plexus (it's free!)

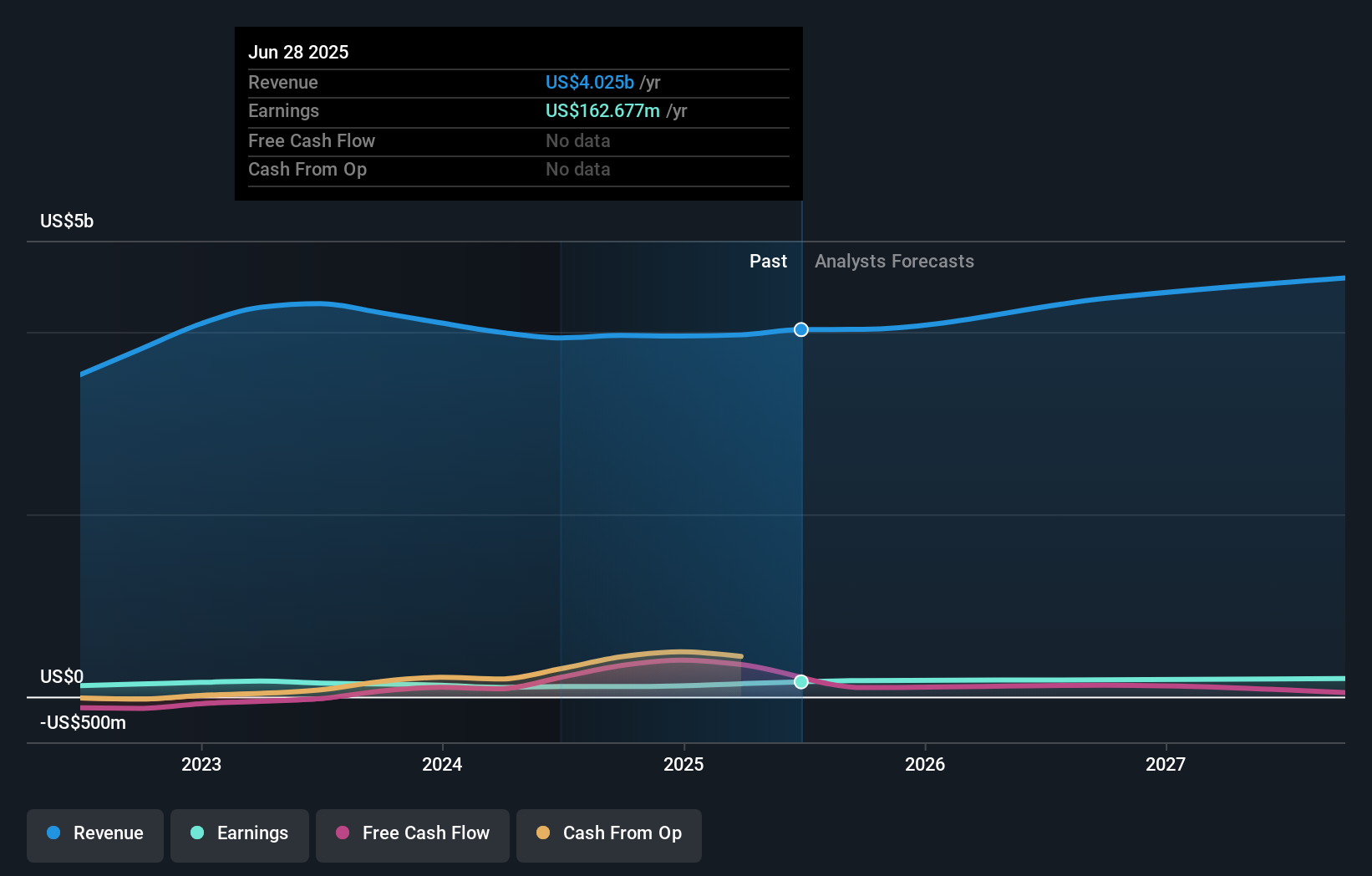

Plexus' narrative projects $4.8 billion revenue and $202.1 million earnings by 2028. This requires 6.1% yearly revenue growth and an earnings increase of $39.4 million from $162.7 million.

Uncover how Plexus' forecasts yield a $159.00 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members submitted one fair value estimate for Plexus at US$114.18, showing a single viewpoint. Consider how program-driven demand swings can shape actual results ahead, and check out more perspectives to see how opinions diverge.

Explore another fair value estimate on Plexus - why the stock might be worth 19% less than the current price!

Build Your Own Plexus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Plexus research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Plexus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Plexus' overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLXS

Plexus

Provides electronic manufacturing services in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives