- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:PLXS

Can Plexus’ (PLXS) Cautious Revenue Outlook Reveal Shifting Industry Dynamics?

Reviewed by Sasha Jovanovic

- Plexus (NASDAQ:PLXS), an electronic manufacturing services company, reported its quarterly results last Wednesday after the market closed, meeting analyst revenue expectations at US$1.02 billion with a slight earnings beat but issuing guidance for the next quarter that missed estimates.

- The mixed performance, especially the softer revenue outlook, has heightened attention around whether Plexus can sustain growth momentum amid ongoing industry uncertainties.

- We'll assess how the company's tempered revenue guidance in the latest results could reshape its investment narrative and outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Plexus Investment Narrative Recap

To own Plexus stock, investors typically look for ongoing gains from its strength in advanced electronics manufacturing, diversified end-markets, and program wins in high-growth areas like healthcare and semicap. The most recent quarterly results, with next-quarter revenue guidance coming in below expectations, cast some doubt on short-term momentum but do not materially impact the longer-term thesis, unless softer guidance proves to be persistent, which would heighten the risk of cyclical sector slowdowns derailing continued gains.

Among recent announcements, the July 2025 quarterly results are highly relevant, especially as Plexus noted modest revenue growth while presenting a cautious outlook for the coming quarter. This tempered guidance has become a central focus for investors watching whether key verticals like semicap can reaccelerate, or if emerging order delays signal a broader trend that could impact near-term earnings and the company’s pipeline.

By contrast, it’s the risk of order reductions or delays from major customers, especially in sectors with outsized revenue contributions, that investors should be mindful of...

Read the full narrative on Plexus (it's free!)

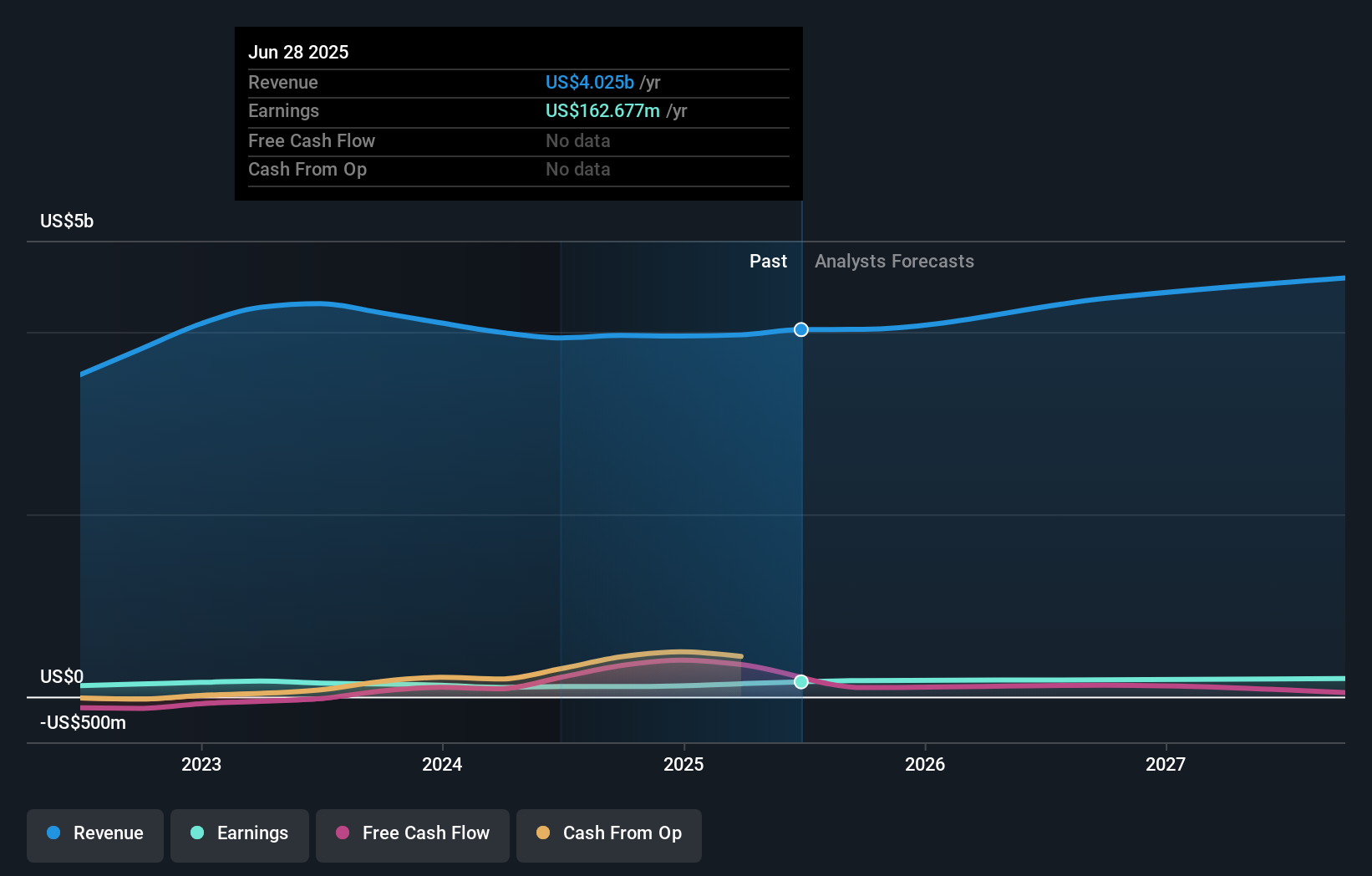

Plexus' outlook forecasts $4.8 billion in revenue and $202.1 million in earnings by 2028. This is based on an expected 6.1% annual revenue growth and a $39.4 million increase in earnings from the current $162.7 million.

Uncover how Plexus' forecasts yield a $154.60 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community show a single US$114.18 view, offering one perspective ahead of the recent cautious company guidance. Broader market participants may weigh this against the risk of revenue volatility tied to sector-specific demand swings.

Explore another fair value estimate on Plexus - why the stock might be worth as much as $114.18!

Build Your Own Plexus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Plexus research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Plexus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Plexus' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLXS

Plexus

Provides electronic manufacturing services in the United States, the Asia-Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion